|

Getting your Trinity Audio player ready...

|

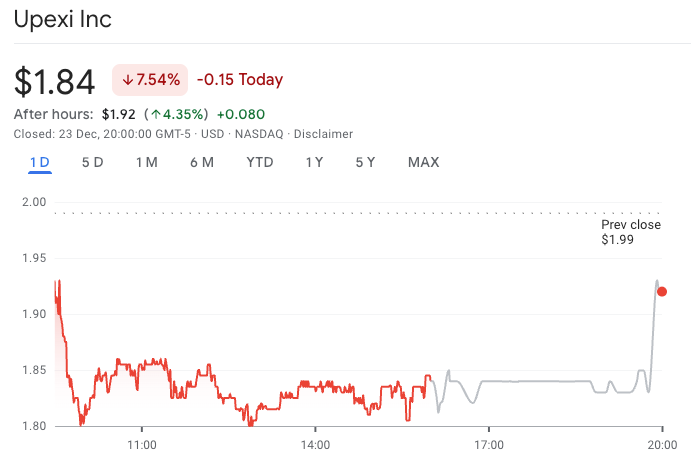

- Upexi shares fell 7.5% after filing a $1B shelf registration.

- The company holds 2.1M SOL but hasn’t bought since July.

- Investor confidence in crypto treasury strategies is fading amid market weakness.

Shares of Upexi fell sharply Tuesday after the company filed a $1 billion shelf registration, a move that reignited speculation around renewed Solana accumulation amid a cooling crypto treasury trend.

The filing, submitted to the U.S. Securities and Exchange Commission, allows Upexi to raise capital over time through a mix of equity, debt, and other securities. While the company framed the offering as funding for general corporate purposes, markets quickly interpreted it as a potential signal that its Solana-focused strategy could resume after months of inactivity.

Market Reacts to Dilution Risk

Upexi shares closed the day down 7.5% at $1.84, reflecting investor concern over dilution and uncertainty around capital deployment. The stock saw a modest rebound in after-hours trading, recovering some losses, but sentiment remained cautious.

The selloff highlights growing investor sensitivity toward crypto treasury plays, particularly as token prices remain under pressure and financing conditions tighten. Even without an immediate token purchase, the scale of the proposed raise raised red flags for shareholders already navigating volatility.

Upexi’s Solana Bet Under Pressure

Upexi currently holds approximately 2.1 million SOL, valued at about $262 million, making it one of the largest corporate holders of Solana. The company’s strategy centers on accumulating SOL and staking it to generate additional yield.

However, Upexi has not added to its Solana position since late July. At its peak in mid-September, the treasury was valued at more than $500 million. Today, that figure has been cut nearly in half, leaving the company with an estimated 19% unrealized loss.

Solana itself remains deep in a downtrend, trading roughly 58% below its all-time high set earlier this year. That drawdown has challenged the assumption that large-scale token accumulation alone can support long-term shareholder value.

Crypto Treasury Strategies Face a Reality Check

Upexi’s pivot from consumer products and e-commerce into a Solana treasury company earlier this year was emblematic of a broader corporate trend. But enthusiasm around crypto balance-sheet strategies has faded in the second half of 2025 as prices fell and risk appetite cooled.

The shelf registration gives Upexi flexibility, not obligation. Still, the market response suggests investors are demanding clearer capital discipline and stronger justification for expanding token exposure in a weaker macro environment.

What Comes Next

Whether Upexi resumes Solana purchases remains unclear. What is clear is that the market is no longer giving treasury-driven crypto strategies the benefit of the doubt.

As investors reassess risk, Upexi’s next move — buy, hold, or diversify — will likely shape both its stock performance and the broader conversation around corporate crypto treasuries.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!