|

Getting your Trinity Audio player ready...

|

The US dollar’s dominance in global currency markets has intensified in July, with emerging economies, particularly BRICS nations, bearing the brunt of its strength. Despite concerted efforts to reduce reliance on the greenback, the Indian rupee has hit a historic low, while the Chinese yuan and Japanese yen have also experienced significant depreciation.

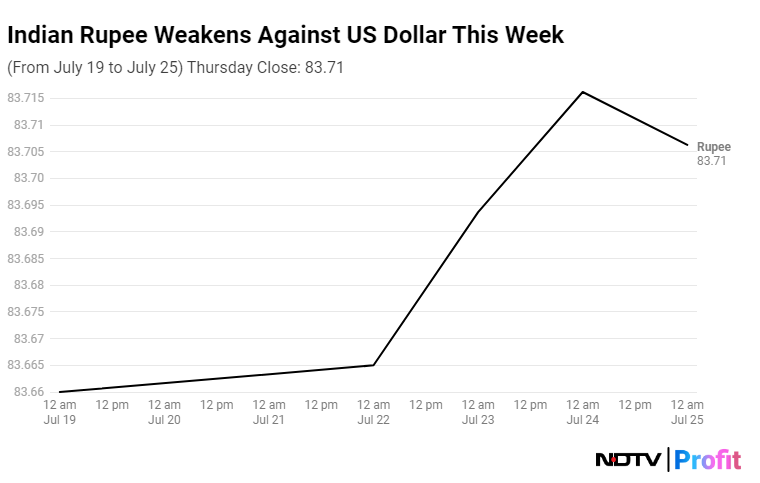

The rupee’s freefall to 83.74 against the dollar is a stark reminder of the greenback’s unwavering power. Analysts predict further declines, with a potential drop to 83.84 in the coming days. This downward spiral is attributed to a combination of factors, including increased demand for the US dollar and recent tax hikes in India.

The Indian government’s decision to raise long-term and short-term capital gains tax rates has dampened investor sentiment and exerted downward pressure on the rupee. These measures, intended to bolster government revenue, have inadvertently weakened the local currency.

The BRICS alliance, comprising Brazil, Russia, India, China, and South Africa, has been vocal about its desire to reduce reliance on the US dollar. However, the current market dynamics suggest that these efforts are yet to yield tangible results.

Also Read: BRICS Bloc’s Anti-SWIFT Push Could Make XRP a Global Financial Powerhouse

While the dollar’s strength is evident, it’s crucial to note that currency fluctuations are influenced by a multitude of factors, including interest rate differentials, trade balances, and geopolitical events. The ongoing conflict in Ukraine, coupled with global economic uncertainties, has also contributed to the dollar’s appeal as a safe-haven asset.

As the BRICS nations navigate these challenging conditions, it remains to be seen whether their de-dollarization initiatives will gain traction and effectively counter the US dollar’s dominance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!