|

Getting your Trinity Audio player ready...

|

Traders and investors in the cryptocurrency market are keenly observing today’s significant options expiry for both Bitcoin (BTC) and Ethereum (ETH). The sheer volume and notional value of these expiring contracts raise the possibility of increased volatility and potential influence on short-term price movements. However, analyzing the put-to-call ratios and identifying the maximum pain points offers valuable insights into the likely market direction as these contracts reach their expiration.

Decoding Put-to-Call Ratios and Maximum Pain

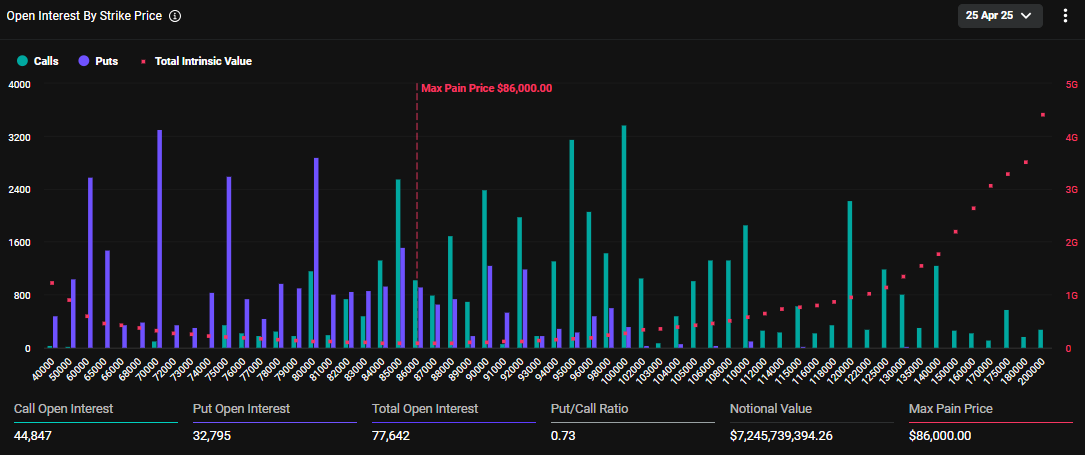

Data from Deribit indicates that 77,642 Bitcoin options, with a substantial notional value of $7.24 billion, are set to expire today. The put-to-call ratio for these options stands at 0.73, signaling a higher volume of call options (buy orders) compared to put options (sell orders). This typically suggests a slightly bullish sentiment among options holders. Furthermore, the maximum pain point for Bitcoin is currently at $86,000. This price represents the level at which the majority of option holders would experience the greatest financial losses upon expiry, often acting as a gravitational pull for the underlying asset’s price due to strategic actions by large players.

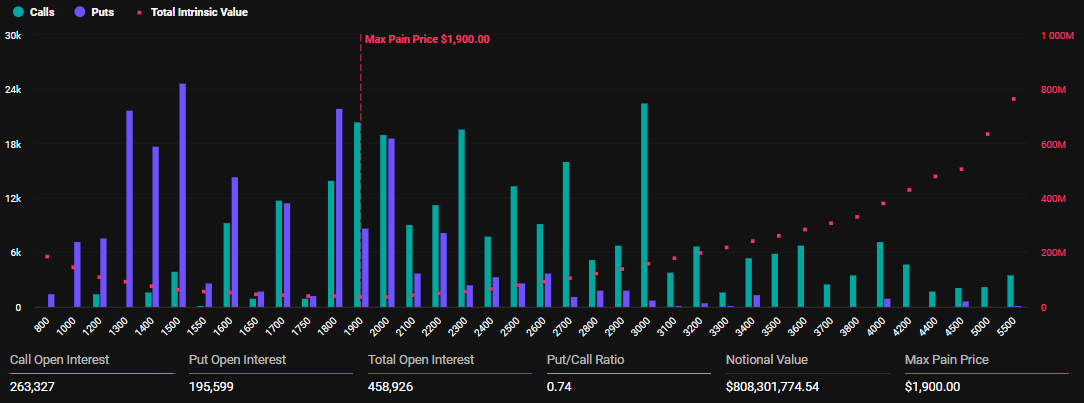

Ethereum also faces a significant options expiry today, with 458,926 contracts and a notional value of $808.3 million. The put-to-call ratio for these ETH options is 0.74, also indicating a slight prevalence of call options. The maximum pain point for Ethereum sits at $1,900. Interestingly, the volume of expiring Ethereum options is notably higher than the 177,130 contracts that expired last week, highlighting the increased significance of today’s event. As of writing, Bitcoin is trading comfortably above its maximum pain point at $93,471, while Ethereum is trading below its strike price at $1,764. Analysts at Deribit have noted this divergence, stating that the positioning into expiry is “anything but aligned,” suggesting potential for interesting price action as expiry approaches.

Contrasting Short-Term Pressures with Long-Term Bullish Signals

The current positioning of open interest for both Bitcoin and Ethereum reveals significant trader activity around their respective maximum pain points ($80,000-$90,000 for BTC and $1,800-$2,000 for ETH). This clustering suggests a possibility of short-term price consolidation or increased volatility as the market navigates the expiry. However, looking beyond the immediate horizon, Deribit‘s data indicates a longer-term bullish sentiment among Bitcoin traders. There’s evidence of traders selling cash-secured put options and using stablecoins to potentially buy Bitcoin at lower prices, aiming to capitalize on future price appreciation.

🚨 Options Expiry Alert 🚨

— Deribit (@DeribitOfficial) April 24, 2025

At 08:00 UTC tomorrow, over $8B in crypto options are set to expire on Deribit.$BTC: $7.2B notional | Put/Call: 0.73 | Max Pain: $85K$ETH: $801M notional | Put/Call: 0.73 | Max Pain: $1.9K

BTC trades above max pain, ETH below.

Positioning into… pic.twitter.com/A9xI1dqzoV

Additionally, the highest open interest for Bitcoin options remains around the $100,000 strike price, reflecting strong market expectations for Bitcoin to reach this milestone, although Polymarket data currently assigns only a 16% probability to this occurring in April.

The cumulative delta across Bitcoin and related ETF options also points to high sensitivity to price changes, potentially amplifying volatility. Despite short-term uncertainties surrounding today’s expiry, the longer-term outlook for Bitcoin, fueled by factors like potential rotation from gold and strategic position adjustments, appears to lean towards bullishness.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: XRP Defies $795M Crypto Market Outflow, Outshines Bitcoin, Ethereum, and Solana

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.