Bitcoin (BTC) is experiencing its longest rally in three months, fueled by growing anticipation of potential rate cuts from the Federal Reserve. This shift in sentiment comes amidst signs of slowing inflation and a softening jobs market in the US, prompting a reevaluation of interest rate policy.

Market optimism has risen significantly, with traders now placing higher odds on a rate cut occurring as early as November. This follows previous predictions of stable rates until the end of the year. The recent trend aligns with the broader bond market rally, its most prolonged stretch since December 2023.

Federal Reserve Policy Shift and Its Impact

The upcoming release of employment data on Friday holds significant weight as the Fed convenes for its rate-setting meeting next week. A strong jobs report could sway the Fed towards holding rates steady, while weaker figures might encourage a quicker policy adjustment.

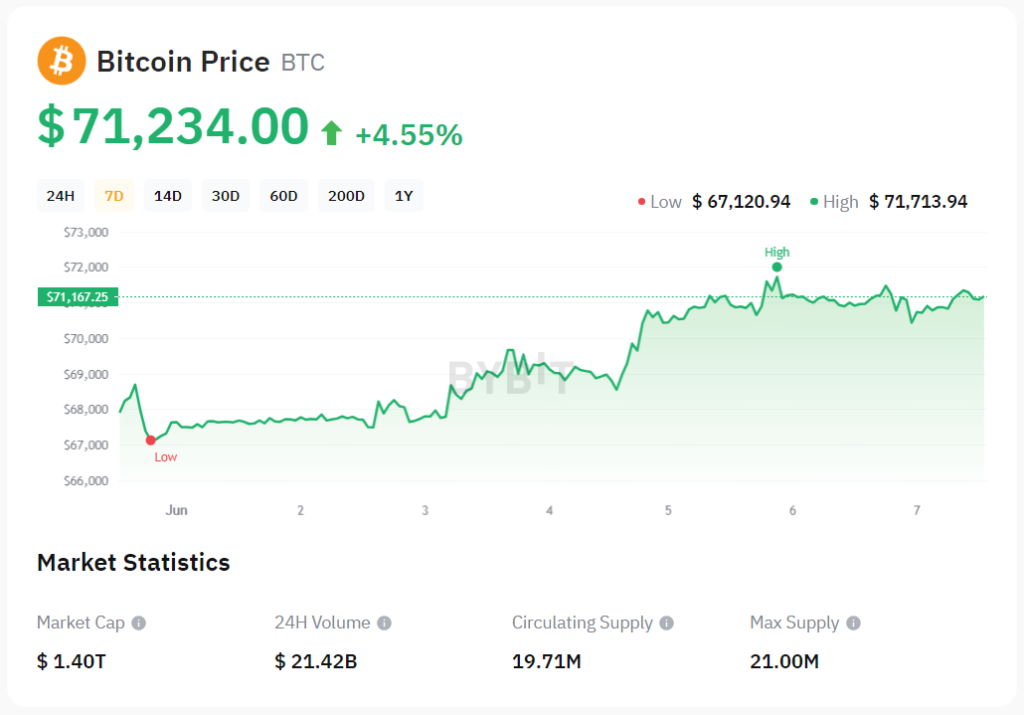

Lower interest rates generally benefit speculative assets like Bitcoin, as they increase the relative attractiveness of non-interest-bearing investments. This explains the current uptick in Bitcoin’s value, which has climbed over 4% to $71,177 within the last week.

Institutional Embrace: Bitcoin as a Treasury Asset

Further boosting Bitcoin’s momentum is the growing involvement of institutional investors. Healthcare company Semler Scientific (SMLR) recently made headlines by designating Bitcoin as its primary treasury asset. Their $40 million acquisition of 581 Bitcoin adds to their existing holdings, bringing their total investment to $57 million across 828 Bitcoin.

Semler Scientific views Bitcoin as a hedge against inflation and a valuable long-term store of value. The company emphasizes the unique characteristics of Bitcoin, highlighting its scarcity and differentiation from traditional fiat currencies and other crypto assets.

Crypto Market Expansion: Bybit Eyes Chinese Diaspora

The bullish sentiment extends beyond traditional institutions. Crypto exchange Bybit reportedly plans to allow Chinese expatriates to establish accounts and trade on its platform. This move caters to the growing demand for secure and user-friendly crypto trading platforms within the Chinese diaspora and broader Chinese communities worldwide.

Bybit’s actions come on the heels of recent reports suggesting the exchange might have previously facilitated account creation for users located in China, despite the country’s ban on Bitcoin. These developments showcase the strategic positioning of major financial players and crypto companies capitalizing on Bitcoin’s potential.

The combined forces of potential rate cuts, increasing institutional adoption, and expanding market access paint a promising picture for Bitcoin’s future. While Friday’s employment data holds the key to the Fed’s immediate policy direction, the overall trend suggests a growing sense of optimism regarding Bitcoin’s long-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. www.chainaffairs.com is not responsible for any financial losses.