|

Getting your Trinity Audio player ready...

|

Over the past week, whale activity has sent ripples through the Chainlink [LINK] market, raising speculation among traders. A prominent whale recently withdrew 594,998 LINK, valued at $17.31 million, from Binance, with the latest 65,000 LINK withdrawal worth $1.81 million. These moves hint at either long-term confidence or preparations for significant market activity.

As of press time, LINK trades at $24.63, reflecting a sharp 9.11% decline over the past 24 hours.

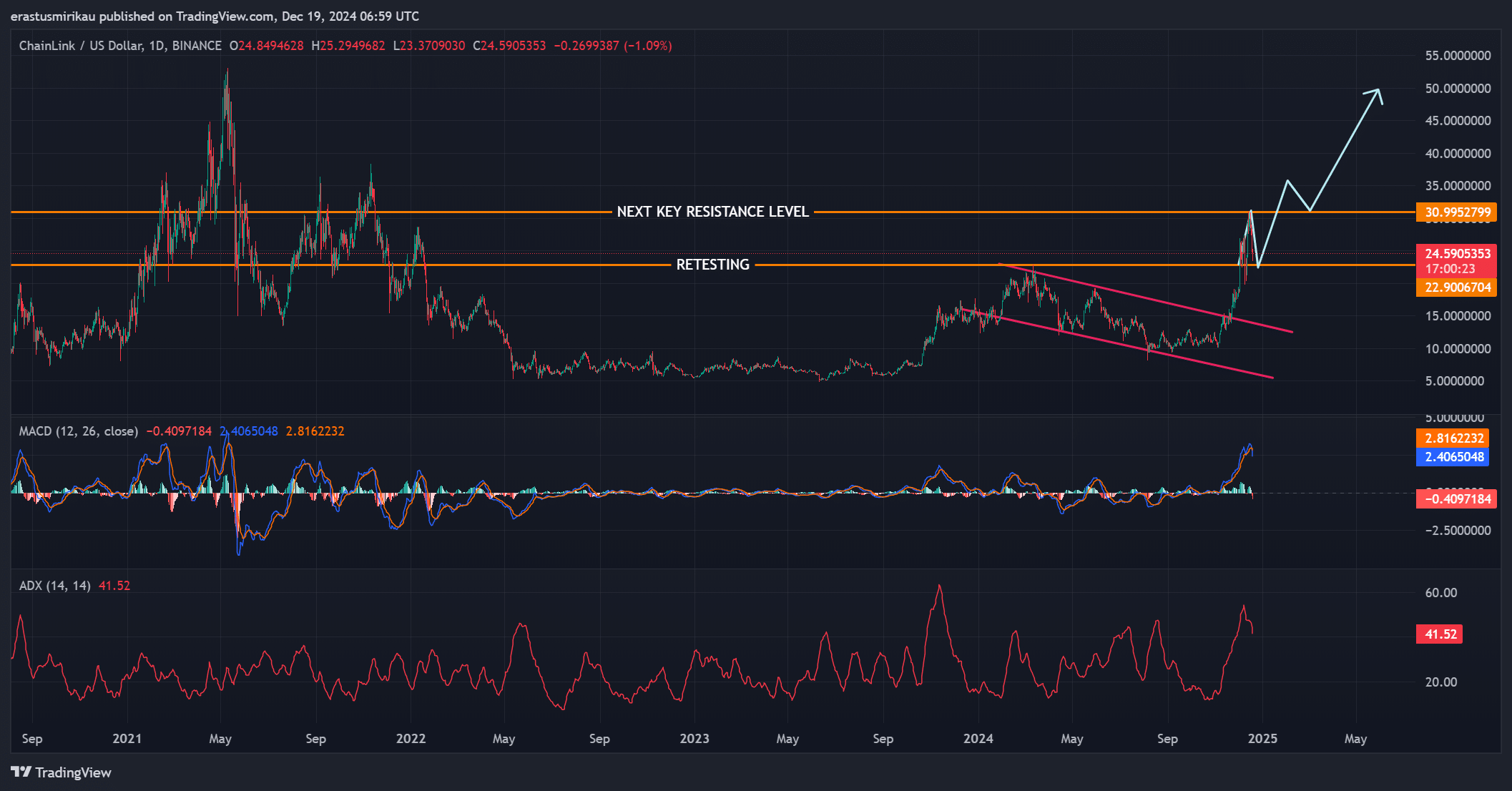

Testing Key Resistance Levels

Chainlink is currently testing a critical resistance zone between $24 and $25. This level has historically acted as a significant barrier in LINK’s rallies. The Moving Average Convergence Divergence (MACD) indicates persistent bullish momentum, though signs of weakening are apparent.

Additionally, the Average Directional Index (ADX) stands at 41.52, highlighting the strength of the ongoing trend. A decisive break above this resistance could propel LINK to $30.99, a crucial psychological and technical milestone. Conversely, failure to sustain momentum may trigger a pullback toward $22, a robust support level.

On-Chain Metrics Highlight Mixed Signals

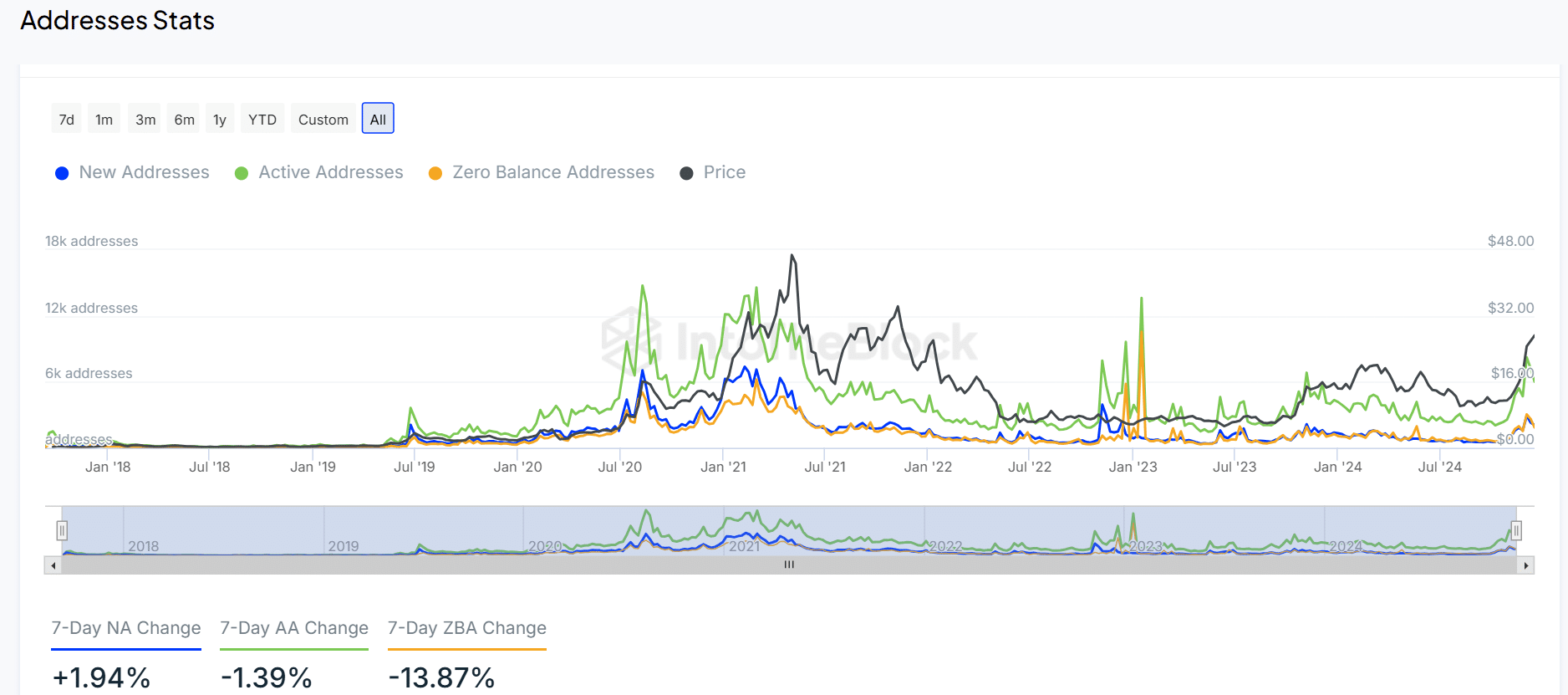

Address activity presents contrasting trends. New addresses have increased by 1.94%, signaling fresh interest, while active addresses dipped by 1.39%, pointing to slightly reduced engagement. A significant 13.87% drop in zero-balance addresses suggests LINK is increasingly moving to long-term storage, underscoring holder confidence.

Transaction Activity and Exchange Reserves

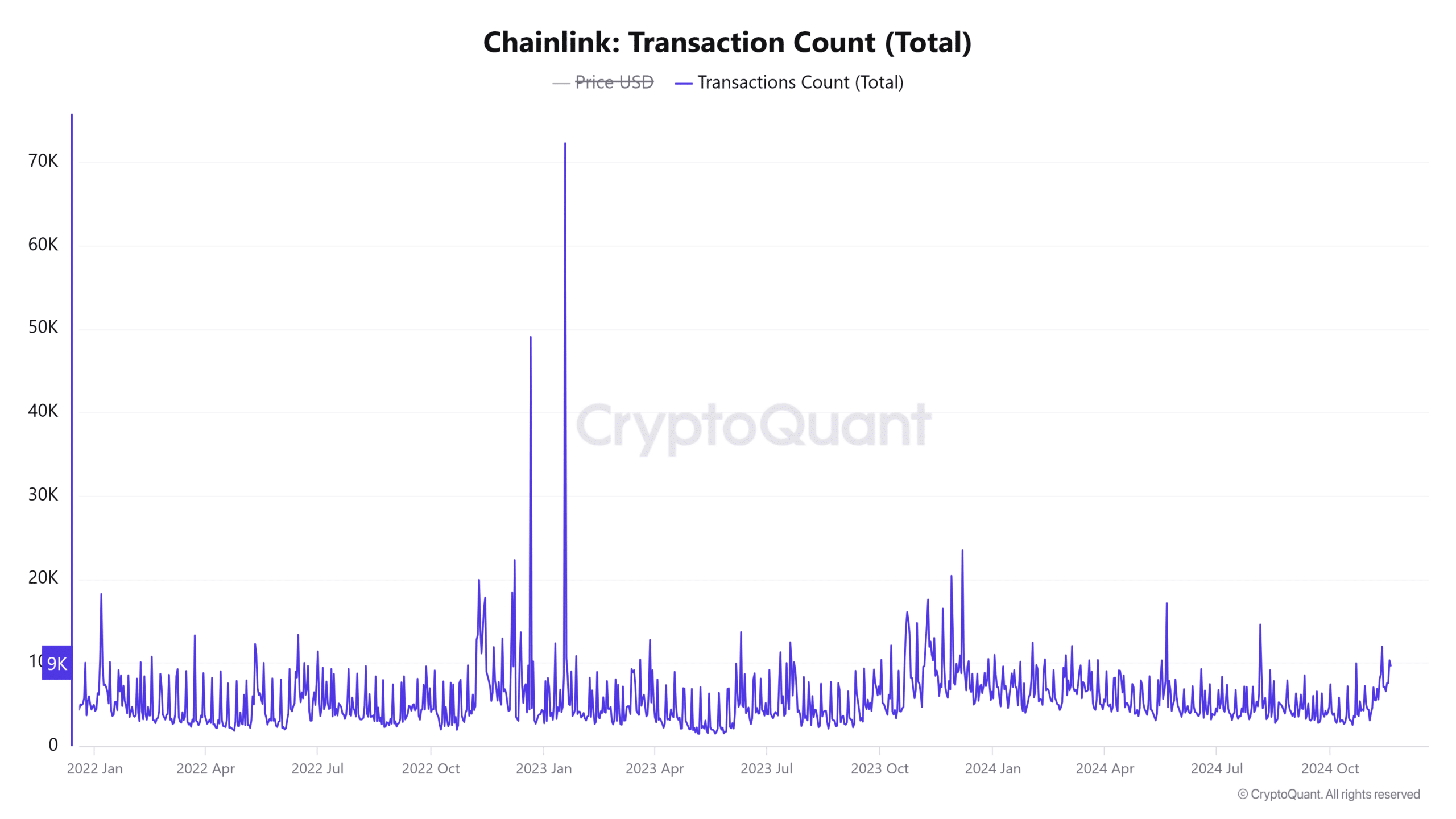

Transaction activity has risen steadily, with a 0.69% increase over the past 24 hours, totaling 12.11K transactions. This uptick reflects heightened market engagement as participants adjust their positions.

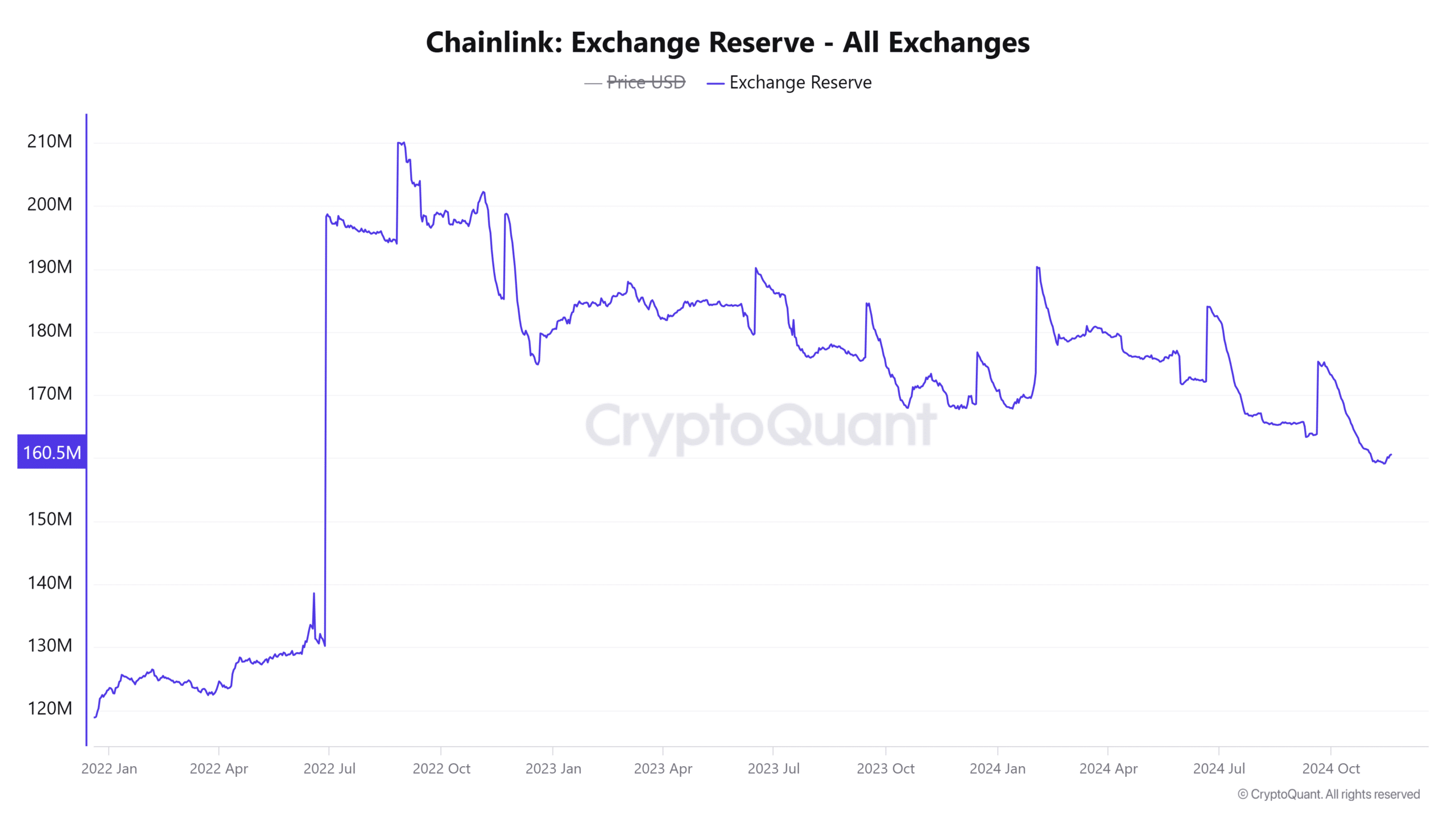

Exchange reserves for LINK have decreased marginally by 0.17% over the past week, aligning with whale withdrawals. With 163.1489M LINK now on exchanges, the reduction in reserves indicates lower immediate selling pressure, potentially supporting bullish sentiment.

Market Outlook

Chainlink faces a decisive moment. A sustained break above the $25 resistance could trigger a bullish breakout, targeting $30.99. However, a failure to maintain momentum may lead to a retracement toward $22.

The interplay of whale withdrawals, growing transaction volumes, and reduced exchange reserves highlights a market bracing for significant moves. LINK’s next steps will likely set the tone for its short-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.