|

Getting your Trinity Audio player ready...

|

The recent arrest of Telegram CEO Pavel Durov sent shockwaves through the crypto market, causing Toncoin (TON) – the native currency of The Open Network – to plummet in value. However, a curious phenomenon has emerged: a significant surge in Toncoin’s open interest.

Durov’s Arrest Sparks Price Dive, But Traders See Opportunity

On August 24th, news broke of Durov’s arrest at Bourget Airport in Paris. He faces a slew of serious charges, including terrorism, trafficking, and money laundering. This development sent the TON price tumbling, reflecting investors’ uncertainty surrounding the future of Telegram and its associated cryptocurrency.

Open Interest Soars as Traders Hedge Bets

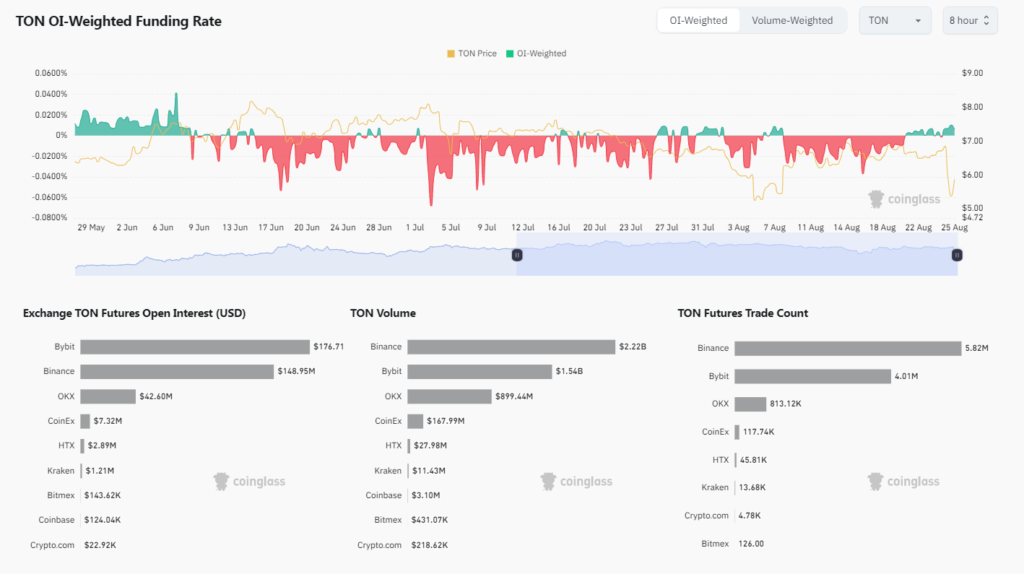

But amidst the fear and uncertainty, another narrative began unfolding. Data from CoinGlass revealed a staggering 32% increase in Toncoin’s open interest, reaching a total of $303.09 million. This influx of new traders suggests a growing interest in hedging bets on TON’s future direction.

Short-term Downturn Expected, But Long-term Optimism?

While the rise in open interest signifies increased trading activity, the specific nature of these positions remains unclear. Pseudonymous crypto trader Daan Crypto Trades believes most of these new entries are likely short positions, anticipating a further price decline. This strategy aims to profit from a continued drop in TON’s value.

However, Daan Crypto Trades also expresses personal optimism about Durov’s potential release, which could trigger a rapid price rebound. He cautions against blindly following a short-term strategy, highlighting the volatility that could follow Durov’s release.

Durov’s Release: A Potential Catalyst for Recovery?

Anup Dhungana, another crypto trader, echoes this sentiment. He suggests that if Durov is released following questioning and international pressure, a “quicker-than-expected price rebound” could occur. This scenario underlines the importance of Durov’s leadership to the continued success of Telegram and, consequently, Toncoin.

The current situation surrounding Toncoin presents a complex picture. While the short-term impact of Durov’s arrest appears negative, the significant increase in open interest suggests a growing market interest in the asset. Ultimately, the fate of Toncoin hinges heavily on the outcome of Durov’s situation. Investors should remain cautious and conduct thorough research before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!