|

Getting your Trinity Audio player ready...

|

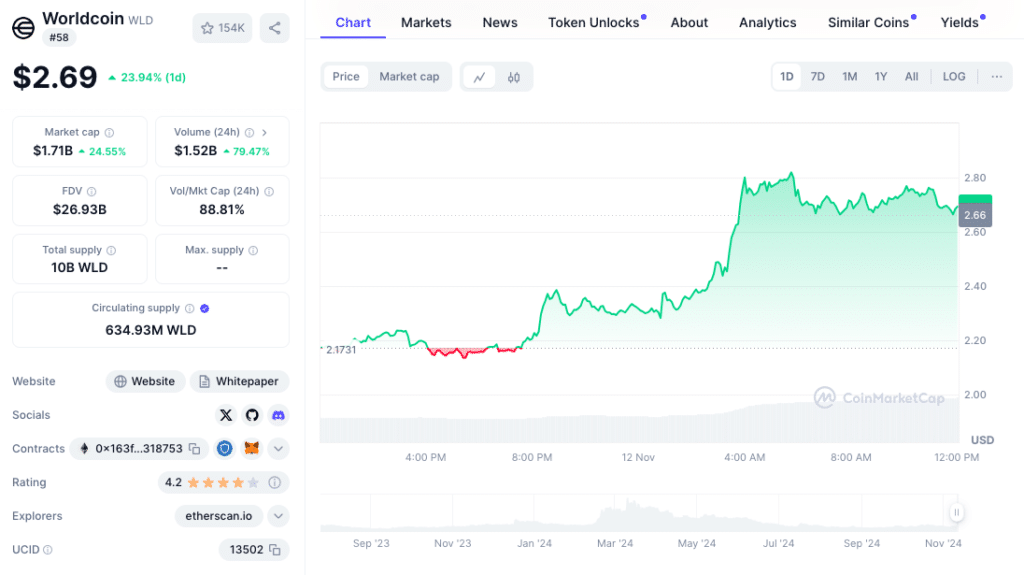

- Worldcoin Price Shoots Up by 28% as Global ID Verification Expands

Worldcoin (WLD) has seen a dramatic price surge, rising by 28% as its World ID project accelerates its global expansion. Co-founded by OpenAI’s Sam Altman, Worldcoin aims to provide a secure, decentralized digital identity solution through biometric verification. Now operational in over 40 countries, the project’s recent rollout includes new launches in Costa Rica, Poland, and Austria. This expansion has brought renewed attention to WLD, Worldcoin’s native cryptocurrency, sparking a wave of investor interest and boosting its market value.

Price Surge Linked to Global Expansion

Over the last 24 hours, WLD has experienced a notable rally, with prices fluctuating between an intra-day high of $2.83 and a low of $2.12. At press time, WLD is trading at $2.69, reflecting a 38% rise from its recent support level and an impressive 66% increase over the past week. Worldcoin’s growth in Latin America has been a significant driver of this trend, with new operations launching in Colombia, Ecuador, and Guatemala. The expansion introduces Orbs—Worldcoin’s biometric verification devices—across these regions to combat identity theft and digital fraud.

Europe, too, has become a focal point for Worldcoin, with recent launches in Austria and Poland. Despite regulatory scrutiny, the project has steadily gained traction. However, some countries have raised concerns about the privacy implications of biometric data collection. Authorities in Spain and Germany, for example, have questioned the use of iris-scanning technology, while South Korean regulators have expressed similar apprehensions. In Kenya, Worldcoin’s operations have been temporarily suspended due to data privacy concerns, underscoring the regulatory challenges the project faces in certain markets.

Sam Altman Celebrates Progress Amid Regulatory Hurdles

Sam Altman recently acknowledged the project’s growth, celebrating over 16 million users verified through World ID. He praised Worldcoin CEO Alex Blania for successfully guiding the project’s expansion, despite regulatory challenges. “Amazing progress at World over the past year,” Altman stated on social media, highlighting his optimism about the potential of cryptocurrency.

With millions of users joining the network, Worldcoin’s growing global presence has driven increased interest in WLD. The project’s rising visibility has positively impacted WLD’s value, attracting both retail and institutional investors.

Technical Analysis: Bullish Signs for WLD

WLD’s recent price surge aligns with a rise in trading volume, which increased by 76.56%, reaching $2.38 billion. Open interest—a measure of market confidence—has also surged by 38.51%, totaling $346.38 million. This uptick suggests continued bullish momentum as new funds flow into the market. Key technical indicators further support this positive trend: the Money Flow Index (MFI) stands at 70.51, close to overbought levels, while the Chaikin Money Flow (CMF) indicates steady buying pressure.

Analysts suggest that if WLD maintains its current momentum, it could approach the $3.00 resistance level. However, they caution that a pullback could occur if buying pressure declines.

Institutional Interest and Market Confidence

Large-scale transactions indicate strong institutional confidence in Worldcoin’s long-term potential. In the past week alone, transactions exceeding $100,000 have totaled $236.93 million. With 45% of WLD holders currently “in the money,” the token has shown resilience amid market volatility. While short-term resistance near the $3.00 mark could present challenges, the sustained interest from large holders reflects a solid foundation of market confidence for Worldcoin’s future growth.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!