|

Getting your Trinity Audio player ready...

|

- Top holders accumulated 20 billion PUMP tokens amid the downtrend.

- The Pump.fun team reduced buybacks and increased exchange deposits, raising bearish concerns.

- Whale activity suggests long-term optimism, but PUMP could still test $0.0022 support.

The cryptocurrency market has been in a prolonged downtrend, affecting many altcoins, including Pump.fun (PUMP). Despite the bearish momentum, top holders have shown significant accumulation of tokens, adding 20 billion PUMP tokens to their balances. However, this positive accumulation may not be enough to reverse the current bearish trend, and PUMP’s price faces potential support tests near the $0.0022 mark.

Heavy Exchange Deposits Raise Concerns

Since October 15th, the Pump.fun team has been actively moving large sums of USDC into centralized exchanges (CEX), particularly Kraken. Lookonchain data reveals that $436.5 million USDC was deposited into Kraken during this period, which has historically been seen as a bearish signal. When large amounts of tokens flow to exchanges, it often leads to selling pressure, as investors may anticipate a dump.

It appears https://t.co/C909I8882s has cashed out at least 436.5M $USDC since Oct 15.

— Lookonchain (@lookonchain) November 24, 2025

Since Oct 15, https://t.co/C909I8882s has deposited 436.5M $USDC into#$Kraken.

During the same period, 537.6M $USDC flowed from #Kraken to #Circle through wallet DTQK7G.

Between May 19, 2024… pic.twitter.com/WQGnUcA8l4

Additionally, previous periods of similar large deposits have been followed by sell-offs, including the sale of $757 million worth of SOL tokens between May and August 2024. This history of significant CEX transfers has created a fragile market sentiment, with many investors fearing further price declines.

Decline in Buyback Activity

Pump.fun’s buyback strategy also appears to be weakening. According to Artemis data, the project reduced its buyback spending by 36.5%, dropping to $886,000—below the $1 million mark. This decrease in buybacks signals weaker support for the token and suggests that the team might lack the conviction needed to stabilize the price in the short term. As buyback activity wanes, downside risks for PUMP increase, making it susceptible to further declines without a shift in market dynamics.

Whale Activity Shows Contrasting Sentiment

While the broader market sentiment remains bearish, whales have been accumulating PUMP tokens. Coinalyze data shows that buyers dominated the market for four out of the past seven days, pushing the token’s buy volume to 39.23 billion tokens. Top holders have also increased their balances by 20 billion tokens, indicating a positive outlook despite the ongoing downtrend. This whale accumulation suggests that larger investors are anticipating future price appreciation, potentially seeing current levels as a buying opportunity.

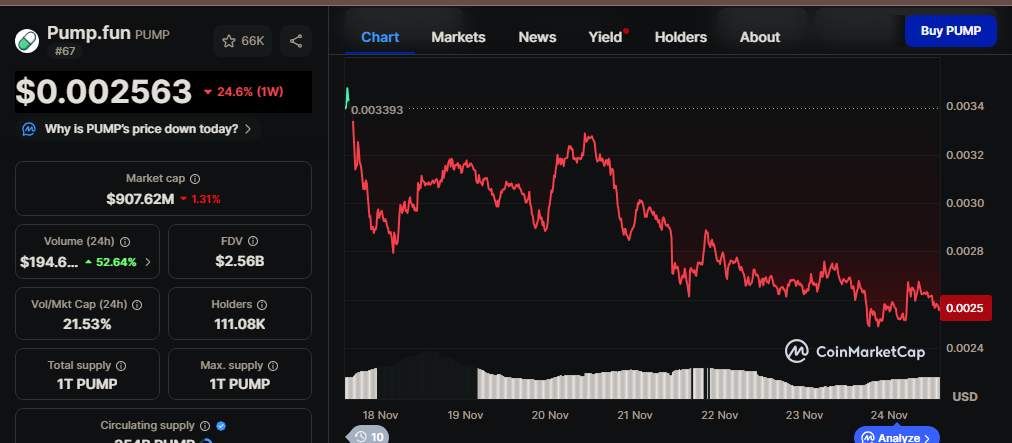

As of now, PUMP is trading at $0.0026, down 3.76% on the day and 21.3% on the week. The token recently rejected resistance at $0.0048 and has been trading within a descending channel. If the bearish momentum persists, PUMP could face further downside, with support potentially forming at $0.0022. However, a successful reversal would require buyers to push PUMP above $0.0030 and target the EMA20 at $0.0033.

In conclusion, while whales have shown interest in accumulating PUMP tokens, the bearish momentum and reduced buyback activity create uncertainty about the token’s near-term prospects. If the downward pressure continues, PUMP might test lower support levels. However, the whale accumulation signals that larger investors remain optimistic about a potential rebound, which could trigger a reversal if buying activity increases.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Pump.fun Rises 17% Ahead of 2B Token Unlock

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.