|

Getting your Trinity Audio player ready...

|

21Shares has filed for a Polkadot (DOT) exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC), sparking strong reactions from the crypto community. The proposed 21Shares Polkadot Trust would be listed on the Cboe BZX Exchange and track Polkadot’s price in U.S. dollars, with Coinbase acting as the custodian. However, the filing has not been met with enthusiasm, as many industry insiders have questioned its relevance and market demand.

BREAKING: 21Shares files S-1 for Polkadot $DOT ETF. pic.twitter.com/FdCbR13P2D

— Altcoin Daily (@AltcoinDailyio) January 31, 2025

Crypto Community Unimpressed

Criticism of the Polkadot ETF filing has been swift and vocal across social media. Many crypto enthusiasts have expressed disdain for the move, with some users on X (formerly Twitter) mocking the idea. One user questioned, “Polkadot ETF? Really? How about a real investment?” while another bluntly stated, “No one needs Dot.” A particularly harsh critic even predicted, “First ETF to go negative price.”

Bloomberg Intelligence analyst James Seyffart noted that the filing has attracted “the most hate” he has seen for any ETF filing. This reaction reflects the broader skepticism surrounding Polkadot, which once ranked among the top ten cryptocurrencies but has since fallen to 22nd place in terms of market capitalization.

Polkadot’s Struggles and 21Shares’ Previous Attempt

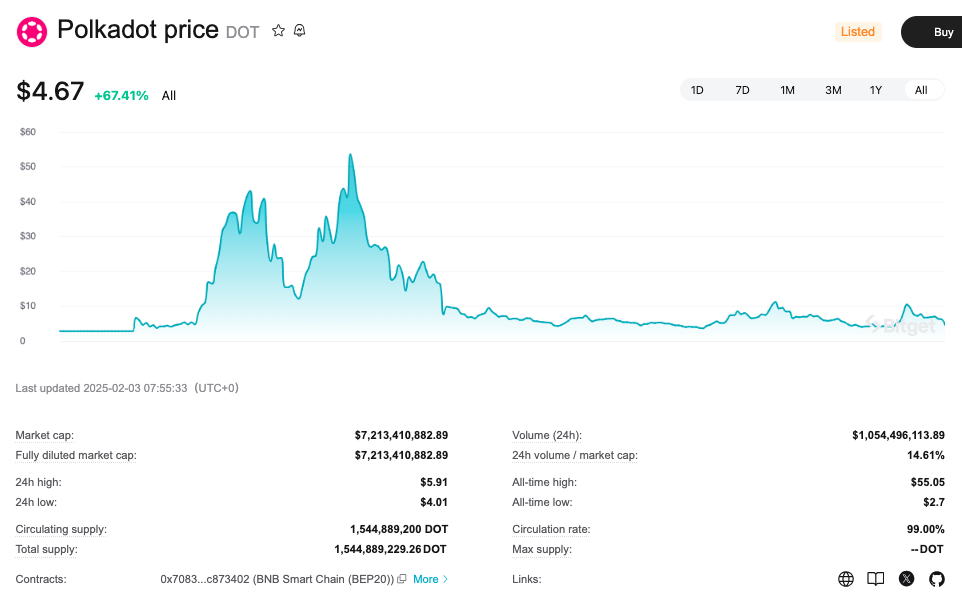

Polkadot, once boasting a $51 billion market cap, has seen its value decline to just $7.2 billion. Its fall from the top ten cryptocurrencies has led many to question whether it can regain its previous prominence.

In 2021, 21Shares launched a Polkadot Exchange-Traded Product (ETP) in Switzerland, but the product struggled to gain traction, with just 240,000 shares in 90-day trading volume.

Despite these setbacks, 21Shares is pressing ahead with its latest Polkadot ETF filing, a move that coincides with a growing number of crypto ETF applications submitted to the SEC. Among the notable filings is Grayscale’s attempt to convert its XRP Trust into an ETF, which was recently submitted by NYSE Arca.

The Growing Trend of Crypto ETFs

The push for crypto-based ETFs has gained momentum, especially following the re-election of former President Donald Trump, who signed an executive order aimed at advancing cryptocurrency innovation in the U.S. This order emphasizes the role of digital assets in economic development and international leadership.

Also Read: Crypto Bloodbath: Ether and Altcoins Plunge Over 20% as Trump’s Tariffs Shake Markets

While 21Shares’ Polkadot ETF may face an uphill battle for approval, the broader trend of crypto ETF filings signals a growing interest in making digital assets more accessible to traditional investors. Whether Polkadot can reclaim its place in the crypto landscape remains to be seen, but the push for crypto ETFs is undeniably gaining steam.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!