A massive $1.19 billion worth of Bitcoin (BTC) left centralized exchanges on Wednesday, marking the largest single-day outflow in 12 months. This dramatic shift suggests a potential change in investor sentiment, hinting at a long-term bullish narrative for the leading digital asset.

On-Chain Data Paints a Bullish Picture:

The exodus, tracked by blockchain analytics firm Glassnode, saw over 28,000 BTC depart exchanges, signifying a clear preference for self-custody or long-term holding strategies. This trend aligns with recent on-chain activity, which has been painting a consistently bullish picture for Bitcoin. Metrics like rising active addresses and decreasing exchange reserves further bolster the case for continued upward momentum.

Coinbase Outflow Sparks ETF Speculation:

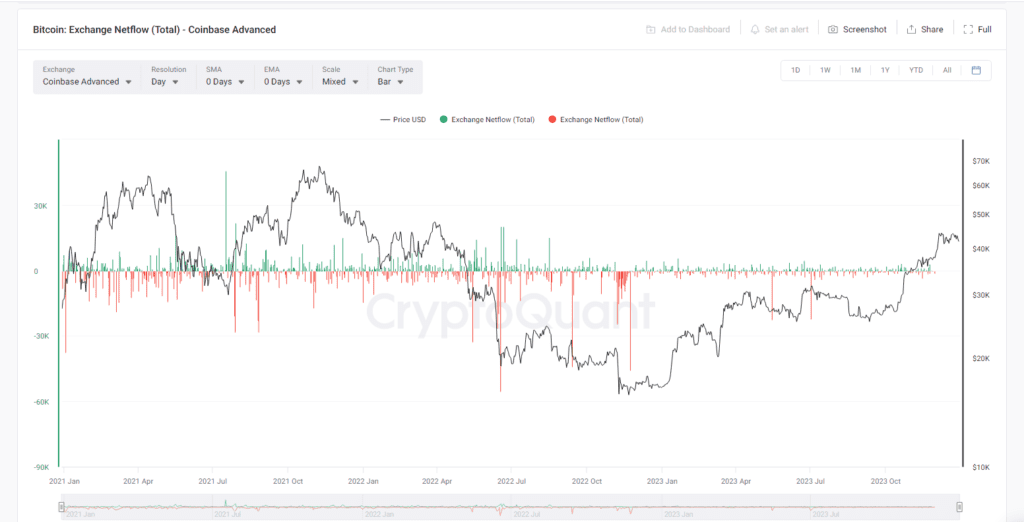

Adding fuel to the fire, the Nasdaq-listed Coinbase, a major custodian for proposed spot BTC ETFs in the US, witnessed a staggering outflow of over 18,000 BTC on Wednesday, as per CryptoQuant data. This substantial movement has sparked speculation on social media platform X, with many suggesting a potential connection to institutional activity ahead of an anticipated ETF launch in early January.

What Does This Mean for Bitcoin?

The mass exodus of Bitcoin from exchanges presents several interesting possibilities. It could indicate increased institutional adoption, as whales and larger players prepare for a potential ETF launch and long-term investment strategies. Additionally, it could reflect a growing sense of confidence among retail investors, opting to hold their BTC rather than sell at current market prices.

A Word of Caution:

While the on-chain data and recent outflows present a compelling bullish case, it’s crucial to remember that the cryptocurrency market remains highly volatile. Unforeseen events or regulatory changes could still disrupt the current trajectory. Therefore, it’s essential for investors to conduct thorough research and exercise caution before making any investment decisions.