|

Getting your Trinity Audio player ready...

|

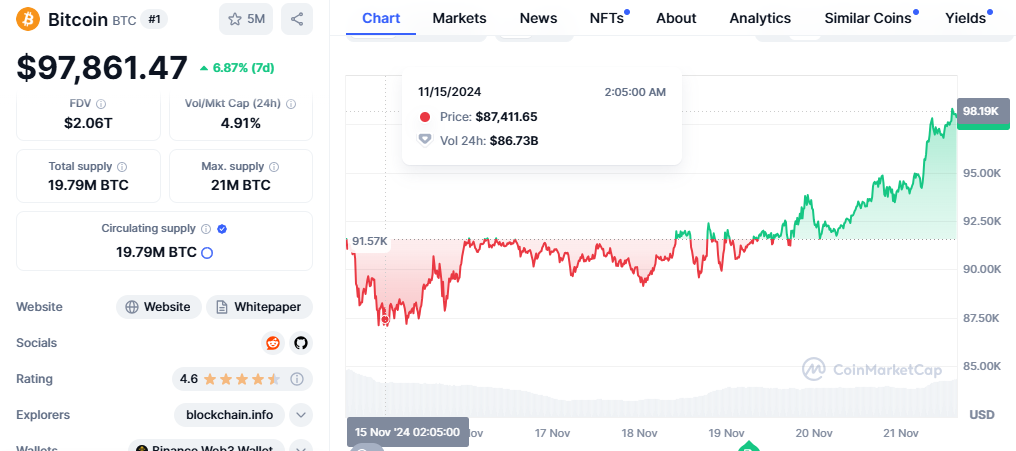

The burgeoning world of cryptocurrency witnessed another historic milestone on Wednesday as US spot Bitcoin exchange-traded funds (ETFs) collectively surpassed $100 billion in assets under management (AUM). This remarkable achievement coincides with Bitcoin’s continued ascent to new all-time highs, further solidifying its position as a dominant force in the digital asset landscape.

According to data from SoSoValue, the 12 US spot bitcoin ETFs collectively held $100.55 billion in assets as of Wednesday, representing a significant 5.4% of Bitcoin’s total market capitalization. BlackRock’s IBIT and Grayscale’s GBTC emerged as the two largest ETFs, commanding $45.4 billion and $20.6 billion in AUM, respectively.

Bitcoin’s price trajectory has been nothing short of spectacular in recent weeks, with the cryptocurrency consistently breaking its own records. At the time of writing, Bitcoin is trading at approximately $97,094, marking a 3.8% increase over the past 24 hours.

The surge in Bitcoin’s price has directly fueled the inflows into US spot bitcoin ETFs. On Wednesday alone, these ETFs collectively attracted $733.5 million in net inflows, following a robust $837.36 million the day before. BlackRock’s IBIT led the charge with $626.5 million in inflows, while Fidelity’s FBTC and Bitwise’s BITB also recorded substantial inflows.

In contrast, US spot Ethereum ETFs experienced a different trend. These ETFs witnessed $30.3 million in net outflows on Wednesday, extending a five-day streak of negative flows. Trading volume for these ETFs also declined to $338.3 million, down from $345.1 million the previous day.

The rapid growth of US spot bitcoin ETFs underscores the increasing institutional interest in Bitcoin as a viable investment asset. As Bitcoin continues to break new ground and attract mainstream attention, it is likely that these ETFs will play a pivotal role in shaping the future of the cryptocurrency market.

The rapid growth of the US spot bitcoin ETF market signifies a significant shift in the perception of cryptocurrencies among traditional financial institutions. As more and more institutional investors seek exposure to Bitcoin, these ETFs provide a regulated and accessible way to participate in the digital asset market. This influx of institutional capital could further catalyze Bitcoin’s price appreciation and solidify its position as a mainstream asset class.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.