|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has seen a significant shift in market behavior as whales accumulated over 180 million ADA in the past week. This large-scale buying spree has fueled speculation about whether ADA’s price can sustain upward momentum or if it will struggle to break key resistance levels.

ADA Price Action: Can Support Hold?

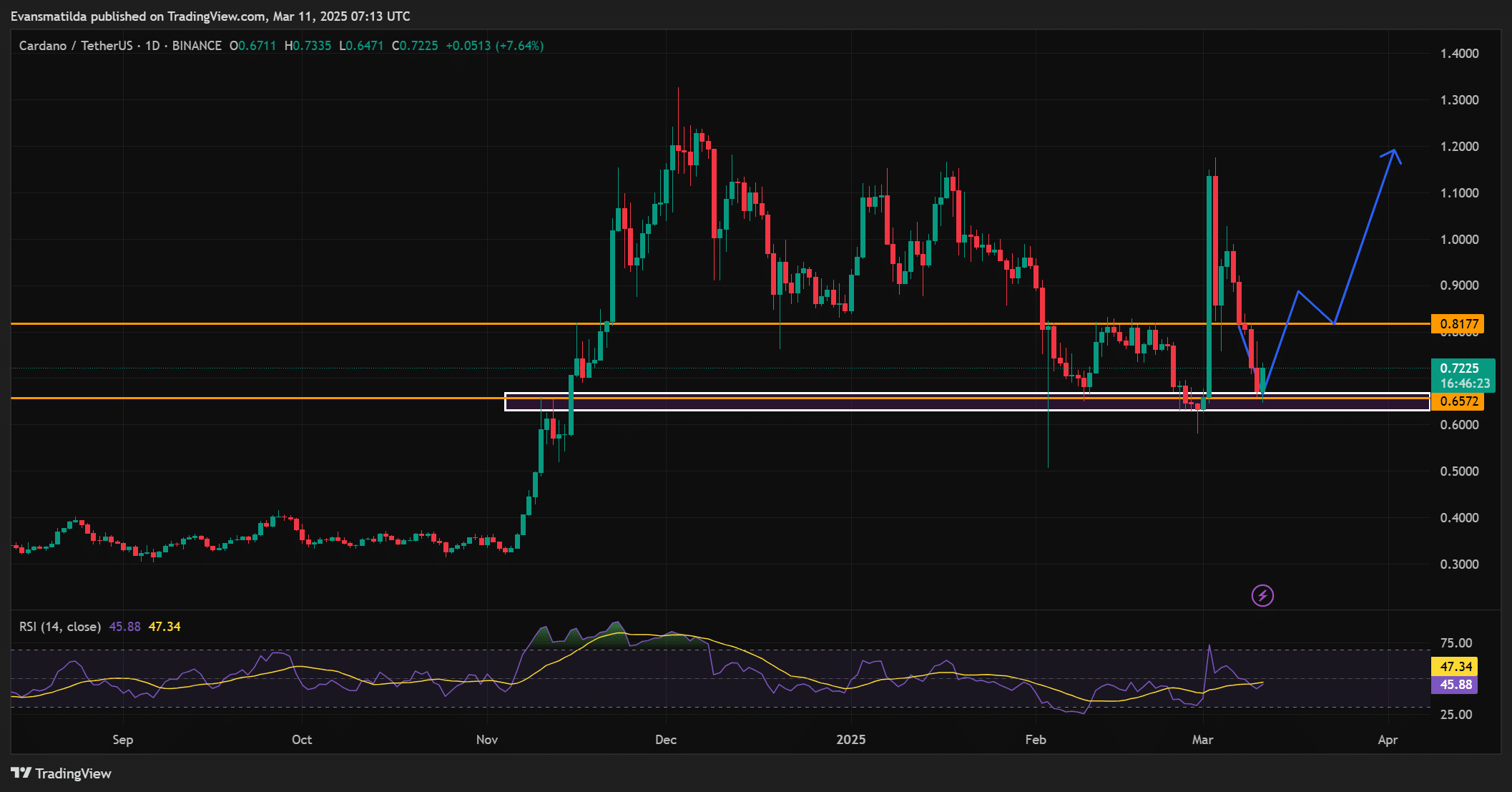

Cardano recently rebounded from a crucial support zone at $0.65, suggesting strong buying interest at this level. The price surged toward $0.72 but has since shown signs of hesitation. At press time, ADA was trading at $0.7217, reflecting a 2.93% decline over the last 24 hours.

Technical indicators present a mixed outlook. The Relative Strength Index (RSI) sits at 47.34, signaling neutral market conditions. While ADA has not entered oversold territory, it lacks the bullish momentum needed for a breakout. Without sustained buying pressure, the price could remain range-bound or face another pullback.

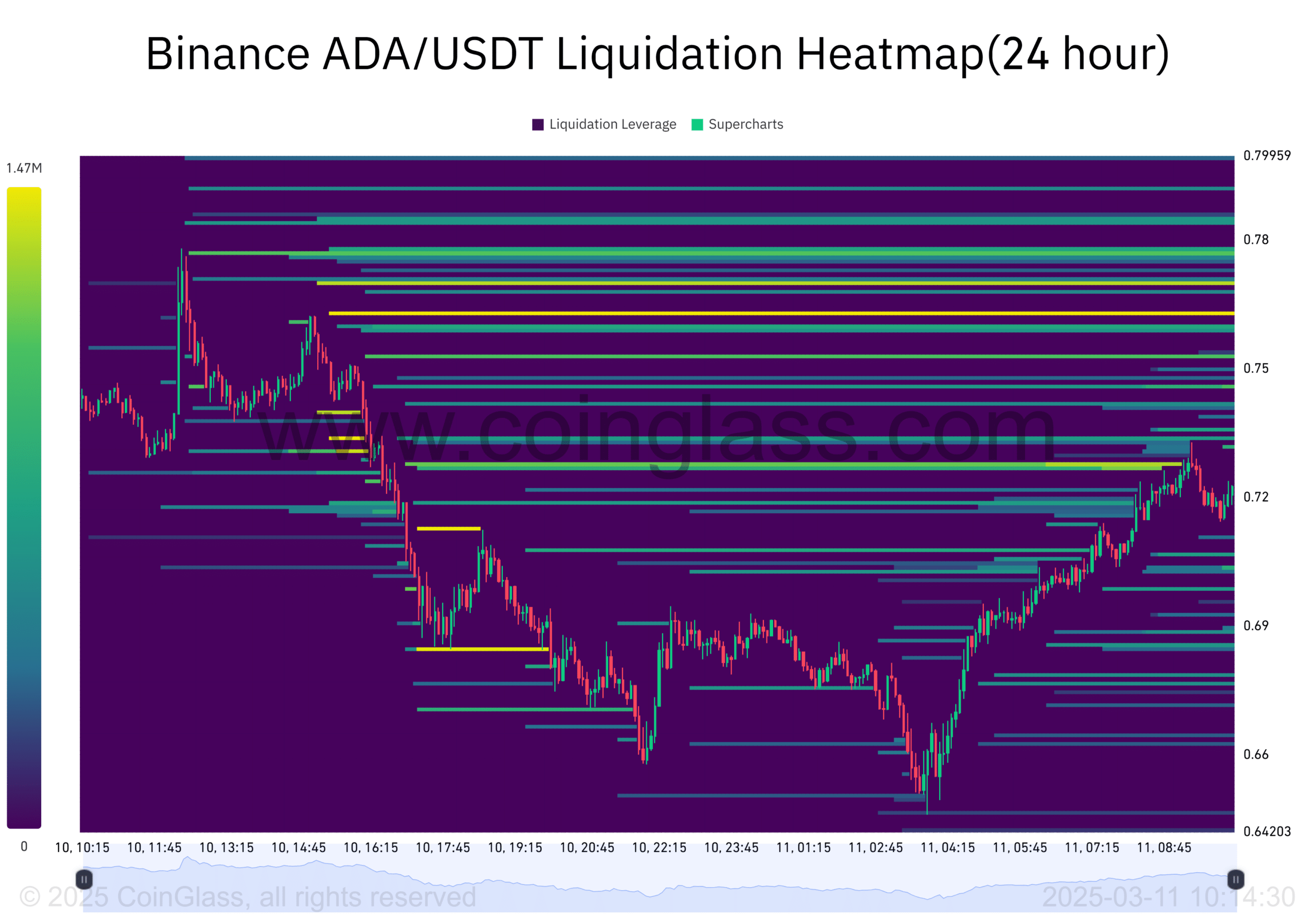

Liquidation Heatmap: Resistance at $0.72–$0.75

Analyzing ADA’s liquidation heatmap reveals pressure points that could trigger sharp price movements. The $0.72–$0.75 range has witnessed significant liquidation activity, making it a pivotal zone for price action. If ADA breaks above this range, it could signal a strong rally backed by whale accumulation.

However, failing to breach this resistance may lead to increased sell-offs, reinforcing a consolidation phase. Traders should watch for volume surges and whale movement to gauge potential breakouts.

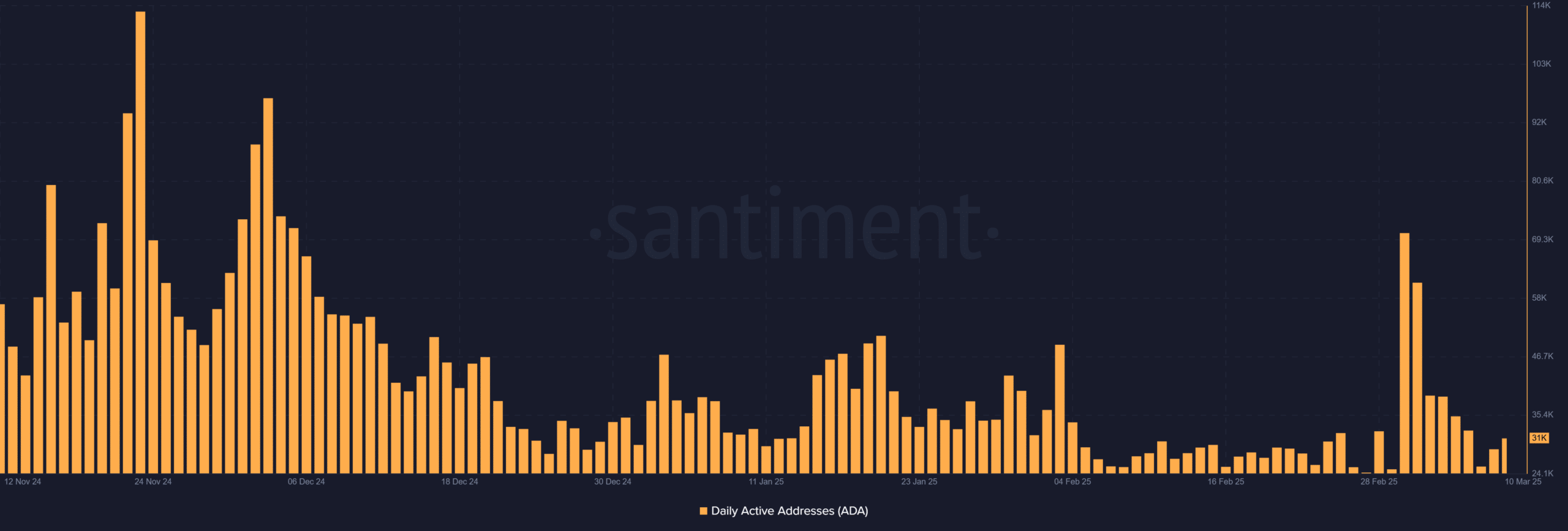

On-Chain Metrics: Moderate Engagement

Cardano’s daily active addresses remain steady at 31,005, indicating consistent but cautious participation. While this reflects stable network activity, it does not signal the rapid user engagement typically associated with strong bullish trends.

Additionally, Open Interest (OI) in ADA futures declined by 11.52% to $738.11 million. This suggests that traders are reducing leveraged positions amid uncertainty, potentially limiting strong price swings.

Also Read: Cardano (ADA) Eyes Major Breakout: Key Levels and Bullish Indicators to Watch

While whale accumulation is a bullish indicator, ADA’s short-term outlook remains uncertain. A breakout beyond the $0.75 resistance could ignite a rally, but the current neutral RSI and declining OI suggest limited momentum. Until stronger buying pressure emerges, ADA may continue consolidating in the near term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.