Crypto influencer Rasgard recently took to a social media platform (formerly known as Twitter) to expose alleged wrongdoings by Do Kwon and Terraform Labs, the company behind the infamous $40 billion collapse of the Terra Luna stablecoin project.

Accusations of Misleading Investors

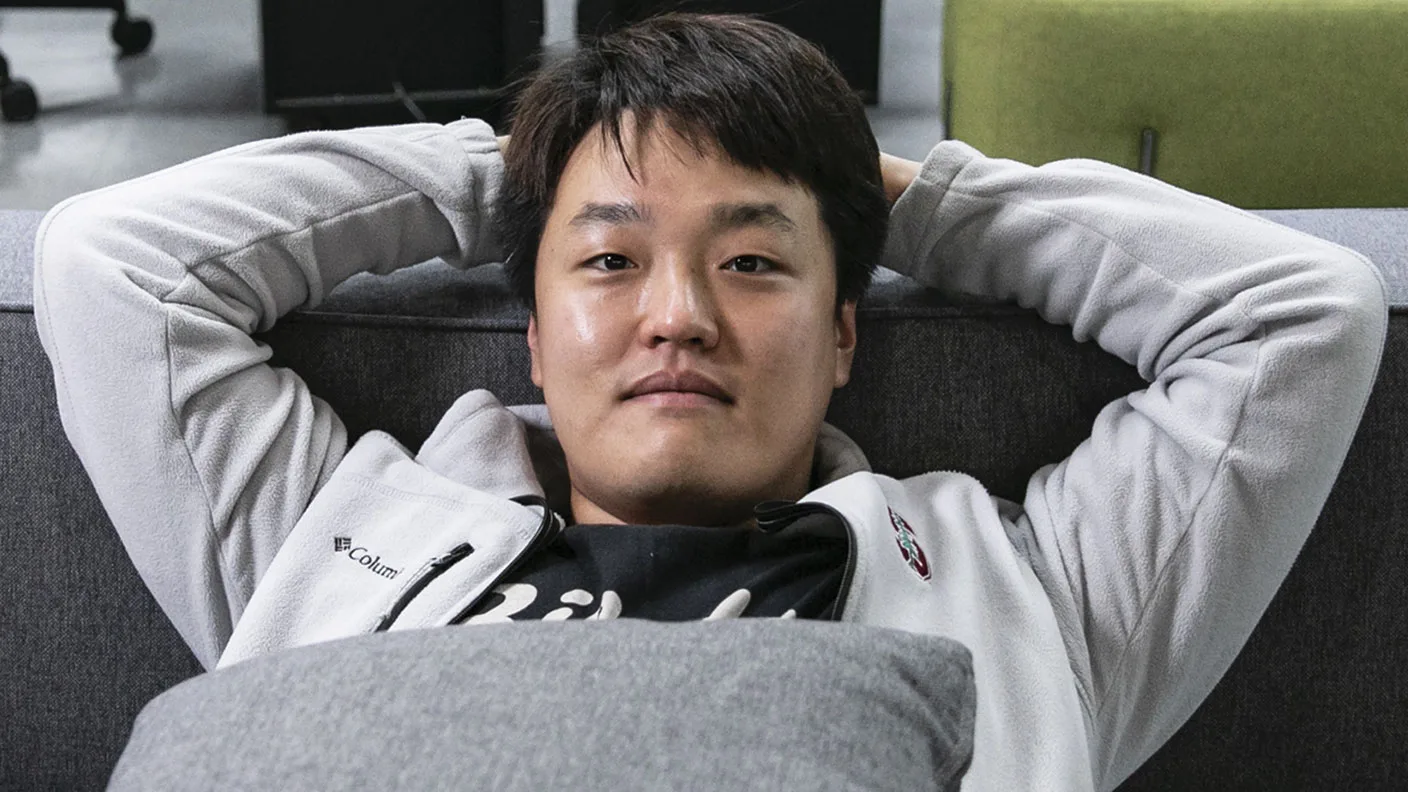

Rasgard’s post sheds light on the downfall of Terraform Labs and its founder Do Kwon’s actions, which ultimately led to a lawsuit by the U.S. Securities and Exchange Commission (SEC) alleging investor deception and securities law violations.

Founded in 2018, Terraform Labs attracted significant funding, boasting investors like Binance and Coinbase. Their rise to prominence was fueled by the launch of LUNA, a native token, and TerraUSD (UST), an algorithmic stablecoin designed to maintain a 1:1 peg with the U.S. dollar. However, Rasgard alleges this peg was compromised as early as May 2021 through a secret deal with Jump Trading, causing the first de-pegging event.

A House of Cards?

Rasgard further accuses Kwon of misleading the public by claiming UST’s “self-healing” mechanism would automatically restore the peg. Additionally, Rasgard alleges Terraform fabricated transactions on the Chai payments platform to create a facade of legitimate activity. Kwon himself even placed a $1 million bet on LUNA’s price stability, raising further questions about his transparency.

The Unraveling and Aftermath

In 2022, the situation worsened when Anchor Protocol, a Terra-linked lending platform, slashed interest rates on UST deposits, leading to a mass withdrawal and ultimately contributing to the UST de-pegging and LUNA’s collapse. This event sent shockwaves through the crypto market and intensified regulatory scrutiny on algorithmic stablecoins.

Following the collapse, Rasgard alleges Kwon transferred over 10,000 Bitcoins (BTC) to a cold wallet, with over $100 million reportedly withdrawn through a Swiss bank. Additionally, Rasgard claims Kwon diverted approximately 40,000 BTC from a designated burn wallet to undisclosed locations.

Kwon was later arrested in Montenegro facing eight charges, including securities and commodities fraud, wire fraud, and conspiracy. Currently, Kwon and his legal team await extradition to face trial after multiple delays.

Also Read: Terra Luna Classic (LUNC) Community in Turmoil Over Missing $8 Million in USTC

A Cautionary Tale

Rasgard’s accusations highlight the importance of transparency and accountability within the cryptocurrency industry. The Terra Luna collapse serves as a cautionary tale for investors, emphasizing the need for thorough due diligence before investing in projects with complex mechanisms and opaque leadership. Regulatory agencies are likely to use this event as a case study to refine future regulations for stablecoins and broader crypto markets.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!