|

Getting your Trinity Audio player ready...

|

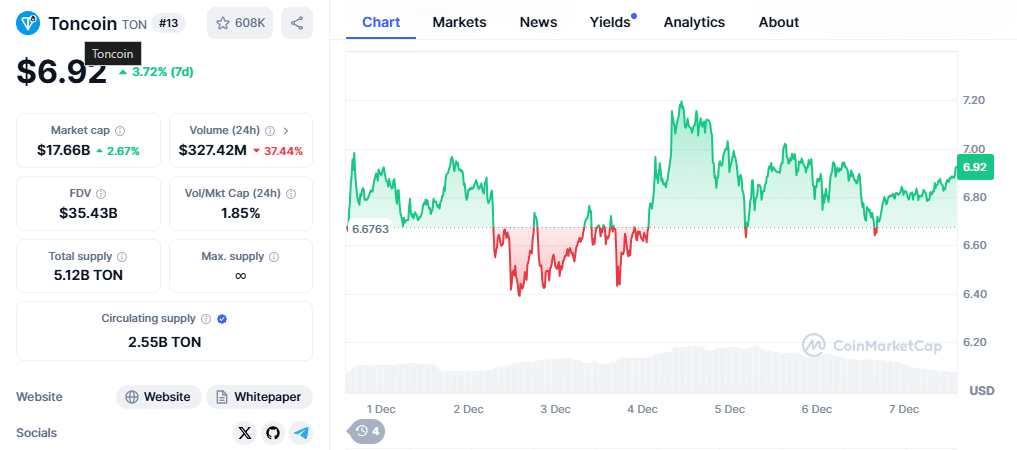

Toncoin (TON) has been on a remarkable run, bouncing back from strong support at $4.6 and surging to test a three-month high of $6.7. This rally has captured the attention of traders as Toncoin breaks through key resistance levels, raising the question: Can this upward trajectory sustain?

TONcoin to the moon 🚀 #TON pic.twitter.com/5sM2J2yrFY

— Khalid H. A (@Babuji_FX) December 4, 2024

Breaking Resistance with a Strong Trend

Toncoin’s recent price action signals a significant shift in market sentiment. The cryptocurrency broke out of a descending channel that had constrained it since September, a move bolstered by a golden cross—where the 20-day exponential moving average (EMA) crossed above the 200-day EMA. This technical event often heralds the start of a long-term uptrend.

The bullish momentum is reinforced by Toncoin’s ability to stay above its 20, 50, and 200-day EMAs. These indicators signal strong support and confidence among buyers. If the 50-day EMA crosses above the 200-day EMA, it could set the stage for even greater gains. Analysts are eyeing $6.8 and $7.6 as key resistance levels to watch in the coming days.

Correction Risks and Support Levels

While the rally has been impressive, Toncoin might face a short-term pullback. If bullish momentum falters, prices could retrace to $6.1, a crucial support zone that aligns with a liquidity pocket. A rebound from this level could attract renewed buying interest and keep the rally intact.

Rising Trading Volume and Market Sentiment

Toncoin’s upward momentum has spurred a surge in trading activity, with volumes climbing 69.39% to $444.65 million. However, Open Interest—a measure of active futures contracts—dipped by 8.15%, suggesting that some traders are locking in profits amid the rally.

The long/short ratio across exchanges is currently 0.8591, indicating a slight preference for short positions. Interestingly, Binance traders are significantly more optimistic, with a long/short ratio of 3.8473. This disparity highlights mixed sentiment across different trading platforms.

Key Factors to Monitor

As Toncoin continues its upward climb, traders should keep an eye on Bitcoin, the market leader. Bitcoin’s price movements often influence broader market trends, and any volatility in BTC could impact Toncoin’s rally. Additionally, watching liquidity levels and market sentiment will be crucial for identifying profit opportunities.

With its recent breakout and strong technical indicators, Toncoin has positioned itself as a token to watch. While some corrections may occur, the bullish sentiment suggests that the rally could continue, offering traders multiple opportunities to capitalize on this momentum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.