|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Bitcoin miner reserves are gradually decreasing, signaling potential short-term selling.

- A sharp rise in Miners’ Position Index points to increased market pressure.

- BTC is trading near key support levels, with potential for further downside if sentiment weakens.

As market uncertainty deepens, Bitcoin miners appear to be gradually reducing their holdings, signaling growing bearish sentiment and hinting at potential short-term selling pressure.

BTC Miner Reserve Declines Amid Price Weakness

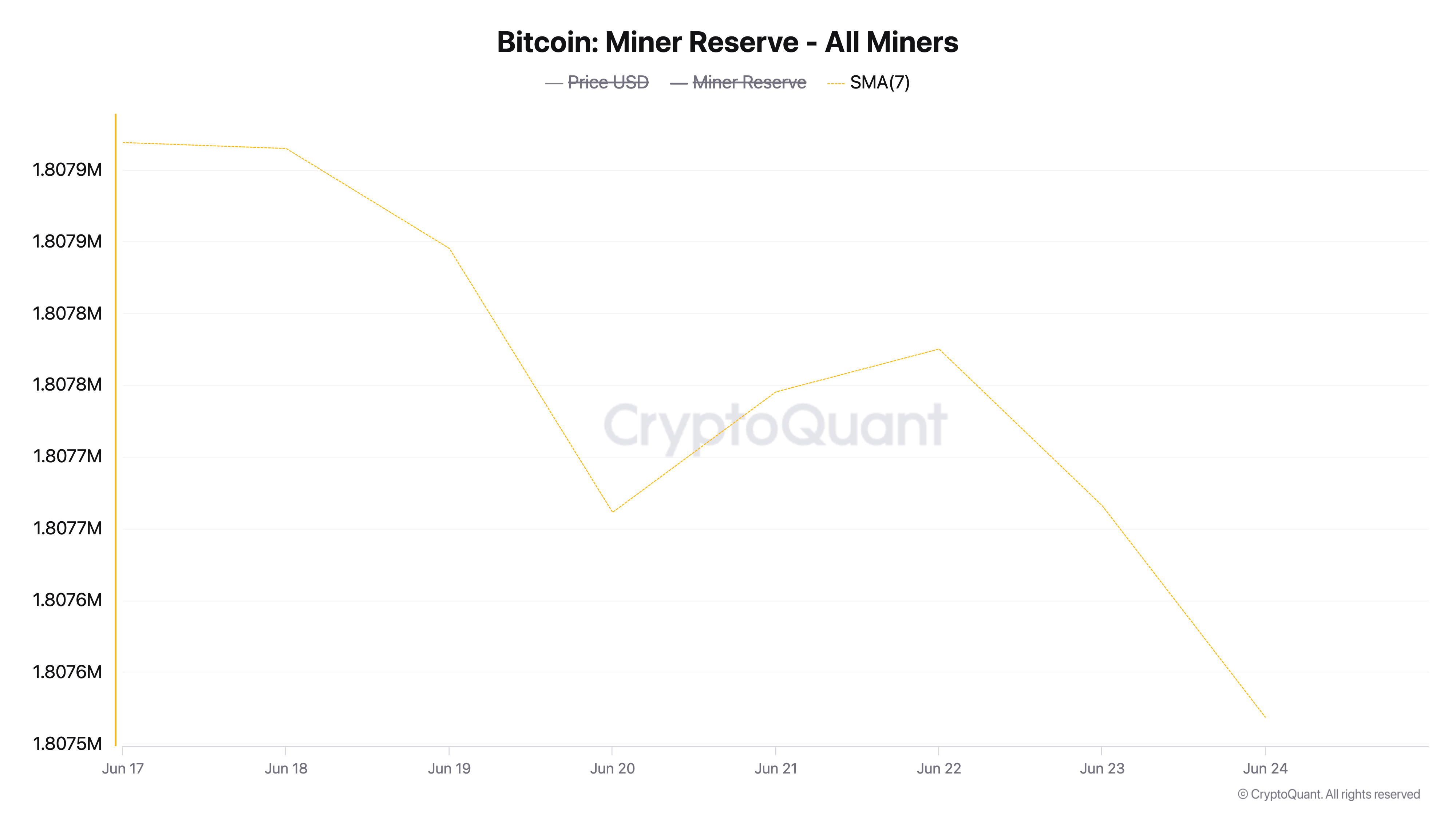

According to recent data from CryptoQuant, Bitcoin miner reserves—representing the number of BTC coins held in miner wallets—have steadily declined over the past week. Using a 7-day moving average, the reserve dipped by 0.022%, suggesting miners are moving coins to exchanges, likely to cover operational costs or lock in profits before a potential market downturn.

Historically, an increasing miner reserve signals confidence in Bitcoin’s future price appreciation, while a falling reserve—like the current trend—typically foreshadows a bearish outlook.

Miners’ Position Index Surges, Indicating Selling Pressure

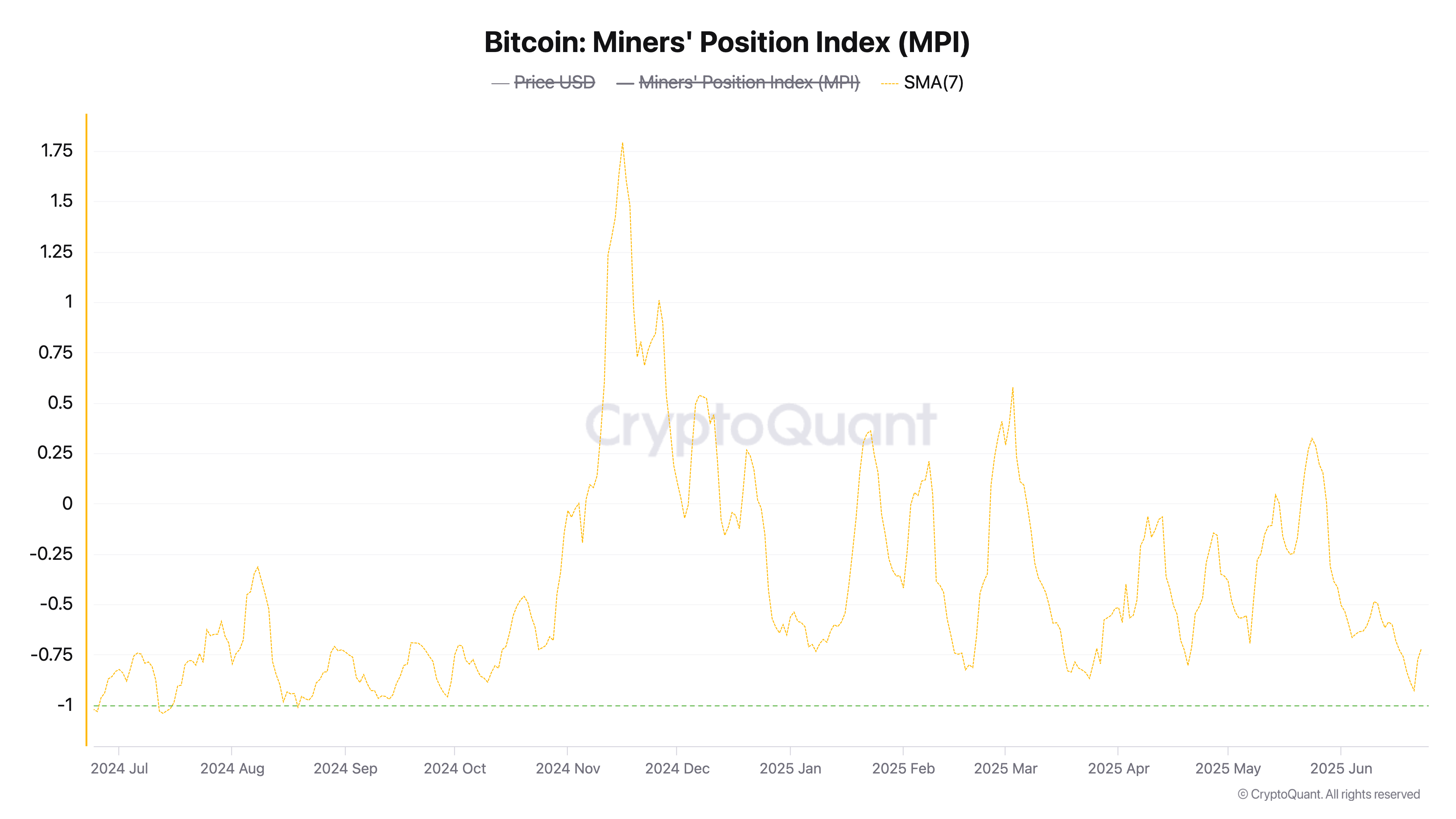

Adding to the negative sentiment is a sharp rise in the Miners’ Position Index (MPI). This metric, also observed on a 7-day moving average, has surged 55% over the past three days. The MPI gauges the ratio of miner outflows against their one-year moving average, with spikes often indicating that miners are actively selling.

This uptick in MPI suggests miners are positioning themselves for further downside, moving coins to exchanges in anticipation of a potential market correction.

BTC Faces Key Support Levels Amid Bearish Momentum

Bitcoin’s recent price action reflects this cautious miner behavior. Over the past two days, BTC briefly dipped below the crucial $100,000 psychological support level. At press time, Bitcoin trades at $104,990, slightly above support at $103,952.

If selling pressure continues, BTC could retest lower levels—potentially falling to $101,520, or even sliding below $100,000 toward $97,658 if bulls fail to defend key zones. Conversely, an uptick in demand could propel BTC back toward $106,295.

Also Read: Tether Mints $2 Billion USDT — Could It Trigger Bitcoin’s Next Breakout?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.