|

Getting your Trinity Audio player ready...

|

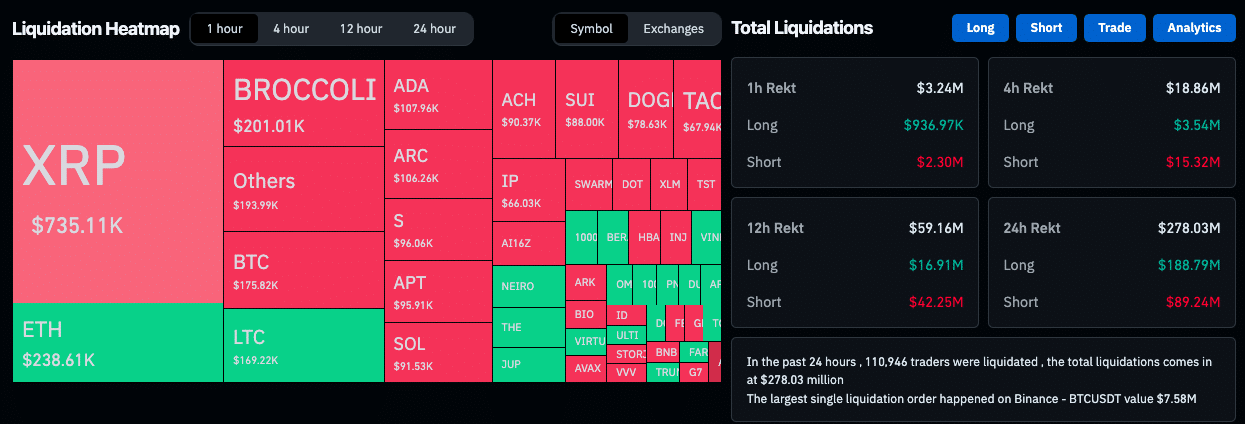

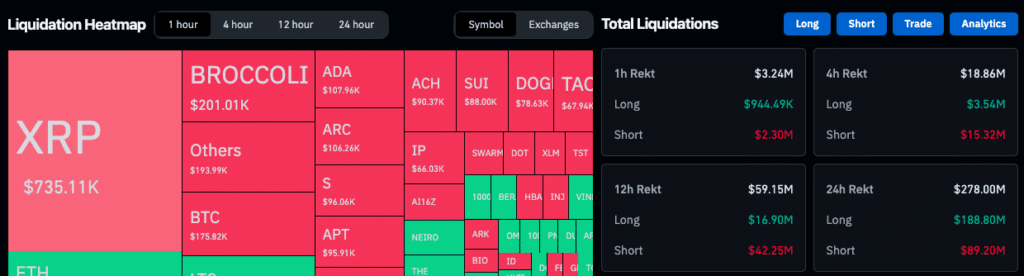

The cryptocurrency market is facing intense selling pressure as Bitcoin (BTC) plunges below $96,000, wiping out nearly $298 million in liquidations within 24 hours. The sharp decline has rattled traders, raising concerns over whether the ongoing bull run is nearing its end.

Massive Liquidations Shake the Market

According to data from Coinglass, over 110,705 traders were affected by the recent downturn. Long traders took the biggest hit, with $206 million in long positions liquidated, while short trades accounted for $92 million in losses. The largest single liquidation occurred on Binance, wiping out a $7.5 million trade.

Binance saw the highest liquidation volume, amounting to $104.03 million (38.67% of total liquidations). Other major exchanges also reported significant losses:

- Bybit: $50.18 million liquidated

- OKX: $49.59 million liquidated

- Gate.io: $31.24 million liquidated

Bitcoin’s Critical $96K Support Under Threat

Bitcoin is currently hovering around the $96,000 support level, a crucial price point that could determine its next move. A break below this threshold could trigger further declines, fueling more liquidations and market panic.

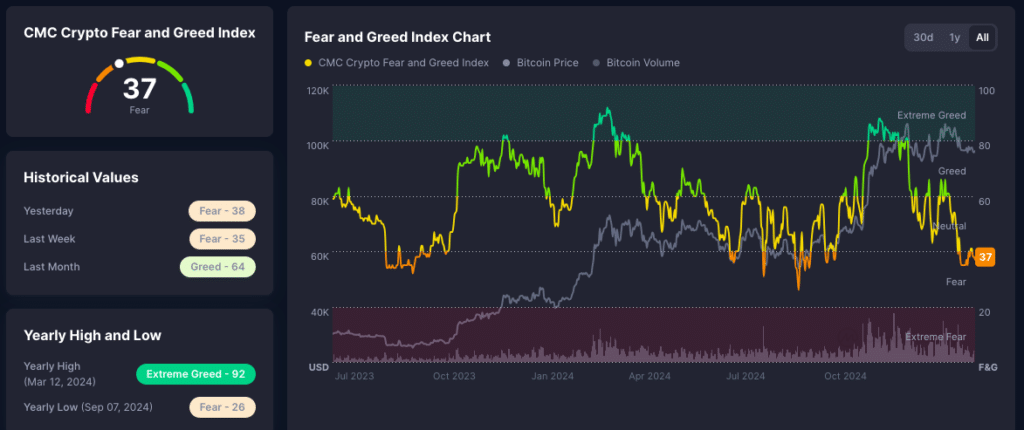

One of the key drivers behind Bitcoin’s price drop is heavy outflows from Bitcoin ETFs. Data from Farside Finance reveals that on February 18, Bitcoin ETFs recorded $129 million in outflows, adding downward pressure on the market. Meanwhile, the Crypto Fear and Greed Index has slipped to 37, signaling a rise in bearish sentiment.

Also Read: FTX Begins $1.2B Creditor Repayment: $800M Disbursed in First Round

Altcoins Follow Bitcoin’s Downtrend

Bitcoin’s slump has sent shockwaves across the crypto market, with major altcoins like Solana (SOL), XRP, and Dogecoin (DOGE) also experiencing sharp declines. Despite speculation surrounding potential ETF approvals for XRP and Solana, investors remain cautious.

With market uncertainty rising, traders are keeping a close eye on Bitcoin’s next move. If BTC holds above $96,000, a recovery could be possible. However, a break below this support level may lead to another wave of sell-offs, potentially derailing the bull market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!