|

Getting your Trinity Audio player ready...

|

- Whales sold 40M XRP despite today’s REX-Osprey ETF launch.

- Heavy sell walls and shorts above $3.05 block bullish momentum.

- On-chain data shows persistent whale distribution and negative sentiment.

Stay ahead with real-time updates and insights—Join our Telegram channel!

The highly anticipated launch of the REX-Osprey XTP ETF today has sparked optimism among XRP investors, with many also eyeing potential approvals of other XRP exchange-traded funds (ETFs) expected next month. However, on-chain data reveals that major XRP whales are not buying into the ETF hype and continue to liquidate their holdings.

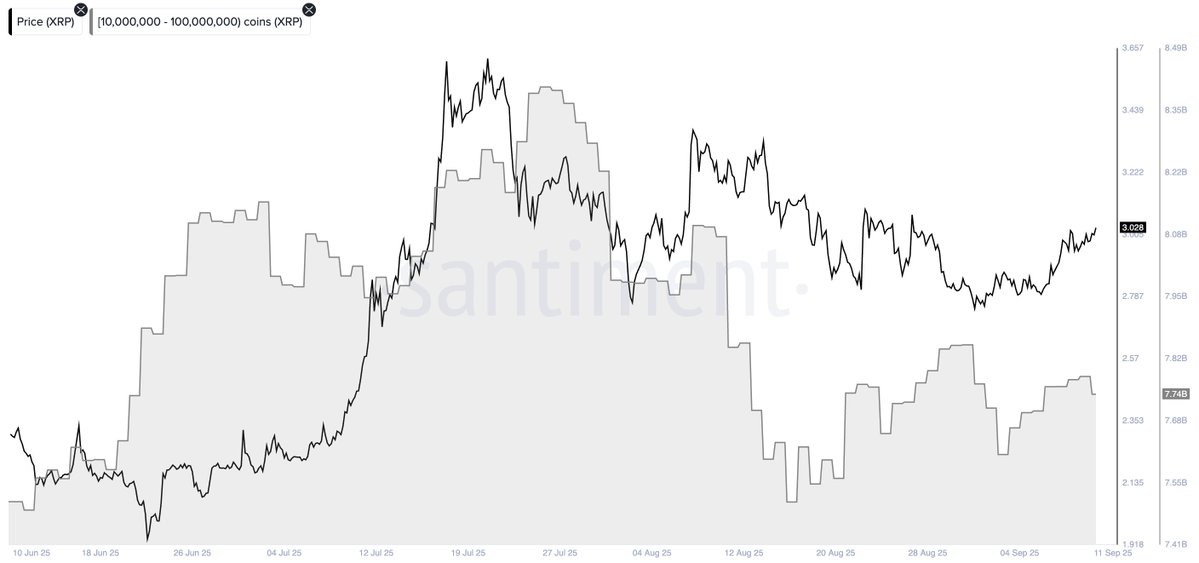

Data from Santiment on September 12 shows that whales holding between 10 million and 100 million XRP sold over 40 million coins in the last 24 hours alone. This aggressive offloading has continued over the past few weeks, signaling persistent negative sentiment from large holders.

Whale Sell Orders Trigger Market Resistance

The uncertainty surrounding U.S. SEC approval of spot XRP ETFs, combined with subdued trading volumes, has delayed the broader XRP price rally. The SEC’s recent delay of the Franklin Templeton XRP ETF added further caution to the market.

Order book data on Binance, Coinbase, and OKX revealed massive sell orders clustered above the $3.05 level, while whales have also opened short positions between $3.3 and $3.6. This heavy resistance could limit XRP’s upside potential even as the REX-Osprey ETF begins trading, echoing the lukewarm demand seen for the REX-Osprey Solana + Staking ETF (SSK), which only saw $205 million in inflows since its launch last month.

On-Chain Data Signals Persistent Whale Distribution

CryptoQuant’s 30-day moving average of XRP whale flows confirms ongoing distribution pressure. The pattern mirrors earlier phases this year when sustained whale selling preceded market corrections. This new wave of selloffs comes as over 99% of long-term holders were in profit, prompting profit-taking and pushing XRP down to $2.70 recently.

While XRP has climbed 1% in the past 24 hours to $3.05 and daily trading volume is up over 40%, Coinglass data shows a decline in open interest across futures markets, suggesting derivatives traders are also pulling back.

Outlook: Bulls Face Uphill Battle

With whales actively shorting and selling, bullish momentum may struggle to sustain despite the REX-Osprey ETF launch. Institutional demand will be key in determining whether XRP can break through the heavy sell walls ahead.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Is It Too Late to Buy XRP? Oscar Ramos Says ‘All In’ Under $3

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!