|

Getting your Trinity Audio player ready...

|

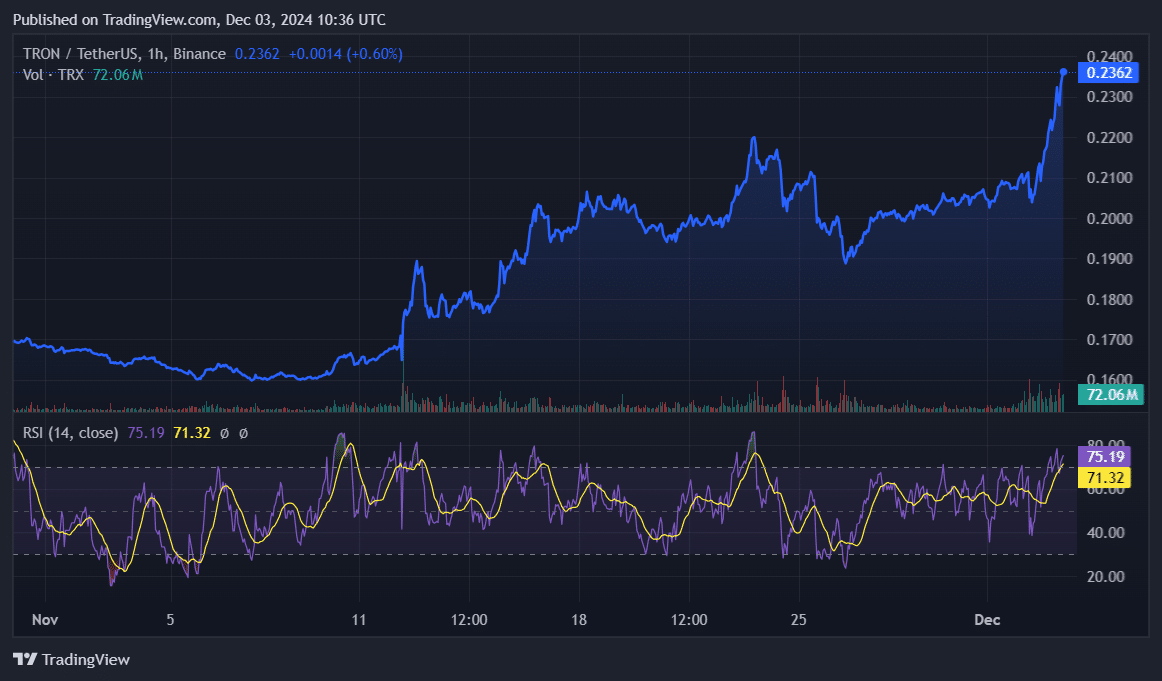

TRON (TRX), the cryptocurrency powering the TRON blockchain, is experiencing a historic rally. Over the past 24 hours, TRX surged by a staggering 22.54%, reaching a new all-time high of $0.236 at the time of writing. This price increase coincides with a significant rise in market capitalization, which now sits at a record-breaking $20.4 billion.

The current market enthusiasm seems to be propelling TRON. The broader cryptocurrency market is experiencing upward momentum, creating a positive ripple effect. Additionally, TRON is witnessing a surge in daily trading volume, doubling to a hefty $2.3 billion.

Whales Enter the Fray

This rally comes amidst a noticeable increase in whale activity surrounding TRON. Data from IntoTheBlock reveals a significant jump in large transactions (over $100,000 worth of TRX) on December 2nd. The number of such transactions rose from 244 to a staggering 722, with a total value exceeding $432 million.

Furthermore, large holders accumulated a significant amount of TRX (over 76 million) on the same day. This whale activity can often trigger FOMO (Fear Of Missing Out) among smaller investors, potentially leading to further buying pressure and a short-term price hike for TRON.

However, a double-edged sword exists. While increased whale activity can boost prices, it can also lead to high volatility. A sudden selloff by whales could trigger FUD (Fear, Uncertainty, and Doubt) within the retail investor community, causing a significant sell-off and price retraction.

Profit Taking on the Horizon?

Another interesting observation comes from TRON exchange net inflows. Data suggests a shift from a net outflow of 104 million TRX to a net inflow of 81 million TRX between November 30th and December 2nd. This sudden change could indicate investors preparing to take short-term profits on their TRON holdings.

Technical Indicators Flash Caution

Adding a layer of complexity, technical indicators paint a slightly concerning picture. Notably, the TRX Relative Strength Index (RSI) is currently hovering above 70. This indicator typically suggests that the asset might be slightly overbought at its current price point.

The Future of TRON

While the current rally is undeniably exciting for TRON investors, it’s crucial to remain cautious. The market remains volatile, and whale activity can be unpredictable. Keeping a close eye on technical indicators and exchange inflows can help investors make informed decisions about their TRON holdings.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.