|

Getting your Trinity Audio player ready...

|

Whispers of a potential market resurgence are circulating as data reveals a notable climb in USDT reserves held on the leading cryptocurrency exchange, Binance. Seasoned traders, keenly aware of historical patterns, are observing this accumulation of stablecoins as a potential precursor to renewed buying pressure across the crypto landscape. While recent price action has remained subdued, this underlying trend suggests a growing appetite for digital assets beneath the surface. Could this quiet build-up be the calm before the next significant market upswing?

USDT Reserves on Binance See Robust Rebound

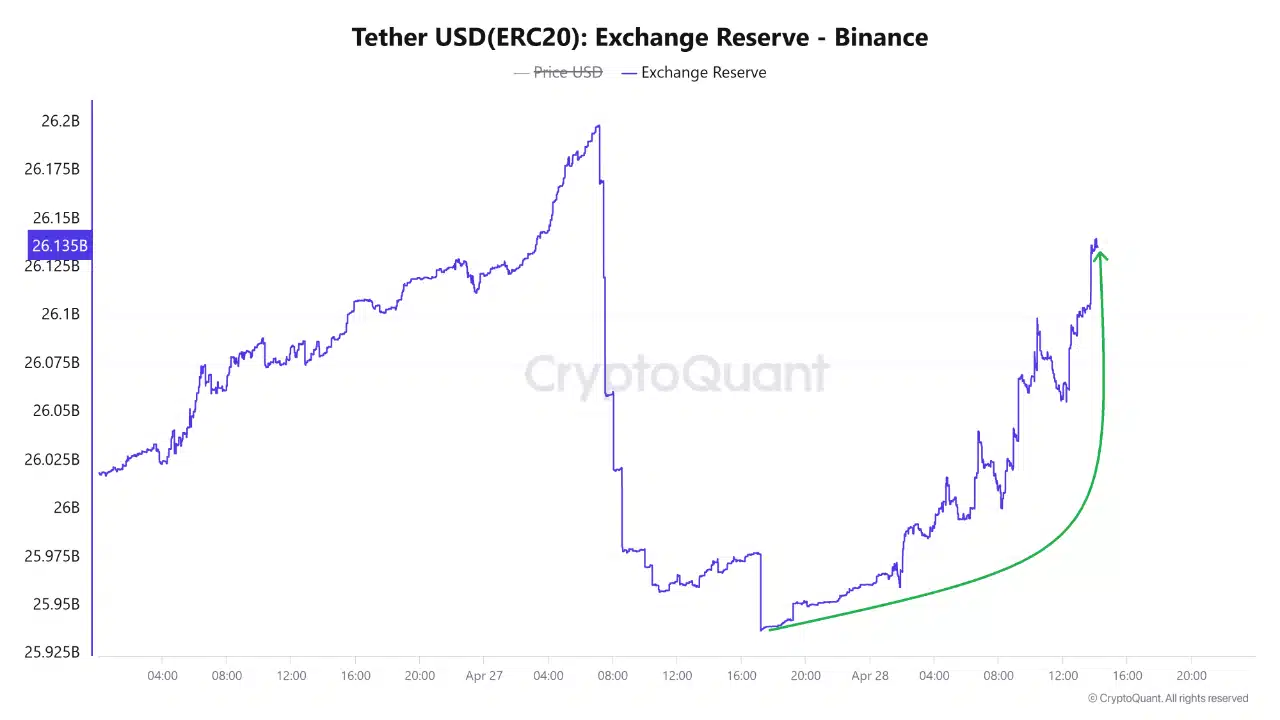

Data from CryptoQuant illustrates a compelling narrative. Following a mid-week dip, the reserves of USDT on Binance have demonstrated a strong and consistent recovery. Bouncing back from a low of approximately 25.93 billion USDT, these reserves have swiftly climbed past the 26.13 billion mark. This sharp upward trajectory resembles a coiled spring, hinting at pent-up capital poised for deployment. Such inflows typically indicate that traders are strategically reloading their financial ammunition, suggesting a readiness to engage with the market.

The return of substantial liquidity, particularly in the form of the dominant stablecoin USDT, is rarely a passive event. Historically, it often signals the initial stages of capital positioning in anticipation of future market movements.

Historical Precedent: USDT Inflows Often Herald Price Rallies

The correlation between rising USDT inflows and subsequent price rallies is a well-documented phenomenon in the cryptocurrency market. The underlying logic is straightforward: traders generally do not transfer stablecoins onto exchanges without the intention of actively trading or investing. In previous market cycles, similar increases in USDT reserves on major exchanges have frequently preceded significant upward movements in the prices of blue-chip cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

This influx of sidelined capital often signifies a renewed risk appetite among investors eager to capitalize on emerging momentum. Therefore, the current growth in Binance’s USDT reserves could be an early indicator that the bulls are quietly preparing to take charge, even as current price action remains muted.

Also Read: Ripple’s RLUSD Joins Aave V3 with $50M Cap, Targets USDT and USDC in DeFi Push

Priming the Market: Implications for Bitcoin, Ethereum, and Altcoins

The ongoing repositioning of liquidity on Binance holds potential implications for various segments of the cryptocurrency market. For Bitcoin, the increased USDT reserves could signify the formation of a robust bid wall, indicating strong buying interest ready to absorb any dips or fuel a potential breakout. Ethereum, which has experienced a period of relative underperformance, could see fresh USDT inflows on Binance spark renewed interest, potentially driving rotation plays or increased activity within the decentralized finance (DeFi) ecosystem.

Perhaps most notably, altcoins, often the last to rally but capable of explosive gains, could find the stage set for sharp upward movements as stablecoin liquidity floods the market, seeking higher-risk, higher-reward opportunities across mid and low-capitalization assets. The coming weeks could prove pivotal in determining whether this quiet accumulation of USDT on Binance will indeed translate into a broader market recovery.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!