|

Getting your Trinity Audio player ready...

|

Aave (AAVE) is experiencing an exciting week as bullish demand resurges, driven by increased interest from whales. Historically, whale activity has played a key role in the price movements of cryptocurrencies, and AAVE is no exception.

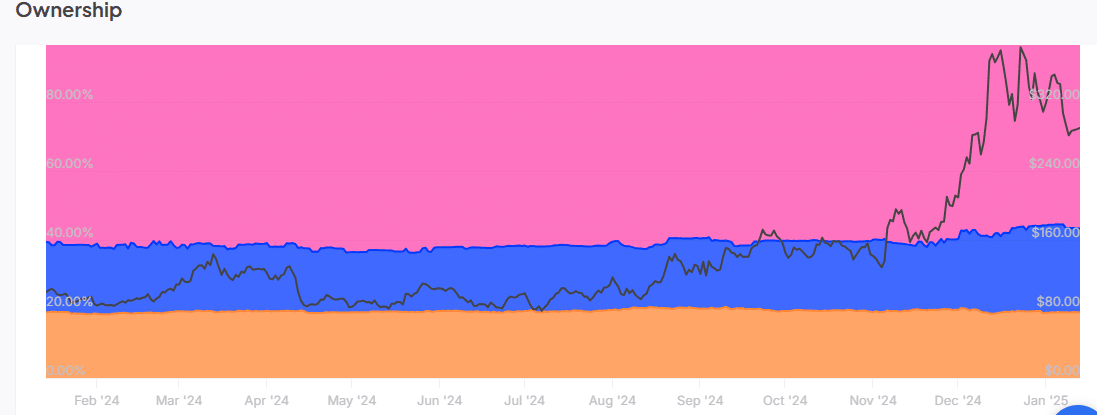

Since the beginning of January, whales have significantly increased their AAVE holdings. As of January 1st, whales controlled 8.92 million AAVE tokens, which accounted for 55.75% of the total supply. By mid-January, this figure had risen to 9.07 million tokens, or 56.69% of the total supply. This increase indicates that whales are still highly confident in AAVE’s potential, fueling speculation about the token’s potential recovery.

Interestingly, while whales have been adding to their positions, retail investors have been buying the dip, slightly increasing their holdings from 3.03 million to 3.05 million AAVE. This shows that both large and small investors are betting on a price rebound.

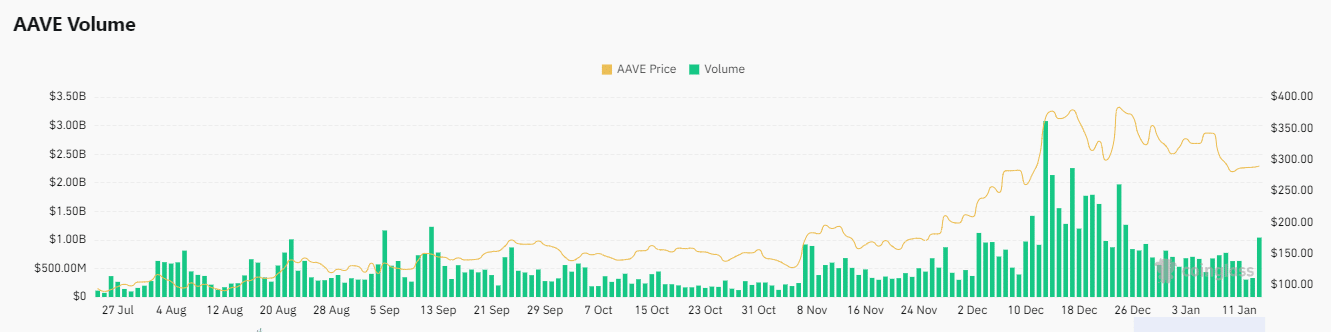

Could whale demand be the catalyst for AAVE’s recovery? Whale accumulation is often seen as a positive signal for bullish trends. The latest price action supports this theory. After dipping to its lowest price on January 13th, AAVE rebounded by roughly 13%, reaching $290.75. This price movement was accompanied by a steady uptrend in the Money Flow Indicator (MFI), a key liquidity metric, signaling a return of demand.

On-chain data further supports the bullish outlook. AAVE’s derivatives volume spiked to $1.04 billion, marking a 61.05% increase in the last 24 hours—the highest daily volume so far this month. Open Interest also surged by 6.95%, indicating more investor activity.

Additionally, spot demand saw a surge, with Spot Inflows peaking at $5.09 million, the highest in two weeks. This renewed interest suggests that AAVE could be gearing up for more upside, but sustained demand is crucial for maintaining this momentum.

In conclusion, AAVE’s recent whale-driven recovery is promising, but only time will tell if the demand can persist to drive the token higher in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: AAVE Faces Potential Correction: Key Support Levels at $264 and $203 – Is This a Buy Opportunity?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!