|

Getting your Trinity Audio player ready...

|

A seismic shockwave rattled the cryptocurrency market on Monday as the US government executed a massive transfer of seized bitcoin, worth an estimated $2 billion. The unexpected move sent shockwaves through the market, contributing to a price decline and reigniting investor fears.

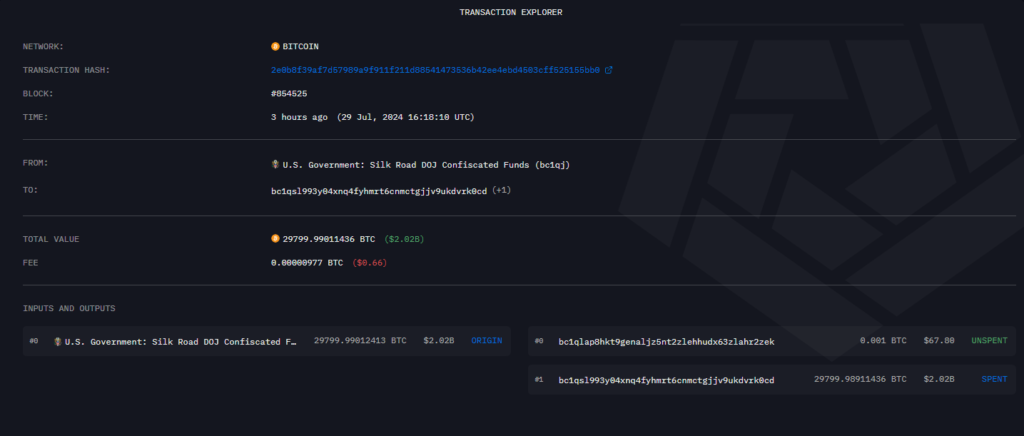

Blockchain analytics firm Arkham Intelligence revealed that a wallet linked to the Silk Road darknet market, under the control of the US Department of Justice, moved nearly 30,000 bitcoin to multiple unlabeled addresses. While the exact destination of the entire sum remains unclear, a portion was sent to an address suspected to be an institutional custody service, a pattern often preceding asset sales.

The market reacted swiftly, with bitcoin prices plunging below the $67,000 mark, erasing earlier gains. The broader cryptocurrency market, as measured by the CoinDesk 20 Index, remained relatively flat but was undoubtedly influenced by the bitcoin sell-off.

The timing of the government’s action is particularly intriguing given the recent Bitcoin 2024 conference where presidential hopeful Donald Trump pledged to create a national bitcoin stockpile if elected. While no direct correlation has been established, the juxtaposition of these events has sparked speculation and uncertainty among investors.

Prior to Monday’s transfer, the US government held a substantial bitcoin stash, valued at approximately $12 billion, according to Arkham data. The decision to offload a significant portion of these holdings has raised questions about the government’s long-term strategy for managing its cryptocurrency assets.

As the market digests this latest development, investors are left grappling with increased volatility and uncertainty. The implications of the government’s actions, as well as the potential impact of a Trump presidency on bitcoin, will continue to be closely watched in the coming weeks and months.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.