|

Getting your Trinity Audio player ready...

|

Book of Meme (BOME) has experienced a meteoric rise and a subsequent decline, leaving investors questioning the future of the Solana-based meme coin. Once boasting a $1 billion market cap, BOME is currently trading at $0.0070, a staggering 74.78% drop from its peak earlier this year.

Despite the downtrend, BOME has shown signs of resilience, with a 20% price increase over the past 30 days. Technical analysis suggests a potential bullish pattern forming, with the token on the brink of a rising trend. The falling wedge formation, characterized by lower highs and lower lows, often precedes a breakout.

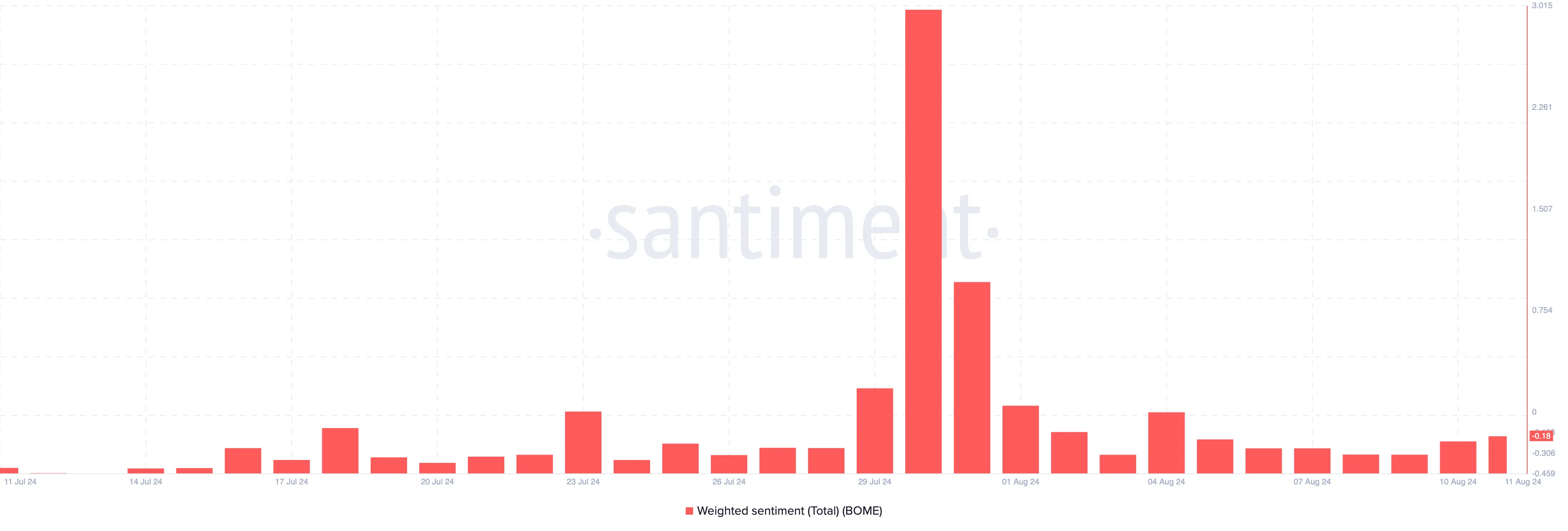

However, market sentiment towards BOME remains cautious. Santiment’s Weighted Sentiment indicator reveals a negative outlook, suggesting that the recent price increase might be short-lived unless supported by increased demand.

Technical indicators offer conflicting signals. The Relative Strength Index (RSI) at 42.76 indicates growing buying pressure but remains below the neutral line, suggesting potential challenges in sustaining an uptrend. Fibonacci retracement analysis suggests potential support and resistance levels, with $0.0075 as a short-term target and $0.0093 as a potential higher target if buying pressure intensifies. Conversely, a decline to $0.0052 is possible if sellers regain control.

The future of BOME remains uncertain. While technical indicators hint at a potential rebound, the overall market sentiment and the token’s historical volatility create a challenging environment for investors. As the cryptocurrency market continues to evolve, BOME will need to demonstrate sustained growth and investor confidence to regain its former glory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!