|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- XLM has formed a bull flag pattern, a bullish continuation signal.

- Liquidity near $0.42 could drive a breakout if tested.

- Breakdown below support would invalidate the bullish setup.

Stellar (XLM) appears poised for its next significant move, forming a classic bull flag pattern on the daily chart. This technical setup often precedes a continuation of bullish momentum and suggests the altcoin could rally toward the $0.67 mark—if current support holds.

Classic Bull Flag Signals Buyer Strength

A bull flag pattern typically emerges after a sharp upward rally, followed by a phase of horizontal consolidation. This pattern is widely regarded as a bullish continuation signal, as it reflects a temporary pause while buyers regain strength before another upward push.

Between July 8 and 14, XLM surged 84%, creating the flagpole. Since then, the token has been consolidating within a horizontal channel—a textbook flag formation. Analysts interpret this pause as a healthy cooldown, not a loss of momentum.

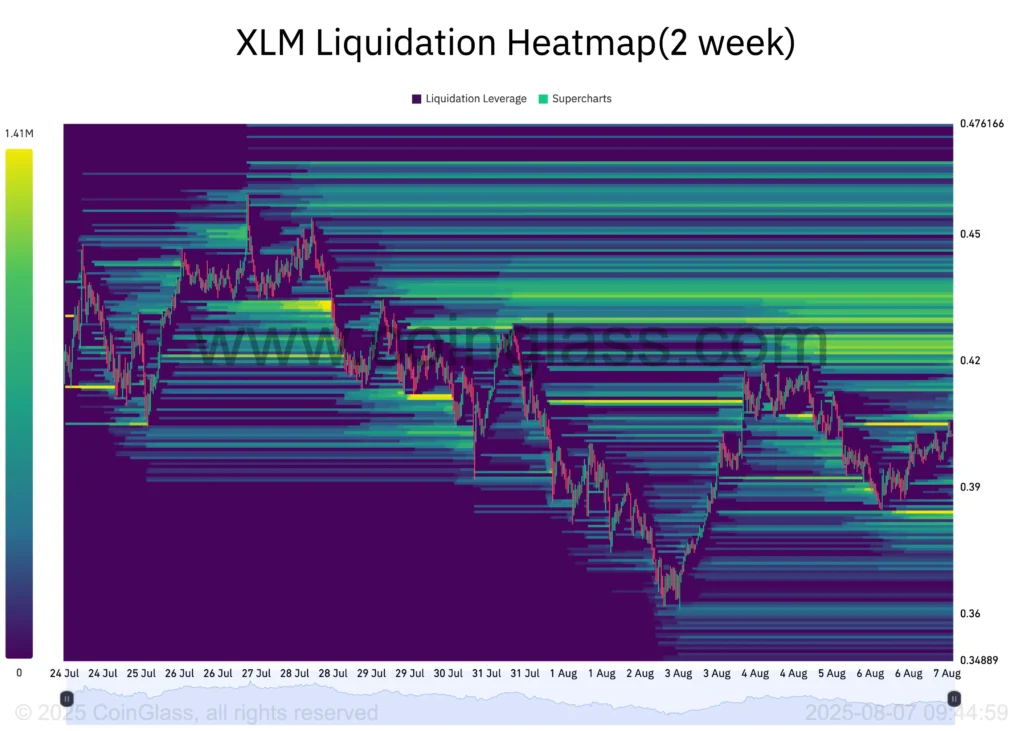

Liquidity Heatmap Adds to Bullish Case

Further strengthening the bullish outlook is XLM’s liquidation heatmap, which shows a heavy cluster of liquidity around the $0.42 level. Such liquidity zones act as magnets for price movement in leveraged markets, making a short-term move toward $0.42 increasingly likely.

If XLM can breach this zone with volume, it could spark renewed interest and pave the way for a breakout toward the measured target near $0.67.

Risk of Breakdown Remains

While the technical setup leans bullish, there are risks. If XLM fails to maintain support and breaks below the horizontal channel, the bull flag pattern would be invalidated. This could open the door for a retracement toward $0.38 or lower, particularly if selling pressure accelerates.

XLM’s current bull flag formation points to a potential breakout, with $0.67 as a key upside target. However, the pattern’s reliability hinges on maintaining consolidation support. A move above $0.42 may confirm bullish momentum, but traders should remain alert to any breakdown below the channel that could shift sentiment.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Stellar (XLM) Breakout Imminent: Key Resistance Levels Signal Bullish Rally in 2025

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.