Ripple’s XRP token is currently trading in a tight range, hovering just above a crucial support level of $0.5664. This level has proven to be a significant barrier against further downward pressure, suggesting a period of consolidation for the cryptocurrency.

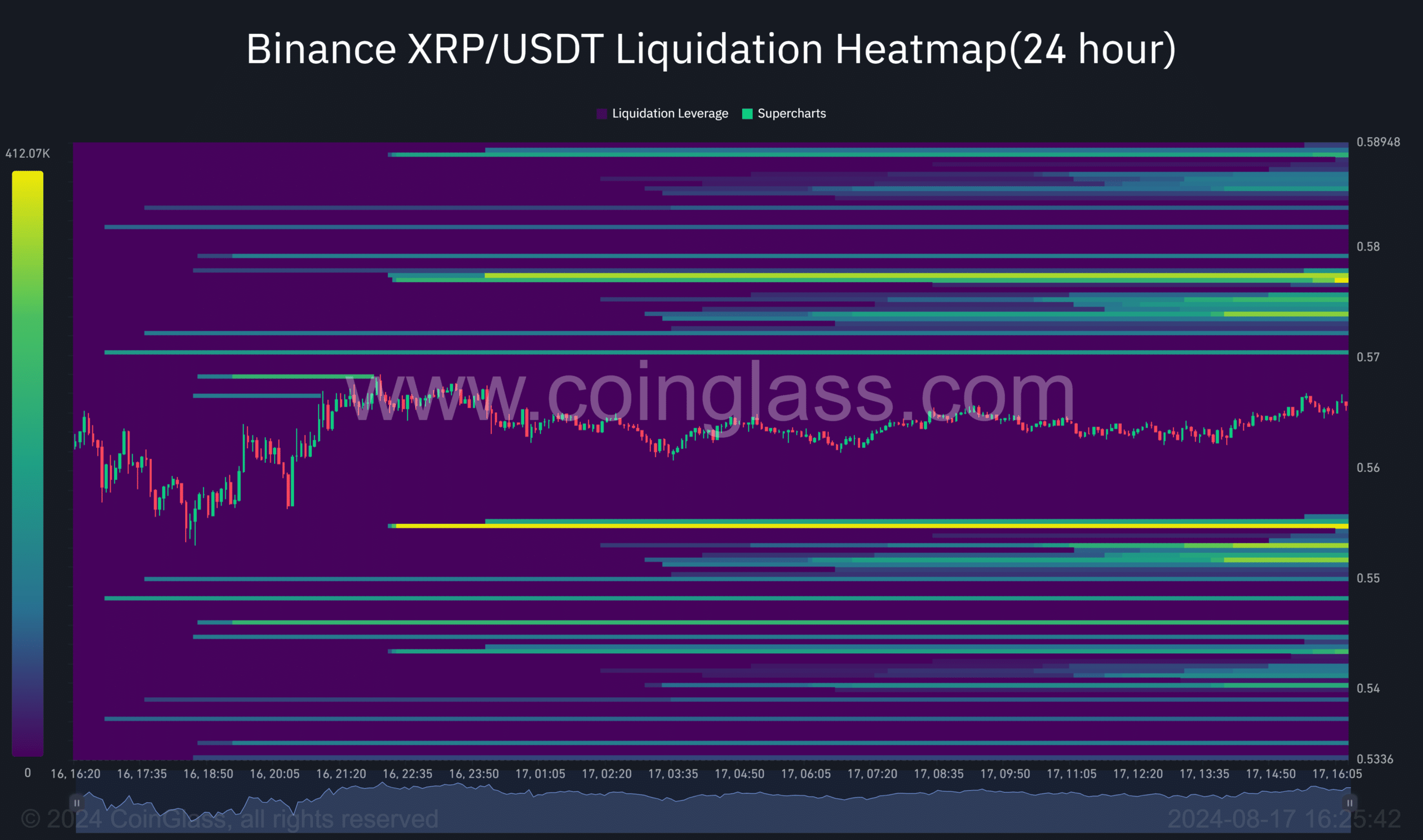

While XRP has shown a slight uptick of 2.3% since its rejection from the support level, indicating some bullish momentum, a deeper dive into the market data reveals a more complex picture. Liquidation data suggests cautious investor sentiment, with a concentration of positions around the $0.56 to $0.58 range. This indicates that traders are adopting a wait-and-see approach.

On the other hand, XRP has seen significant outflows from exchanges, a trend often interpreted as accumulation. However, the number of active XRP addresses has been declining, suggesting a potential decrease in overall market participation.

This discrepancy between exchange outflows and active addresses paints a nuanced picture of XRP’s current market dynamics. While the former points to potential accumulation, the latter suggests a lack of strong buying pressure.

As XRP continues to trade within a narrow range, traders should closely monitor the $0.5664 support level for any potential breakdowns. A break below this level could signal a more significant downward move. Conversely, a decisive break above the $0.6487 resistance level would likely ignite a stronger bullish rally.

Also Read: XRP Could Hit $52 – BitBoy Outlines Bullish Path To $5 Trillion Market Cap

Ultimately, the direction of XRP’s price will depend on a combination of factors, including overall market sentiment, regulatory developments, and investor confidence. Until then, traders may want to exercise caution and consider adopting a range-bound trading strategy.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.