|

Getting your Trinity Audio player ready...

|

Ethereum, the second-largest cryptocurrency by market capitalization, is facing a significant downturn. After a 2.41% decline in the past 24 hours, ETH is now trading closer to the crucial $3,600 support level. As Bitcoin struggles to hold the $95,000 support, the broader crypto market’s loss of momentum is putting immense pressure on Ethereum.

Technical Analysis: A Bearish Outlook

A closer look at Ethereum’s 4-hour chart reveals a concerning price action. The cryptocurrency has formed a rising channel pattern, but recent price movements suggest a potential breakdown. The failure to break through the overhead resistance trend line has triggered a bearish cycle.

- MACD Divergence: The negative divergence between the MACD and signal lines indicates a bearish trend.

- Bearish Histograms: The increasing bearish histograms on the MACD further solidify the sell signal for ETH.

Ethereum ETFs: A glimmer of Hope

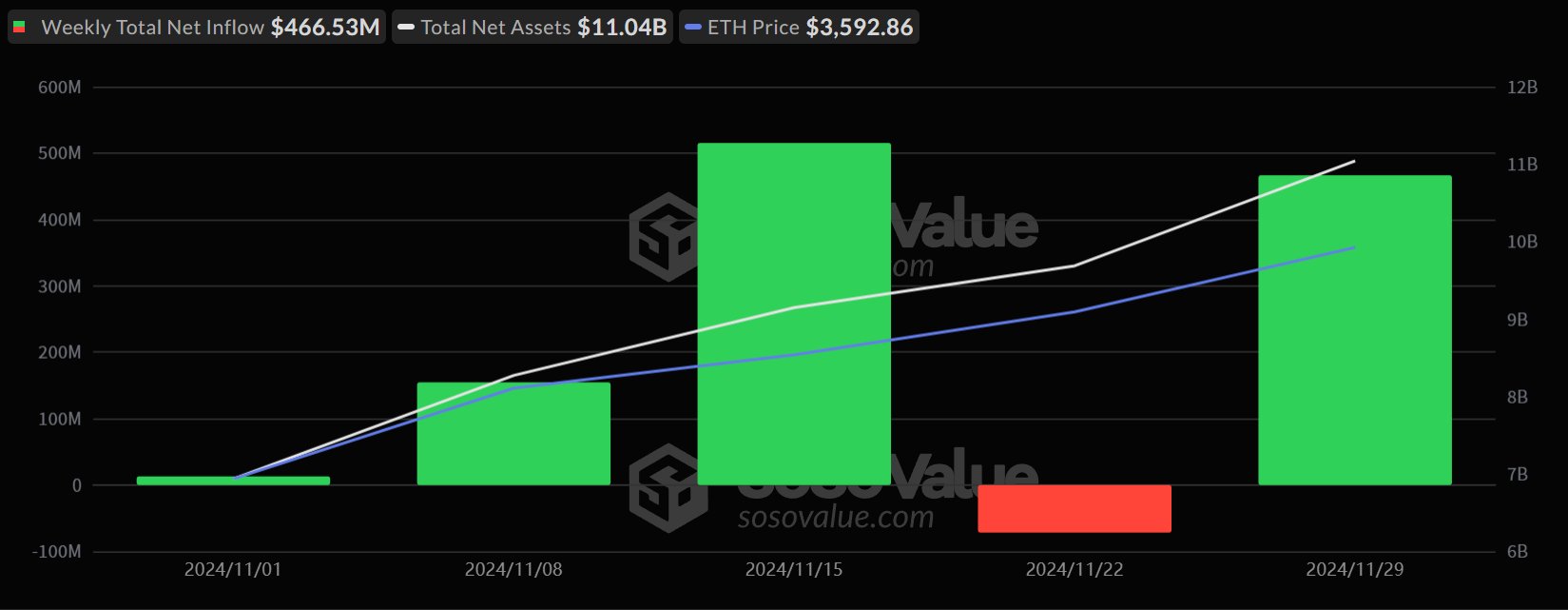

Amidst the bearish sentiment, the recent surge in Ethereum ETF inflows has offered some respite. Last week, U.S.-based spot Ethereum ETFs witnessed a net inflow of $467 million. BlackRock’s ETF led the charge with a net inflow of $300 million, followed by Fidelity with $120 million. While this positive trend may drive demand for ETH in the long run, it’s unlikely to reverse the current bearish momentum in the short term.

Price Targets and Outlook

Given the current market conditions, Ethereum’s immediate support level lies at $3,570. However, a breakdown below this level could lead to further declines, with the next significant support at the S-1 pivot level of $3,392.46.

For a bullish reversal, ETH must reclaim the $3,600 level and break through the overhead resistance trend line. This could potentially propel the price towards the $4,000 mark.

Ethereum is currently facing a challenging period, with the potential for a significant price correction. While the recent influx into Ethereum ETFs offers some hope for the future, the immediate outlook remains bearish. Investors should closely monitor the price action and technical indicators to gauge the next potential moves in the ETH market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.