|

Getting your Trinity Audio player ready...

|

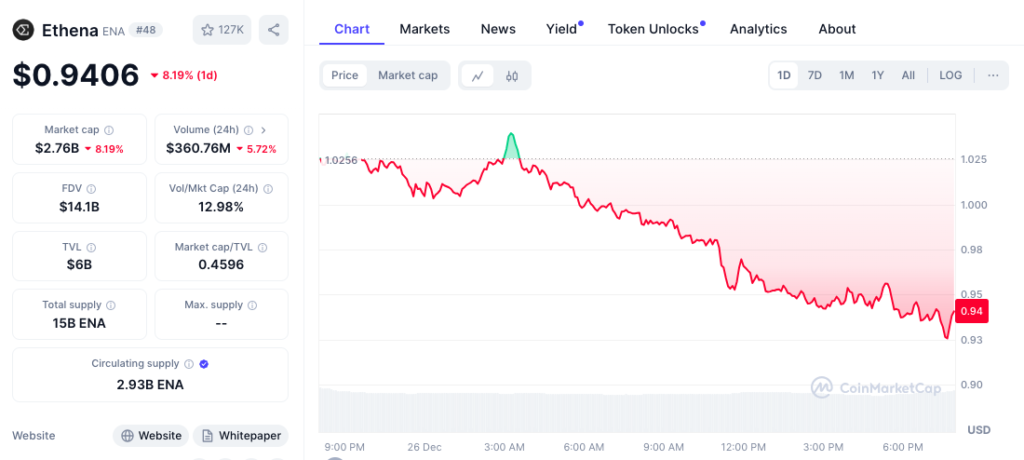

Ethena (ENA) has faced a sharp price decline, retreating for three consecutive days to trade at $0.95, breaching the psychological $1 level for the first time since December 20. The downturn reflects a broader risk-off sentiment in the cryptocurrency market, with Bitcoin and other major tokens also under pressure.

Whales Fuel Selling Pressure

The recent drop in Ethena’s price has been exacerbated by significant sell-offs from whales. On December 26, whales offloaded $30 million worth of ENA tokens. The largest transactions included one whale transferring 11.6 million ENA tokens (valued at $11 million) and another trader moving $10.7 million worth of tokens to Binance.

Adding to the bearish momentum, Arthur Hayes, founder of BitMEX and an early Ethena investor, sold a portion of his ENA holdings last week. Hayes now holds 18,616 ENA tokens valued at $17,458, signaling a potential lack of confidence among high-profile investors.

Rising Exchange Balances and Sluggish Stablecoin Demand

On-chain data shows a 5.82% increase in ENA tokens on exchanges over the past week, now totaling 730.27 million tokens. This rise in exchange balances, often a precursor to selling pressure, has pushed the total supply on exchanges to 4.87%, up from 4.60% a week earlier.

Meanwhile, Ethena’s USDe stablecoin, which supports its ecosystem, has seen stagnant inflows. Its market cap remains at $6 billion, signaling sluggish demand and limited investor activity.

Technical Indicators Point to Further Downside

From a technical perspective, Ethena appears to be on a bearish trajectory. The token has formed a head-and-shoulders (H&S) pattern on its four-hour chart, with the neckline at $0.8552 acting as critical support.

Ethena’s price has also dipped below the 50-period moving average and the 38.2% Fibonacci retracement level, further reinforcing bearish sentiment. If the price falls below the neckline, analysts predict further declines to the next support level at $0.5860.

As selling pressure from whales persists and technical indicators flash red, Ethena’s short-term prospects remain bleak. A break below $0.8552 could trigger deeper losses, with recovery dependent on renewed demand and a shift in market sentiment.

Investors will be closely monitoring on-chain metrics and broader market trends for signs of stabilization in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!