|

Getting your Trinity Audio player ready...

|

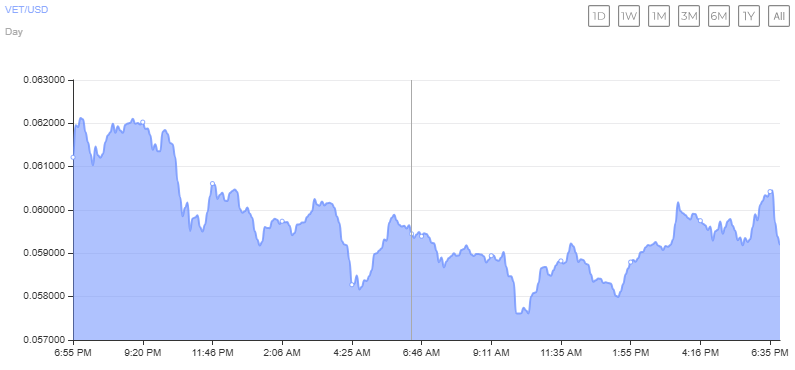

VeChain (VET) has shown impressive price movement in recent days, reaching a high of $0.06238 on December 12, 2024, before pulling back in today’s trading session. Despite this minor dip, technical indicators suggest that VeChain’s price has the potential for further growth. Market participants are closely watching VET’s ability to sustain this momentum and break through key resistance levels.

VeChain Price Technical Outlook: Bullish Indicators

VeChain has demonstrated a consistent upward trajectory, establishing strong technical support at $0.05561. This level has proven crucial for further price advancement, giving traders a solid foundation for potential growth. The Relative Strength Index (RSI) stands at 61.34, signaling positive momentum without indicating an overbought market, which is a strong indicator for a continued bullish trend.

Additionally, VeChain’s recent price action aligns with Fibonacci retracement levels, with the altcoin reclaiming the 38.2% level at $0.05672. The next significant resistance is set at $0.065, which presents an opportunity for continued price growth in the short term if broken.

Social Sentiment and Market Dynamics Favoring VET

VeChain’s social metrics have also seen a positive uptick, reflecting increased market interest. Social Dominance increased from 0.211% to 0.239%, signaling a rise in discussions around VeChain within the crypto community. This surge in social media attention often translates to higher trading volumes, further driving the price action upward.

Sentiment among traders remains bullish, as evidenced by the Long/Short Ratio of 1.23, with 55.16% of traders positioned long. While this bias toward long positions suggests optimism, the relatively balanced ratio between long and short positions highlights caution in the market. Such balance indicates that any significant price shifts could trigger quick market reactions.

Moreover, the OI-Weighted Funding Rate of 0.0098% remains neutral, suggesting that the current uptrend is driven by organic trading activity rather than speculative hype. This stability reduces the risk of drastic price corrections, offering a healthier environment for sustainable price growth.

Key Resistance Levels and Potential Breakout

VET’s recent surge has traders eyeing the $0.065 resistance level. A successful breakout above this mark could lead to further price gains, with analysts setting an ambitious target of $0.10 for VeChain if the uptrend continues. However, with VET currently trading at $0.05879, down by 4.35% on December 13, the market must recover from this short-term pullback to maintain upward momentum.

In summary, VeChain is positioned for potential growth with strong technical indicators, increasing social dominance, and a neutral market sentiment. Traders and investors will be closely monitoring VET’s price action as it approaches key resistance levels, with the potential for further gains if momentum is sustained.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.