|

Getting your Trinity Audio player ready...

|

Bitcoin(BTC) enthusiasts bracing for a continuation of the bull run might need to adjust their expectations. Analysts, after dissecting key on-chain metrics, believe Bitcoin’s ascent to greater heights might be delayed until later this year, possibly Q3 or even Q4.

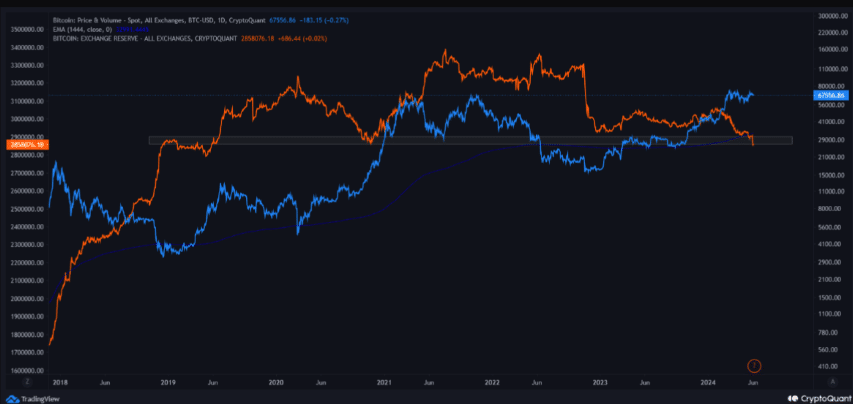

One sign hinting at this delay is the decline in the number of Bitcoin’s(BTC) circulating. This could indicate that investors are accumulating more BTC rather than selling, a behavior typical during bull markets. Interestingly, this drop also suggests Bitcoin might be 50% away from its peak for this cycle.

Currently priced around $67,937, Bitcoin has witnessed a dip since its all-time high in March. This slump, coupled with the declining reserves, points towards Bitcoin potentially “hunting liquidity.” In simpler terms, market participants might be seeking areas with low liquidity where prices fluctuate within a narrow range. Analysts also observed this behavior with Bitcoin oscillating between $64,000 and $68,000.

This price inefficiency translates to a potential pause in the bull run until the end of Q2. The next leg of the surge might then unfold sometime between Q3 and the year’s close.

Supporting this outlook is XBTManager, a CryptoQuant analyst, who shares a similar sentiment. He emphasizes that market sentiment, gauged by the fear and greed index, currently sits at 60. This indicates that the market is neither overly greedy nor fearful, suggesting Bitcoin’s current price might be fair.

However, it also paves the way for a potential price hike in the mid to long term.

Also Read: Mt. Gox on the Move: Bitcoin Price Swings as Dormant Billions Spark Repayment, Opportunity

To bolster this bullish prediction, Analysts looked at the Cycle Change Detector, a metric that identifies Bitcoin’s transition between bull and bear phases. This metric considers the correlation between price and supply in profit. When Bitcoin reaches its peak, a light blue line appears on the chart. Conversely, a light red line suggests the price is nearing its bottom. As of now, Bitcoin has surpassed the bottom, signaling a potential upswing ahead.

While the immediate future might see a wait-and-watch approach, analysts remain optimistic about Bitcoin’s long-term trajectory. The current market sentiment and on-chain metrics paint a picture of a potential price surge later this year, possibly reaching new highs by the end of 2024.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.