Sergey Nazarov, co-founder of Chainlink, has expressed his belief that real-world assets (RWAs) could eventually surpass the size of the crypto market. This optimistic outlook is fueled by the potential of RWAs to bring more off-chain asset value on-chain.

Nazarov highlighted the growing interest in investment products like stablecoins, gold coins, and commodity coins. He emphasized that these assets, when tokenized, can significantly increase the potential for RWAs to drive on-chain value.

Previously, Nazarov had discussed how RWAs were overtaking DeFi in terms of total value locked. He pointed out the trillions of USD worth of real-world assets that could be tokenized to enhance on-chain value. Nazarov stressed that only a small fraction of these assets, including real estate, treasury bills, and more, are currently in RWA form.

Nazarov’s vision aligns with efforts by major institutions like BlackRock and Fidelity to participate in real-world asset tokenization. He believes that RWAs offer a superior format for safe and transparent asset ownership with rapid on-chain transfer.

Bridging TradFi and DeFi

Nazarov explained that RWAs could serve as a crucial bridge between traditional finance (TradFi) and decentralized finance (DeFi). He envisions RWAs as the initial interaction point between these two sectors.

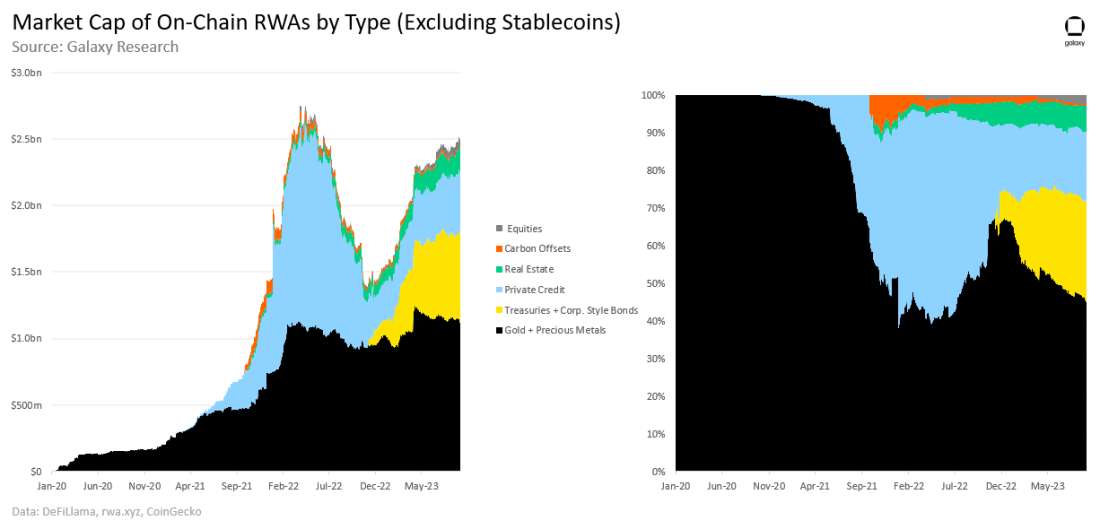

This perspective is shared by Zack Porkony, a research analyst at Galaxy, who acknowledged the significant contribution RWAs have made to DeFi. Porkony highlighted the rapid growth of RWAs within DeFi, with their total value locked reaching $2.5 billion as of September 30, 2023.

Chainlink’s community liaison, Zach Rynes, defined DeFi as a highly speculative market, citing Vitalik Buterin’s previous comments on DeFi. Rynes emphasized that while DeFi might not be the key to mainstream crypto adoption, bringing traditional markets on-chain could achieve that goal. He also noted that DeFi’s infrastructure could contribute to the future of the global economy.

Skepticism Persists

While some investors are optimistic about Chainlink’s role in fueling the growth of RWAs, others remain skeptical about its capabilities. One point of contention is the recent dumping of $LINK by investors.

Critics have questioned Chainlink’s utility, arguing that its off-chain layer-2 deals should be on-chain and settled using $LINK. They have expressed disappointment that Chainlink has not yet found a significant use case for its native token after seven years.

Also Read: Chainlink (LINK) Shows Signs of Recovery -Potential for 4x Gains?

Some have also speculated that RWAs are simply the latest buzzword being promoted by Chainlink’s co-founder. They pointed out that Nazarov has previously promoted AI, derivatives, supply chains, NFTs, and more.

Despite the skepticism, there are crypto enthusiasts who agree with Nazarov’s vision of RWAs revolutionizing DeFi and increasing on-chain value. They emphasize the importance of reliable technology to keep up with the pace of RWA development.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.