|

Getting your Trinity Audio player ready...

|

Uniswap, the leading decentralized exchange (DEX), has smashed its monthly trading volume record on Ethereum layer-2 networks, a sign of renewed interest in the decentralized finance (DeFi) space. According to Dune Analytics, Uniswap processed a staggering $38 billion in trading volume across major layer-2 solutions like Arbitrum, Optimism, Polygon, and Base in November. This surpasses the previous record of $34 billion set back in March, highlighting a significant surge in activity.

Increased Demand Drives Growth

Experts attribute this upswing to a rise in demand for assets and stablecoins within the DeFi ecosystem. Henrik Andersson, Chief Investment Officer at Apollo Crypto, suggests this aligns with the “DeFi renaissance” and the recent positive trend in the ETH/BTC ratio. He further emphasizes rising on-chain yields as a contributing factor, potentially signaling a period of sustained growth for the Ethereum ecosystem.

Layer 2 Solutions Lead the Charge

Uniswap’s volume distribution across layer-2 networks reveals interesting insights. Arbitrum led the pack with a remarkable $19.5 billion in volume, followed closely by Coinbase-backed Base at $13 billion. This highlights the growing adoption of layer-2 scaling solutions, which offer faster transaction speeds and lower fees compared to the main Ethereum network.

Uniswap Takes the Fee Crown

Uniswap’s dominance extends beyond trading volume. As of publication, it stands as the sixth-largest protocol by fees, generating over $90 million in the last month. This surpasses even established networks like Tron and Maker, as well as the popular Solana memecoin launchpad Pump.fun.

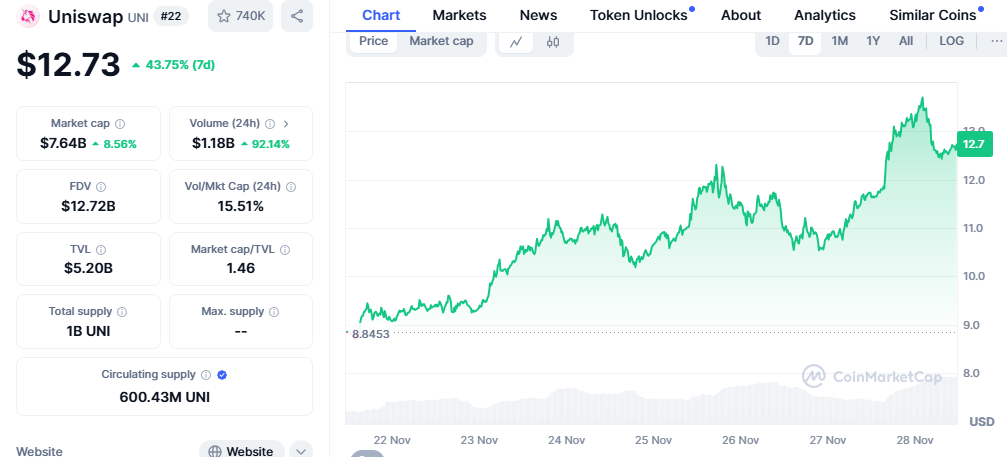

UNI Token Reflects Market Optimism

The surge in Uniswap activity has directly impacted its native token, UNI. UNI’s price has skyrocketed by over 42% in the past week, currently trading at $12.58. This impressive performance makes UNI the clear outperformer among DEX tokens. While Solana-based DEX tokens like Raydium and Jupiter have also seen some movement, UNI’s gains significantly eclipse theirs.

Uniswap’s record-breaking month on layer-2 networks paints a promising picture for the future of DeFi. The increased demand for assets, rising on-chain yields, and the adoption of layer-2 solutions all contribute to a bullish outlook. Whether this signals a sustained period of DeFi growth remains to be seen, but Uniswap’s performance certainly sets an optimistic tone.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.