|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC) has been hovering around the $90,000 mark for a while now, but that hasn’t dampened market enthusiasm. According to the Crypto Fear and Greed Index (FGI), sentiment remains in “extreme greed” territory, hitting this level for the fifth time since 2021 (FGI score above 80).

Historically, such “extreme greed” readings have coincided with Bitcoin’s local and cycle tops. In early 2024, a similar FGI reading preceded a local peak above $73,000. Likewise, in 2021, “extreme greed” correlated with a February local top, followed by a cycle peak in August.

Does this signal a potential price pullback for Bitcoin? Interestingly, sentiment in the options market seems to disagree – at least until BTC surpasses $100,000.

Options Market Points To Bullish Continuation

Data from Deribit paints a bullish picture, with large players shedding bearish bets (puts) at strike prices of $75,000 and $85,000 while accumulating bullish calls (options to buy) at $95,000 to $110,000. In simpler terms, this suggests that major hedge funds don’t anticipate a drop below $75,000 or $80,000 (evidenced by selling puts at those strike prices). Conversely, they appear to be positioning for a further rally, with potential targets between $95,000 and $110,000 by December or early 2025.

2) Chart shows:

— Deribit Insights (@DeribitInsights) November 17, 2024

Notional roll-up of Nov 84k to Dec 90k Calls.

Additional early buying of Nov90, Dec90+95k Calls.

2-way action Nov+Dec 100k Calls.

Later dumping of Dec 75+80k Puts + 90k Calls+ Straddles.

Buying across Dec+Mar 110k+ Call spreads.

Positioning remains bullish bias. pic.twitter.com/BmKdTCVBJu

Technical Analysis Aligns with Options Market

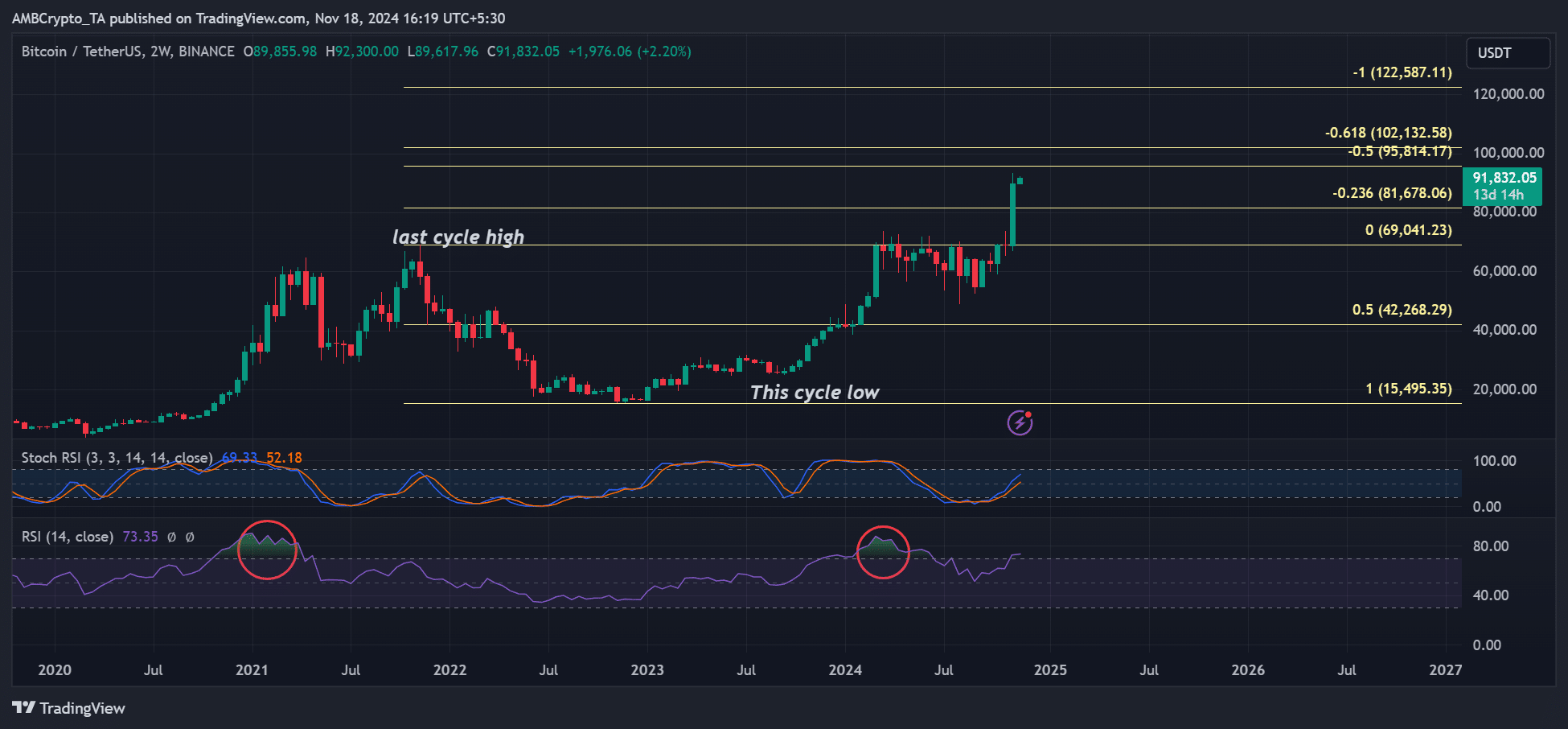

Bitcoin’s 2-week chart echoes this sentiment. The immediate upside resistances lie at $95,800 and $102,000. With current price momentum and the Stochastic RSI close to overbought territory, BTC might attempt to test these levels.

However, a note of caution emerges with the return of retail investors. Historically, their re-entry into the market has been a telltale sign of a potential local or cycle top, as whales (large investors) often use them as exit liquidity.

Correction Likely, Not Necessarily a Bear Market

CryptoQuant founder Ki Young Ju believes a price correction is likely, but not necessarily a sign of a prolonged bear market. He suggests the correction could be a healthy consolidation before another leg up.

Here's #Bitcoin transaction volume over $1M.

— Ki Young Ju (@ki_young_ju) November 18, 2024

If I were a giga whale, I’d wait for more exit liquidity. It’s just starting. Imagine retail in FOMO joining at $100K.

We might see some corrections, but it wouldn’t mark the start of a bear market, imo. pic.twitter.com/1iAvxJiFjl

While historical trends and retail participation warrant some caution, the combined weight of bullish sentiment in the options market and technical analysis suggests Bitcoin could attempt to reach the $95,000-$110,000 range in the coming months. However, close monitoring of retail activity and price movements around these key resistance levels is crucial.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Bitcoin’s (BTC) Puell Multiple Golden Cross – A Historical Indicator Of 90% Price Rallies

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.