|

Getting your Trinity Audio player ready...

|

Uniswap (UNI), the native token of the leading decentralized exchange (DEX) protocol, has been making waves lately. Fueled by a massive $38 billion in monthly volume across Ethereum Layer-2 networks like Base, Arbitrum, Polygon, and Optimism, UNI has experienced a surge in activity and bullish sentiment.

At the time of writing, UNI is trading at $12.95, up 2.16% in the last 24 hours. But the question remains: can UNI maintain this momentum and push past key resistance levels, or will it face a pullback in the near future?

Bullish Signals on the Blockchain

Uniswap’s on-chain data paints a promising picture. Net network growth rose by 0.34%, suggesting an influx of new users adopting the platform. Additionally, “into the money” transactions, where investors are now in profitable positions, climbed by 1.56%. This indicates growing confidence among holders, further reinforced by a slight rise (0.04%) in concentration, suggesting larger investors are accumulating UNI.

However, the most significant indicator might be the 6.92% spike in large transactions. This jump highlights the growing involvement of institutional investors and whales, potentially positioning themselves for further price appreciation.

Price Action at a Crossroads

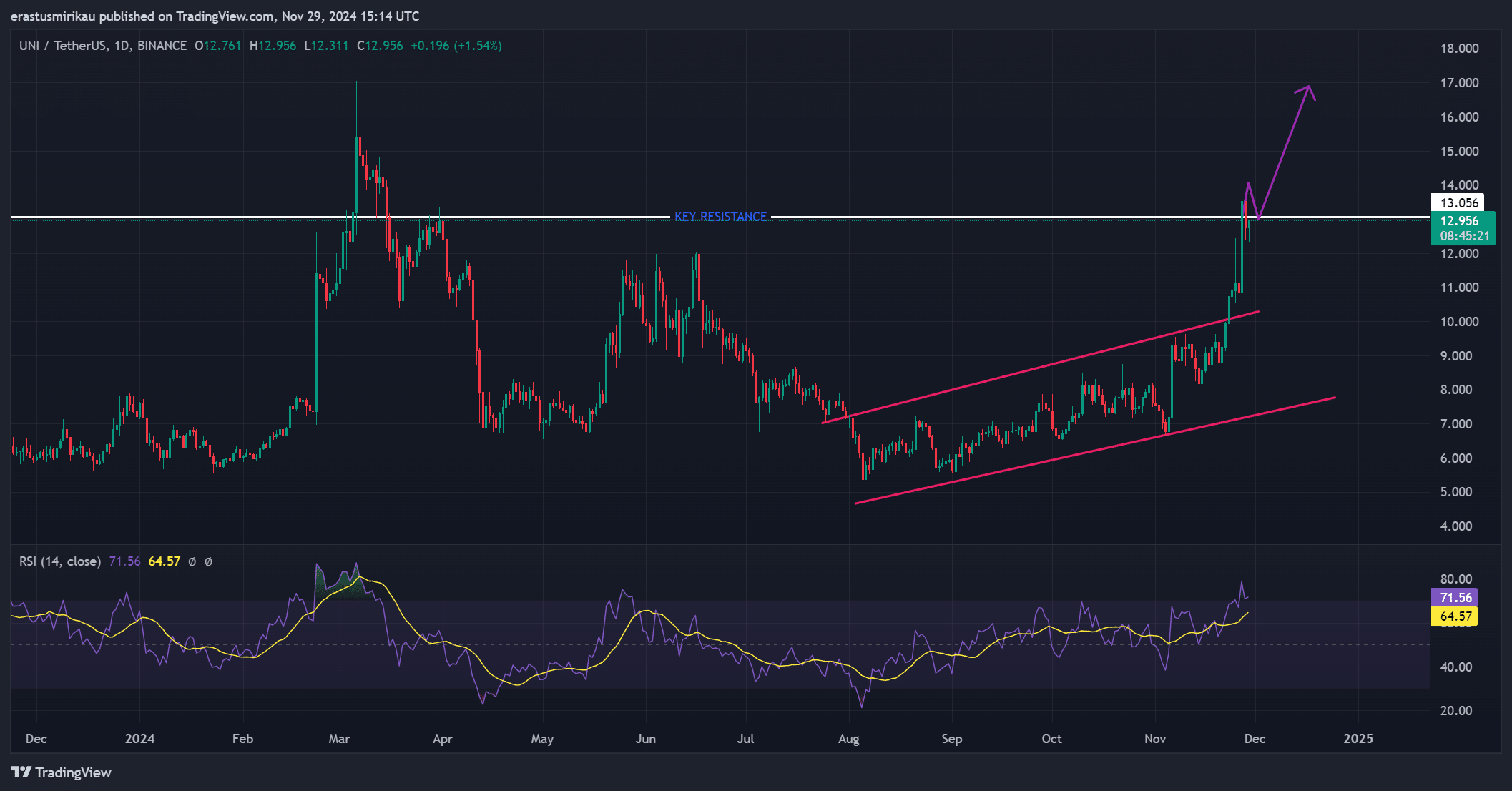

UNI is currently testing the crucial $13 resistance level. A successful breakout could propel the price towards $17, where the next hurdle lies. However, caution is advised as the Relative Strength Index (RSI) sits at 71.56, nearing overbought territory. This suggests a potential pullback or consolidation before any significant upward movement.

Mixed Signals from Exchange Activity

Exchange reserves saw a slight increase (0.12%) in the past 24 hours, reaching 68 million UNI tokens. This could be interpreted in two ways: investors holding onto their tokens or preparing to sell based on their market outlook.

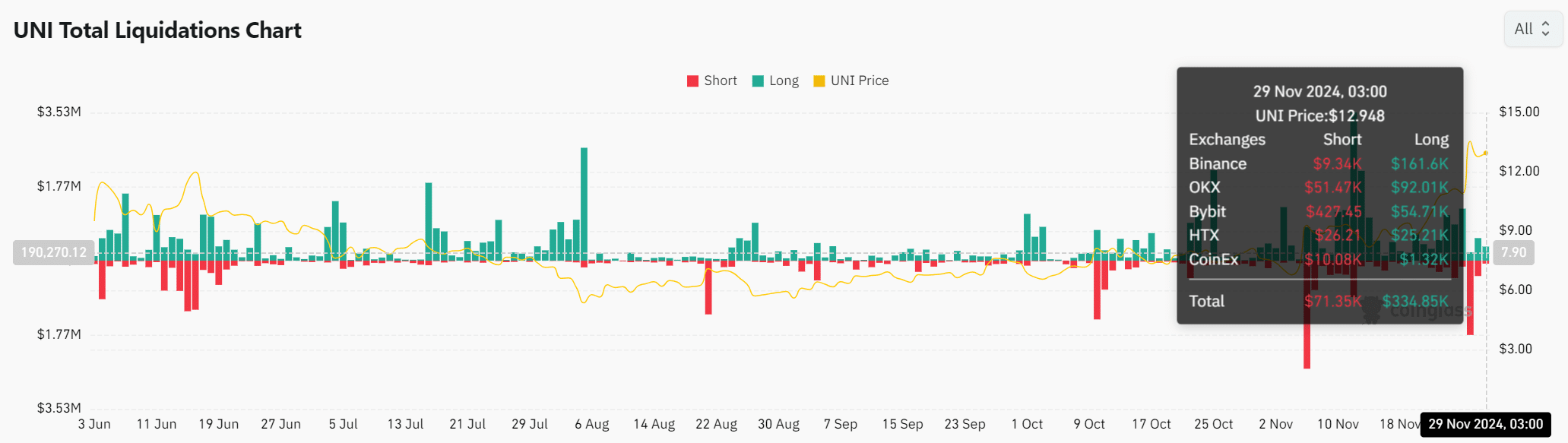

Meanwhile, liquidations reveal a higher concentration of long positions ($334.85k) compared to short positions ($71.35k). This suggests most traders are bullish on UNI. However, a large number of long positions also increases vulnerability to short squeezes if the market turns bearish.

The Road Ahead for UNI

The recent price surge, strong on-chain signals, and a rise in large transactions all point towards a potentially bullish future for UNI. However, the RSI nearing overbought territory and mixed signals from exchange reserves necessitate a cautious approach.

A breakout above $13 could lead to further gains, but the possibility of a pullback cannot be ignored. Ultimately, if UNI can maintain its current momentum and break through resistance, we might see the token continue its upward trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.