|

Getting your Trinity Audio player ready...

|

XRP is facing a decisive moment as it clings to the critical $2.00 support level. Despite positive developments both on-chain and in the Ripple-SEC lawsuit, XRP’s price remains vulnerable to a sharp decline. If the $2.00 threshold fails to hold, analysts warn of a potential 40% drop to $1.20.

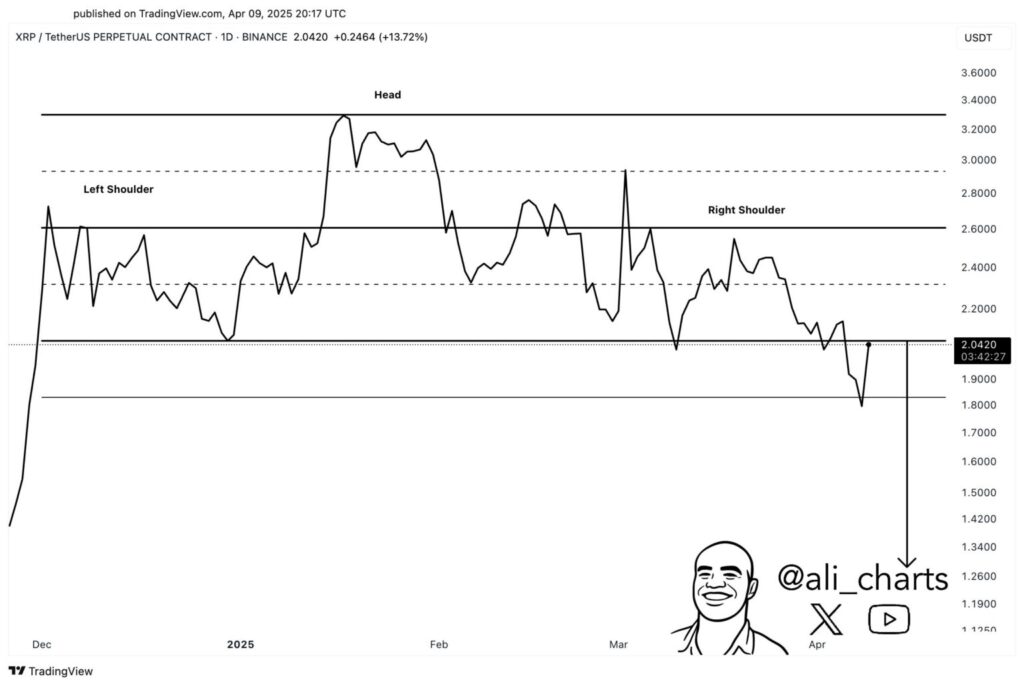

In the past 24 hours, XRP briefly rebounded from $1.90 to retest the $2.00 mark. However, trading volumes tell a different story, plunging 51% to $4.21 billion—indicating weakening momentum. Technical patterns are also flashing warning signals. Crypto analyst Ali Martinez highlights a bearish head-and-shoulders pattern, with $1.80 acting as immediate support. A decisive breakdown could open the gates for a deeper plunge.

Yet, hope isn’t lost. EGRAG Crypto sees a potential for a massive rally if XRP can decisively reclaim and hold above $2.00. The analyst references XRP’s historic 2,600% surge during the 2017 cycle, suggesting a similar breakout could catapult the token to $22, $30, or even higher—especially if a long-term trendline is confirmed.

#XRP – 🆙 Symmetrical Triangle ($30):

— EGRAG CRYPTO (@egragcrypto) April 10, 2025

Let’s focus on this cycle for the breakout from the symmetrical triangle. Instead of using the triangle’s measured move, I’m looking at the last pump from the 2017 cycle, which was an incredible 2,600%! Starting from $1.20, if we see a… pic.twitter.com/FLIDZgTTee

Meanwhile, on-chain fundamentals remain robust. Over 6.26 million addresses now hold at least one XRP, according to data from analyst Ali Martinez, marking a new all-time high in wallet adoption. This signals continued investor interest despite broader market uncertainty.

Adding to the optimism, Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC) has reached a potential turning point. This week, both parties filed a joint motion with the U.S. Court of Appeals to pause the appeal process, pending approval of a proposed settlement. The legal clarity could pave the way for an XRP spot ETF—a major catalyst for institutional inflows.

Also Read: 81.6% of XRP Supply in Profit—But Korean Traders Turn Bearish: What’s Fueling the Sell-Off?

However, macroeconomic factors continue to cloud sentiment. The resurgence of trade tensions under Trump’s escalating tariff rhetoric has cast a bearish shadow across the crypto landscape.

For now, XRP sits on the edge. A breakout above $2.00 could reignite the bulls, while a breakdown risks a swift descent to $1.20.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!