|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- SBI VC Trade’s massive XRP move hints at strategic preparation, possibly linked to a financial product launch.

- Regulatory shifts are positioning Japan as a potential crypto ETF hotspot—XRP may be a key beneficiary.

- Despite subdued price movement, rising volume shows traders are preparing for volatility.

A mysterious XRP transaction totaling 320 million tokens, valued at over $703 million, has sparked widespread speculation across the XRP community. The transfer was flagged just hours before Ripple’s routine $1 billion escrow release scheduled for early July.

Whale Alert Flags Massive XRP Movement

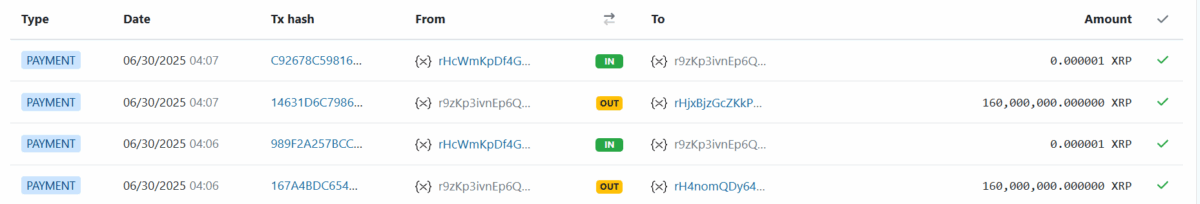

On June 30, Whale Alert reported three significant XRP transfers. The largest involved 320 million XRP moving between two unknown wallets. Blockchain analysis later linked the sender wallet (rNR…6jS) to SBI VC Trade, a subsidiary of Japan’s financial giant SBI Holdings.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 320,000,000 #XRP (703,517,724 USD) transferred from unknown wallet to unknown wallethttps://t.co/EzDk6g8ZUw

— Whale Alert (@whale_alert) June 30, 2025

The recipient wallet (r9z…RCZ) then split the funds evenly into two additional wallets, each receiving 160 million the coin. While none of the transactions appear to involve Ripple directly, the scale and timing have raised questions about SBI VC Trade’s intent—especially given the proximity to Ripple’s upcoming escrow unlock.

Ripple Ties and Japan’s Crypto Push

SBI VC Trade is a long-term partner of Ripple, and the transaction’s timing may not be coincidental. Just last week, Japan’s Financial Services Agency (FSA) submitted a groundbreaking proposal to reclassify digital assets as legitimate financial products. This regulatory shift could potentially open the door for cryptocurrency ETFs in Japan, including one based on the coin.

The FSA also proposed cutting Japan’s punitive crypto tax rate from up to 55% to a flat 20%—a move expected to boost institutional and retail crypto activity. The combination of these regulatory changes and SBI VC Trade’s aggressive XRP movements could be laying the groundwork for a major XRP-linked financial product or institutional offering.

Also Read: XRP ETF Incoming? Ripple Ends SEC Battle With $50M Deal, July Filings Expected.

XRP Price Action and Technical Indicators

Following the large-scale movement, XRP’s price briefly surged but later retraced below the $2.20 level. The token traded between a 24-hour low of $2.18 and a high of $2.22. Despite the price cooling, trading volume rose 15% over the past 24 hours, suggesting heightened trader interest.

From a technical standpoint, the coin remains below its 50, 100, and 200 simple moving averages (SMAs), indicating bearish short-term momentum. Meanwhile, the Relative Strength Index (RSI) dipped slightly to 50.68, signaling market indecision.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.