|

Getting your Trinity Audio player ready...

|

- Institutional tokenization interest now operates independently of Bitcoin’s price.

- Blockchain’s efficiency is proving its long-term value to traditional finance.

- Stablecoins and tokenized money market funds mark the next phase of growth.

Institutional interest in blockchain technology is no longer tied to Bitcoin’s price movements, signaling a maturing shift in how traditional finance views crypto innovation. According to Thomas Cowan, head of tokenization at Galaxy, tokenization has entered a stage where its value stands on its own.

Tokenization Gains Independence from Bitcoin

Speaking at The Bridge conference in New York, Cowan noted a clear shift: “There’s been a separation of the interest in tokenization from the price of Bitcoin.” In past cycles, institutional enthusiasm rose and fell with crypto prices. This time, however, firms are maintaining — even expanding — their blockchain initiatives despite Bitcoin’s volatility.

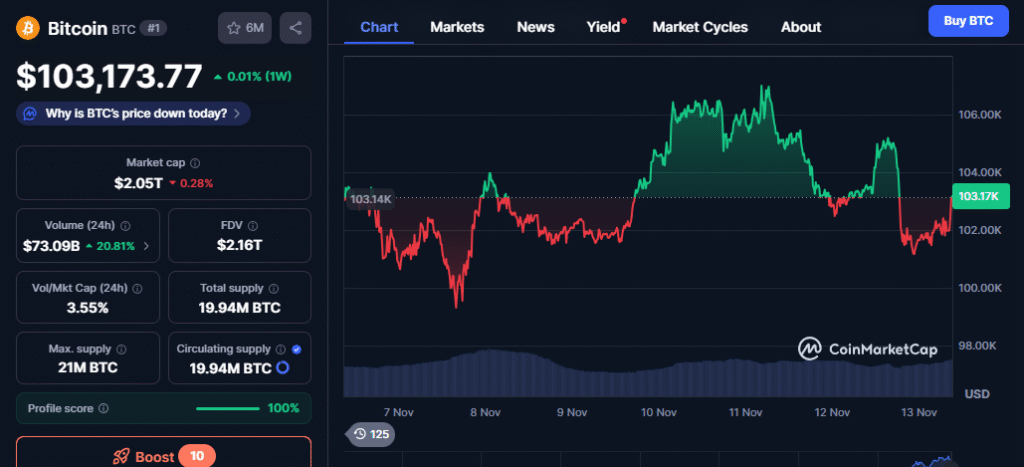

Bitcoin has swung between $126,000 and $102,000 this year, yet the momentum behind asset tokenization remains strong. The process, which involves representing real-world assets like bonds or oil on a blockchain, is drawing consistent attention from major financial institutions eager to modernize their infrastructure.

Clear Benefits Driving Long-Term Institutional Adoption

Cowan emphasized that the key to sustained growth lies in proving tokenization’s practical advantages. “We need to show institutions that this technology is a better, faster, cheaper way to move and store assets,” he said. For organizations thinking in decades, clarity and reliability matter more than hype cycles.

He added that blockchain-based financial systems are becoming the likely “back end” of global finance — a durable trend rather than a speculative experiment.

Also Read: Bitcoin Mining Is a Zero-Sum Game,” Warns MARA CEO Fred Thiel

Stablecoins and Money Market Funds: The Next Frontier

The rapid rise of regulated stablecoins has created a bridge for institutions entering blockchain finance. Cowan pointed out that tokenized money market funds — which provide low-risk, yield-bearing options — are the next logical step. “As capital moves onchain, investors will want that risk-free rate they miss by holding stablecoins,” he said.

Cowan believes tokenization is nearing its breakout moment: a phase where it delivers measurable, transformative value to mainstream finance. “This is the time to invest,” he concluded. “Institutions are about to see it really happen.”

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!