|

Getting your Trinity Audio player ready...

|

The cryptocurrency market, particularly Bitcoin, is experiencing a surge in anticipation of a potential Federal Reserve interest rate cut. The CME FedWatch tool, a reliable indicator of market expectations for Fed policy, has significantly increased the probability of a rate reduction at the central bank’s upcoming meeting on December 17th and 18th.

As of Monday, December 2nd, the CME FedWatch tool projected a 74.5% chance of a 0.25% rate cut, a substantial jump from the 66% probability estimated just a few days prior. This heightened expectation has been fueled by recent comments from key Federal Reserve officials.

Federal Reserve Governor Christopher Waller expressed his inclination towards supporting a rate cut, though he emphasized that the final decision would hinge on upcoming economic data. Similarly, New York Fed President John Williams suggested a potential rate reduction over time.

While Federal Reserve Chair Jerome Powell has previously indicated no immediate urgency for rate cuts, market sentiment remains bullish. Investors anticipate further clarity on the Fed’s stance during Powell’s public discussion in New York on December 4th.

The potential for lower interest rates is seen as a positive catalyst for Bitcoin and other cryptocurrencies. Historically, lower borrowing costs have encouraged investors to allocate capital towards riskier assets, including cryptocurrencies. The combination of a potential rate cut and positive regulatory developments, particularly under the Trump administration, has significantly boosted Bitcoin’s price performance this year.

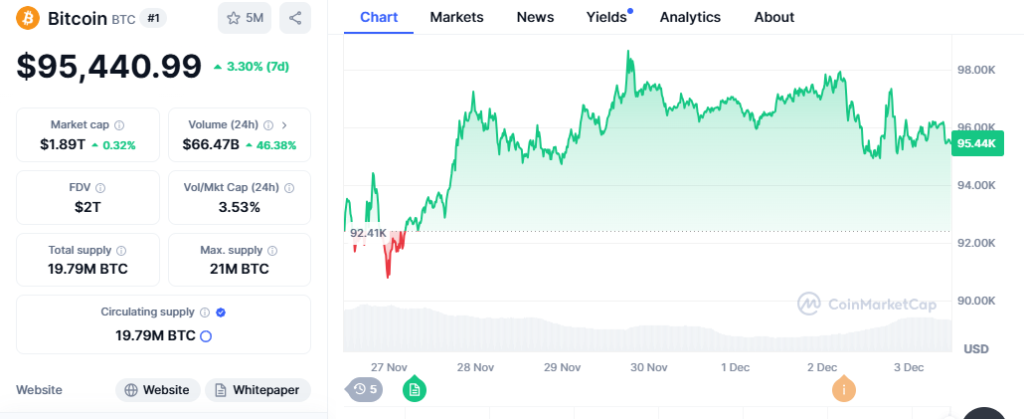

As of Tuesday morning, Bitcoin is trading around $95,800, down slightly from its recent highs. However, analysts remain optimistic, with many predicting a surge towards the $100,000 mark before the year’s end.

The cryptocurrency market is closely monitoring the Federal Reserve’s policy decisions and any potential impact on the broader economic landscape. As the Fed’s meeting approaches, market volatility is expected to increase, with Bitcoin’s price movements likely influenced by the central bank’s actions and subsequent market reactions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.