|

Getting your Trinity Audio player ready...

|

- Institutional interest, like TON Strategy Co.’s $558M reserve, validates TON’s long-term potential.

- Near-term price targets for 2025 are high ($6.48 max), but token unlocks pose a key risk.

- Long-term forecasts suggest TON could hit an average of $32.81 by 2030, driven by Telegram’s user base.

Once a mere concept birthed from the minds at Telegram, Toncoin (TON) has burst onto the global crypto stage, leveraging an unprecedented potential user base of over 900 million Telegram users. This powerful confluence of blockchain technology and a massive social media platform is driving significant institutional interest, recently highlighted by Gemini’s support for TON trading. As investors ponder the next big price move, particularly the aspirational $10 target, we delve into the technical indicators and ecosystem catalysts that define Toncoin’s trajectory through 2030.

Institutional Confidence and Market Exposure

The narrative for TON shifted dramatically with the announcement of Nasdaq-listed Verb Technology rebranding as TON Strategy Co. in August 2025. This move, which involved raising $558 million and adopting Toncoin as its primary treasury reserve asset, signals a profound and rare institutional vote of confidence.

Furthermore, the ecosystem’s legitimacy has been bolstered by investment from major venture capital arms like Coinbase Ventures, Sequoia, and Benchmark. This influx of sophisticated capital, alongside broadened exchange accessibility like Gemini’s listing, not only increases TON’s liquidity but also positions it as a serious contender for the next wave of mainstream blockchain adoption, moving beyond its Telegram roots into global finance.

Technical Headwinds and 2025 Price Outlook

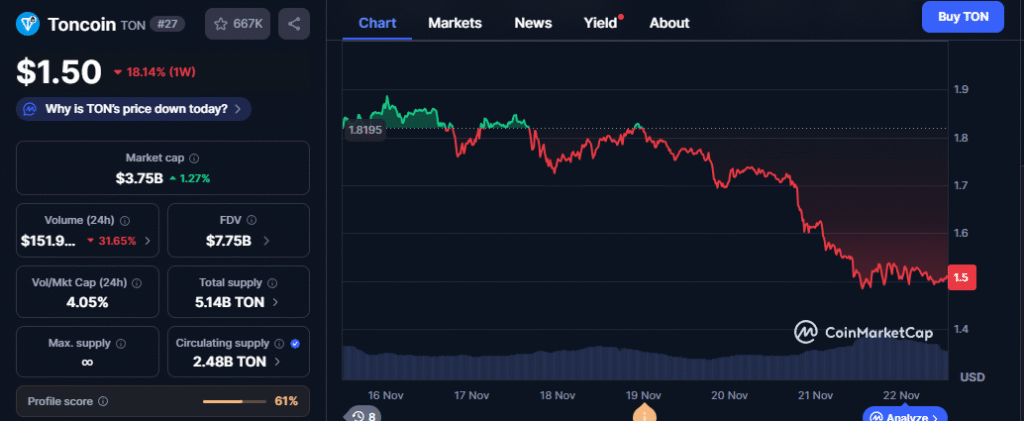

Despite the strong fundamental tailwinds, Toncoin is currently battling short-term technical resistance. Trading around the $1.50 mark, the asset faces hurdles at the 20-period Simple Moving Average ($1.63) and the upper Bollinger Band ($1.85). The Relative Strength Index (RSI) at 23.23 indicates oversold and strong bearish sentiment, suggesting that a short-term price correction or consolidation may be imminent before a sustained upward move.

However, the 2025 outlook remains decidedly bullish, based on ecosystem growth and increased demand. Experts predict a potential high of $6.48 for TON, driven by the expanding adoption across Telegram’s super-app ecosystem.

The main challenge lies in managing circulating supply; a significant token unlock scheduled for late 2025 could introduce downward price pressure if network utility and user demand don’t keep pace with the supply increase. The average predicted trading price for 2025 settles near $4.32.

Also Read: Toncoin Drops 9.8% After Nasdaq Warning: Key Price Levels & Market Outlook

Long-Term Price Targets: The Road to $30+

Looking further ahead, the price forecasts for Toncoin become increasingly optimistic, fueled by the accelerating network effect of a billion-user platform. The elusive $10 price point is projected to be reached, on average, in 2027, with high-end forecasts pushing towards $14.58 in that year. By 2030, analysts project a massive surge, with the altcoin’s average price potentially landing at $32.81, and the bullish maximum target reaching an astonishing $49.22. This explosive long-term growth hinges on the success of TON in fully monetizing the vast Telegram user base through DeFi, gaming, and cross-border payments, cementing its role as a key Layer-1 in the global crypto landscape.

Toncoin is strategically positioned at the intersection of a massive social platform and growing institutional appetite, creating a compelling investment thesis. While near-term volatility is expected, the long-term outlook, buoyed by major corporate endorsements and mass user access, paints a picture of aggressive value appreciation. The path to $10 and beyond is challenging, but with its unique infrastructure and adoption vectors, TON is quickly becoming one of the most exciting long-term bets in the crypto market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.