|

Getting your Trinity Audio player ready...

|

Bitcoin has been on a remarkable bull run, recently surpassing the $91,000 mark. This surge in price ignited excitement and speculation about the potential for a $100,000 milestone. However, recent market indicators suggest that a correction may be on the horizon.

A Sell Signal Emerges

A popular crypto analyst, Ali, recently highlighted a sell signal on Bitcoin’s TD Sequential indicator. This technical analysis tool suggests that the asset may be due for a price decline. Indeed, Bitcoin’s price has dipped below the $90,000 mark in the past 24 hours, confirming the potential for a correction.

A #Bitcoin $BTC price correction could be underway as the TD Sequential indicator presents a sell signal on the daily chart! pic.twitter.com/MMCPzY1bAx

— Ali (@ali_charts) November 14, 2024

Market Sentiment and On-Chain Data

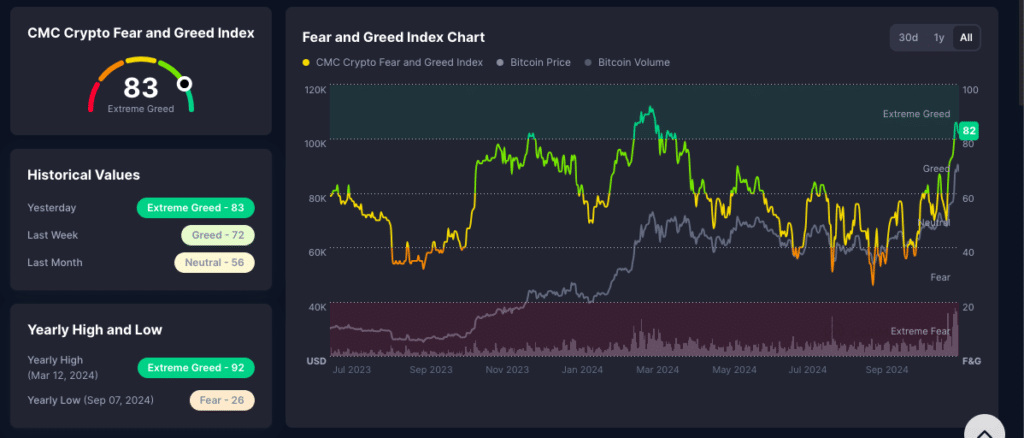

The crypto market is currently in a state of “extreme greed,” which could indicate a potential market correction. This sentiment is also reflected in the Fear and Greed Index, which is currently at 80.

However, on-chain data suggests a more optimistic outlook for Bitcoin. The NVT Ratio, a metric that measures Bitcoin’s valuation, has recently declined, indicating that the asset may be undervalued. Additionally, the decreasing exchange reserves suggest that investors are not panicking and selling their Bitcoin.

Potential Price Scenarios

In the short term, Bitcoin’s price is likely to fluctuate around the $86,000 support level. If this level holds, Bitcoin could resume its upward trend and potentially retest the $91,000 resistance. However, if the support level breaks, Bitcoin could experience a more significant correction, potentially dropping to the $76,000 to $80,000 range or even lower.

While a correction may be imminent, it’s important to remember that Bitcoin’s long-term trend remains bullish. As long as the fundamental factors supporting Bitcoin remain strong, the asset is likely to continue its upward trajectory in the long run.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.