|

Getting your Trinity Audio player ready...

|

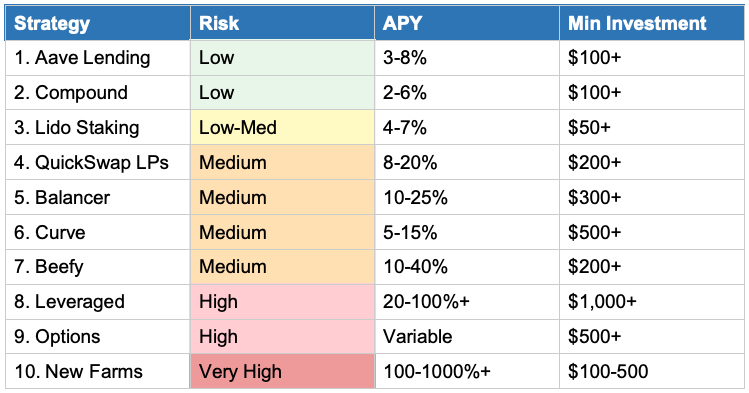

Your tokens are on Polygon. Now put them to work. This guide covers 10 strategies earning 3-100%+ APY: conservative stablecoin lending (5-8%), medium-risk liquidity pools (10-25%), and high-risk leveraged farming (20-100%+). You’ll get real math, hidden costs, and exact portfolio allocations for $500-$50,000. The goal isn’t chasing yields—it’s sustainable returns with managed risk.

First: Get MATIC/POL for Gas

You need MATIC (now POL) to pay transaction fees on Polygon. Keep 5-10 POL in your wallet.

Pro Tip:

Always keep a separate ‘gas wallet’ with 2-3 POL that you never touch. If you accidentally drain your main wallet doing transactions, you’ll still have gas to move funds or exit positions.

How to get POL:

- Some bridges provide POL automatically

- Use Polygon’s gas swap feature (0.5% fee but convenient)

- Swap tokens for POL on QuickSwap (better rates for >$100)

10 Opportunities Overview

Low Risk Strategies (3-8% APY)

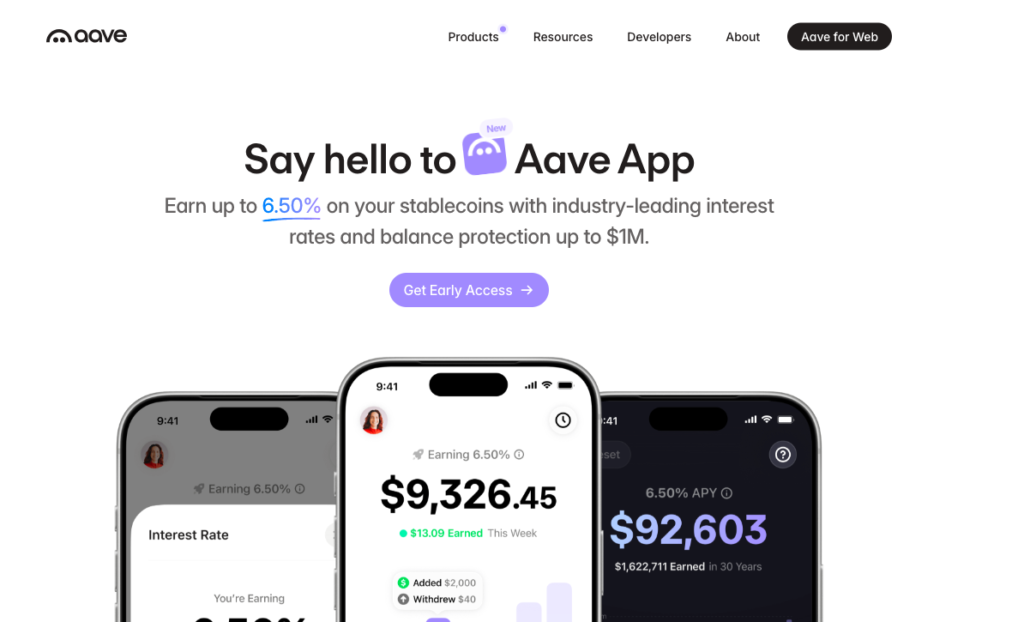

1. Aave – Lend Stablecoins

Supply USDC, USDT, or DAI to earn interest. Battle-tested protocol with $10B+ TVL.

- How: app.aave.com → Connect wallet → Supply stablecoins

- Why safe: Multiple audits, huge TVL, stablecoin = minimal volatility

- Risk: Smart contract exploit, stablecoin depeg

Advanced Strategy: Supply USDC to Aave, borrow USDT at lower rate, supply borrowed USDT back to Aave. This ‘recursive lending’ can boost yields to 8-12% APY. Monitor health factor closely (keep >2.0).

⚠️ Hidden Cost: Aave’s utilization rate affects both supply and borrow rates. When utilization hits 90%+, you may not be able to withdraw immediately. Check utilization before depositing large amounts.

Tax Note: In many jurisdictions, interest earned is taxable income. Track your aToken balance changes for accurate reporting.

2. Compound Finance

Similar to Aave. Auto-compounds interest. Slightly lower yields but more consistent liquidity.

- Best for: Set-and-forget investors who value liquidity over max yield

Pro Tip: Compound’s cTokens (cUSDC, cDAI) are accepted as collateral on other DeFi protocols. You can deposit to Compound, then use your cTokens elsewhere – double-dipping on yields.

3. Lido Liquid Staking (stMATIC)

Stake MATIC to earn 4-7% while keeping liquidity. Get stMATIC tokens usable in other DeFi.

- Advantage: No lockup period, earn while maintaining flexibility

- Best for: MATIC holders who want passive income

�� Yield Stacking Strategy: Stake MATIC → Get stMATIC → Deposit stMATIC to Aave → Borrow against it → Buy more MATIC → Repeat. This can amplify yields to 12-20% but increases liquidation risk.

⚠️ Liquidity Warning: stMATIC trades at a slight discount to MATIC (usually 0.5-2%). If you need to exit quickly, you’ll lose this discount. For best rates, unstake properly instead of swapping.

Medium Risk Strategies (8-40% APY)

4. QuickSwap – Liquidity Pools

Provide liquidity to trading pairs, earn 0.25-0.3% per swap + QUICK rewards.

- Safe pairs: USDC/USDT (minimal impermanent loss)

- Higher yield: WETH/WMATIC (more IL risk but 15-25% APY)

- Key risk: Impermanent loss if token prices diverge

IL Mitigation: The breakeven formula: Daily volume should be >0.2% of pool TVL for fees to offset 10% price divergence over 30 days. Check pool analytics before depositing.

⚠️ Real Numbers: If ETH 2x vs USDC while you’re in a 50/50 pool, you’ll have ~5.7% less value than holding. If ETH 5x, you’ll have ~25% less. Fees need to exceed this to profit.

Entry Timing: Enter volatile pairs during consolidation phases, not after one token pumps. Use technical analysis – enter when RSI is 40-60, not 70+.

5. Balancer – Weighted Pools

Custom weightings (80/20, 60/40) reduce impermanent loss vs 50/50 pools.

- Best for: Maintaining exposure to preferred assets while earning fees

Power User Strategy: 80/20 pools let you stay 80% exposed to your bullish asset while earning 15-20% APY. Example: 80% POL / 20% USDC when you’re bullish on POL long-term.

Math: In an 80/20 pool, if the 80% asset 2x, you experience only ~2.5% IL vs ~5.7% in a 50/50 pool. The trade-off: lower trading volume usually means lower fee income.

6. Curve Finance

Optimized for stablecoins. Best pools: 3pool (DAI/USDC/USDT), aTriCrypto.

- Boost: Lock CRV tokens for up to 2.5x higher yields (veCRV)

Boosting Math: To get max 2.5x boost on $10,000 deposited, you need ~$2,500 worth of veCRV locked. Without boost, you get base APY. With max boost, multiply by 2.5x.

⚠️ Lock-in Risk: veCRV locks are non-transferable and can’t be unlocked early. Locking CRV for 4 years gets max boost, but you’re stuck. Consider 1-2 year locks as a compromise.

Alternative: Use Convex Finance or Yearn to get boosted Curve yields without locking CRV yourself. They pool users’ voting power for ~2x boost automatically.

7. Beefy Finance – Auto-Compounder

Automatically harvests and reinvests rewards. Compounds multiple times per day.

- How: Deposit LP tokens or single assets → Beefy auto-compounds

- Saves: Gas fees on manual compounding

Compounding Frequency: Beefy compounds based on gas costs vs harvest value. High APY vaults compound every 1-2 hours. Lower APY vaults compound daily. This is automated – you don’t control it.

Real Benefit: Manual compounding once daily on Polygon costs ~$0.05. Beefy compounds 10x per day. For a $5,000 position at 30% APY, auto-compounding adds ~$150/year vs manual daily compounding.

⚠️ Performance Fee: Beefy charges 0.5% withdrawal fee + 4.5% performance fee on harvested profits. Still worth it for most, but factor this in when comparing to manual farming.

High Risk Strategies (20-1000%+ APY)

⚠️ Only use capital you can lose. High APY = high risk.

8. Leveraged Yield Farming

Borrow 2-3x your collateral to amplify yields. Can get liquidated if collateral value drops.

- Requires: Active monitoring, understanding of health factors

�� Safe Leverage Setup: Start with 1.5x leverage, not 3x. Maintain health factor >3.0. Set price alerts 20% above current price. Never leverage during high volatility periods.

�� Math Example: Deposit $10k, borrow $15k (1.5x leverage). Farm at 30% APY on $25k = $7,500/year. Pay 8% interest on $15k borrowed = $1,200. Net: $6,300 on $10k = 63% APY (vs 30% unleveraged).

⚠️ Liquidation Reality: At 3x leverage, a 20% drop in collateral value triggers liquidation. You lose your position + 10% liquidation penalty. In volatile markets, this can happen in minutes.

9. Options Trading (Dopex/Hegic)

Buy options to speculate or sell (write) options to earn premiums.

- Buying: Limited downside (premium paid), unlimited upside

- Selling: Earn premiums, risk of assignment

Income Strategy: Sell covered calls on assets you already own. Example: Own 100 POL, sell call options 10% above current price. If POL stays flat/down, keep premium (5-10% monthly). If it rises >10%, you sell at profit anyway.

�� Premium Math: Typical covered call on POL: 5-8% premium for 30-day option 10% OTM. Annualized = 60-96% if you can repeat every month. Reality: you’ll get assigned sometimes, missing big pumps.

⚠️ Greeks Matter: Options lose value over time (theta decay). As expiration nears, time value drops exponentially. Don’t buy options with <7 days to expiry unless you’re very confident in timing.

10. New Protocol Launches

100-1000%+ APYs to attract initial liquidity. Maximum risk of total loss.

- Risks: Rug pulls, smart contract bugs, token inflation/dumps

- Max allocation: 1-5% of portfolio only

Due Diligence Checklist:

- Team doxxed? LinkedIn profiles verified?

- Smart contract audited by known firm?

- Tokenomics sustainable? (Check emission schedule)

- Liquidity locked? For how long?

- Code open-source and on GitHub?

Exit Strategy: Take out principal after 2x gain. Let profits ride. Never let greed prevent you from securing your initial investment.

⚠️ Emission Warning: If APY is 500%, ask: where do these tokens come from? Usually from minting new tokens. Check if there’s real revenue or just inflationary rewards that will crash the token price.

Advanced Insights & Pro Tips

Gas Optimization Hacks

- Batch transactions: If claiming rewards from multiple farms, use tools like DeBank or Zapper to batch claims in one transaction

- Timing: Polygon gas is cheapest 2-6 AM UTC (Asian night / European early morning)

- Network choice: For large positions (>$50k), bridging to Polygon saves $100+ per interaction vs Ethereum

Tax-Efficient Strategies

- Harvest losses: If IL resulted in realized losses when you exit, use this to offset other crypto gains

- Timing: In jurisdictions with calendar-year tax, realize gains in January vs December to defer taxes 12 months

- Tracking: Use Koinly or CoinTracker from day 1. Retroactive tracking is painful and error-prone

Portfolio Rebalancing Triggers

Set calendar reminders to review positions:

- Weekly: Check health factors on leveraged positions, IL on LPs

- Monthly: Rebalance if any position grows >40% of portfolio

- Quarterly: Reassess protocol risks, review new audits/exploits

Hidden Yield Opportunities

- Airdrops: Many protocols reward early users. Using 5+ protocols increases airdrop chances

- Governance: Holding governance tokens sometimes qualifies for revenue sharing (e.g., Curve’s veCRV gets trading fees)

- Points programs: Some protocols give ‘points’ that convert to tokens later. Track these on platforms like Layer3 or Galxe

Sample Portfolio with Real Dollar Amounts

$5,000 Portfolio (Conservative):

- $3,500 → Aave USDC (7% APY = $245/year)

- $1,000 → Curve 3pool (10% APY = $100/year)

- $500 → Lido stMATIC (5% APY = $25/year)

Total expected: ~$370/year (7.4% blended APY)

$20,000 Portfolio (Balanced):

- $8,000 → Aave/Compound mix (6% = $480/year)

- $6,000 → QuickSwap USDC/USDT LP (12% = $720/year)

- $4,000 → Beefy auto-compound vaults (25% = $1,000/year)

- $2,000 → Balancer 80/20 POL/USDC (18% = $360/year)

Total expected: ~$2,560/year (12.8% blended APY)

$50,000 Portfolio (Aggressive):

- $15,000 → Base layer (Aave/Curve) 8% = $1,200/year

- $20,000 → Medium risk LPs + Beefy 20% = $4,000/year

- $10,000 → Leveraged farming 1.5x 40% = $4,000/year

- $5,000 → High APY new farms 80% = $4,000/year (take profits monthly)

Total expected: ~$13,200/year (26.4% blended APY)

⚠️ Reality Check: These are estimates. APYs fluctuate daily. Impermanent loss, token price changes, and protocol risks can significantly impact returns. Always track actual performance.

Critical Safety Checklist

- Start small: 10-20% of capital, learn mechanics, scale gradually

- Verify contracts: Check PolygonScan for verification + audit badges

- Hardware wallet: For holdings >$10k (Ledger, Trezor)

- Monitor positions: Weekly checks minimum – set phone reminders

- Exit strategy: Define before entering (e.g., take 50% profits at 100% gain)

- Diversify: Max 3-5 protocols. No single position >30% of portfolio

- Emergency fund: Keep 10-20% in stable, liquid assets (Aave USDC) for opportunities or emergencies

- Insurance: For large holdings, consider Nexus Mutual coverage on major protocols

7 Costly Mistakes to Avoid

- Chasing 1000% APY without understanding where yields come from (usually unsustainable token emissions)

- Never taking profits – greed destroys portfolios. Take 25-50% out at 100% gain

- Ignoring impermanent loss – use IL calculators BEFORE depositing to LPs

- Over-leveraging – start at 1.5x max, not 3x. Liquidations happen fast

- Unlimited approvals on sketchy protocols – approve exact amounts for new/unaudited protocols

- Not tracking for taxes – use Koinly/CoinTracker from day 1, not after tax season starts

- Panic selling at losses – have a plan, stick to it. Emotional decisions lose money

Essential FAQs

What’s a realistic APY target for conservative investors?

8-12% is realistic and sustainable with stablecoin lending + safe LPs. Anything >20% requires accepting significantly more risk.

How much should I keep in POL for gas?

Active traders: 10-15 POL. Passive farmers: 5-7 POL. Always keep 2-3 POL as emergency reserve.

Should I compound daily or use auto-compounders?

For positions >$5k: use Beefy/auto-compounders. For <$5k: manual weekly compounding is fine. Daily compounding is overkill unless position is >$20k.

How do I calculate break-even on impermanent loss?

Use formula: (Daily Volume / Pool TVL) × 365 × 0.0025 = annual fee APY. This must exceed your expected IL%. For 10% IL over a year, you need ~10% fee APY to break even.

Are unlimited token approvals safe?

For audited, established protocols (Aave, Curve, Uniswap): generally yes. For new protocols: NO – approve exact amounts. Revoke old approvals at revoke.cash quarterly.

What happens if I get liquidated in leveraged farming?

You lose your collateral + 5-10% liquidation penalty. Your debt is repaid from your collateral. If collateral is insufficient, you owe the difference (rare on most platforms).

How do I know if a new protocol is a scam?

Red flags: Anonymous team, no audit, liquidity not locked, copy-paste code, unrealistic promises, heavy marketing with no product. If 3+ red flags, avoid.

What’s the optimal portfolio size to start DeFi on Polygon?

Minimum $500 to make gas fees negligible. Optimal $2,000-5,000 to diversify across 3-4 strategies. Below $500, you’re better off just holding or using a single low-fee strategy like Aave.

Final Thoughts

DeFi on Polygon offers real yield opportunities, but success requires education, discipline, and risk management.

The 3 keys to profitable DeFi:

- Start small and scale – master one strategy before adding another

- Understand where yields come from – sustainable yields = real economic activity, not token printing

- Take profits systematically – don’t let greed override your strategy

Remember: If you can’t explain where the yield comes from, you’re the yield. Stay safe, stay informed, and may your returns be high and your losses minimal.

⚠️ DISCLAIMER: DeFi carries significant risks including smart contract vulnerabilities, impermanent loss, and volatility. Never invest more than you can afford to lose. This is educational content, not financial advice. DYOR.