|

Getting your Trinity Audio player ready...

|

The cryptocurrency market continues its downward spiral, with Dogwifhat (WIF) bearing the brunt of the sell-off. The memecoin has plummeted by a staggering 36% in the past week, mirroring the broader market’s decline.

Bitcoin, the market’s bellwether, has lost nearly 10% of its value, dragging altcoins like Ethereum and Solana down with it. However, WIF has been particularly hard hit, raising concerns about its future trajectory.

Market sentiment surrounding WIF is overwhelmingly bearish. Analysts are predicting further declines, with some even suggesting a potential drop to $1.00. Rehan Rao, a prominent analyst, has warned of a potential plunge to $0.90, citing a recent whale sell-off of 14.53 million WIF tokens.

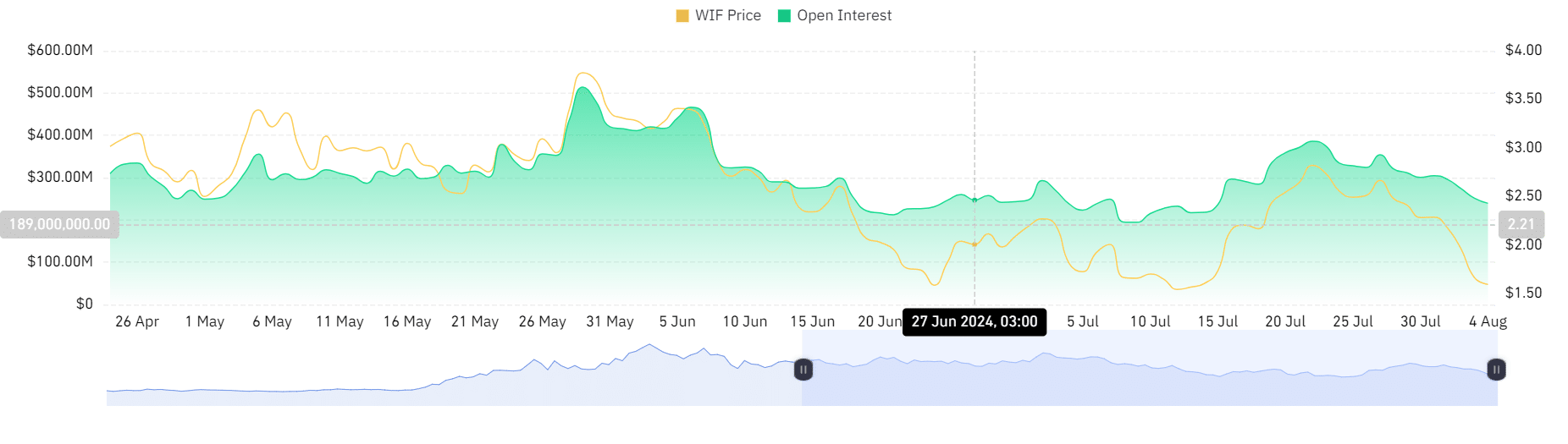

To compound the bearish outlook, WIF’s open interest has declined significantly, indicating a lack of investor confidence. Additionally, massive liquidations of long positions have exacerbated the price decline.

Technical indicators also paint a bleak picture for WIF. The Relative Strength Index (RSI) and Awesome Oscillator (AO) are both firmly in oversold territory, suggesting strong downward momentum. The Moving Average Convergence Divergence (MACD) is also negative, confirming the bearish trend.

While a drop to $1.00 seems plausible given the current market conditions, it’s essential to remember that the cryptocurrency market is highly volatile. A potential retest of the $0.50 support level could trigger a significant rebound, as seen in previous instances.

Also Read: Investor Turns $5,340 Into $24 Million by Selling 14.53M Dogwifhat Tokens—A 4,497x Profit!

Investors should exercise caution and conduct thorough research before making any investment decisions. The cryptocurrency market remains highly unpredictable, and losses can be substantial.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!