|

Getting your Trinity Audio player ready...

|

- S&P Global downgraded Tether’s USDT stablecoin, citing high-risk assets like Bitcoin and gold.

- Tether CEO Paolo Ardoino defends the firm’s strategy, calling the downgrade an attack on the financial system.

- Tether’s USDT reserve strategy includes a mix of short-term Treasuries, Bitcoin, gold, and loans, with critics calling for more transparency.

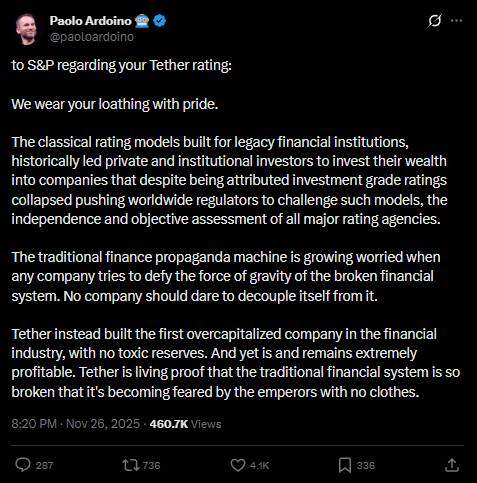

Tether, the world’s leading stablecoin issuer, has come under fire after S&P Global downgraded its USDT stablecoin rating from “constrained” to “weak.” The major credit rating agency pointed to rising exposure to high-risk assets like Bitcoin (BTC) and gold, as well as limited transparency surrounding Tether’s reserves. This decision has sparked controversy, with Tether’s CEO, Paolo Ardoino, vehemently defending the firm’s strategy and accusing critics of attacking Tether for challenging the traditional financial system.

The Reason Behind the Downgrade: High-Risk Asset Exposure

The downgrade primarily focuses on the growing portion of Tether’s reserves invested in assets deemed high-risk. S&P Global highlighted that Bitcoin, gold, secured loans, corporate bonds, and other speculative investments make up a significant share of the stablecoin’s collateral. These assets carry various risks—credit, market, interest-rate, and foreign-exchange risks—that could jeopardize the stability of USDT, particularly in times of broader market volatility.

System is broken. They're upset we make it evident https://t.co/TDFFQbs6RV

— Paolo Ardoino 🤖 (@paoloardoino) November 26, 2025

According to S&P, the lack of full transparency regarding Tether’s reserve portfolio exacerbates concerns. While the firm reports that 77% of USDT’s reserves are backed by short-term Treasury bills and cash-equivalents, the remainder in Bitcoin and gold is seen as more volatile. The rating agency warned that, should Tether fail to reduce its exposure to these risky assets and provide more transparency, it could struggle to maintain the USDT peg to the US dollar.

Tether’s CEO Responds: “We’re Exposing a Broken System”

Paolo Ardoino, Tether’s CEO, has strongly rebuked the downgrade, arguing that S&P’s decision stems from a bias against Tether’s business model. Ardoino claims that the negative rating is rooted in the firm’s exposure to Bitcoin and gold, which he sees as a way to challenge the traditional, outdated financial system. He criticized the current financial structure, calling it “broken” and stating that Tether’s actions have exposed its flaws.

In response to S&P’s criticism, Ardoino declared, “We wear your loathing with pride.” He also suggested that Tether’s business strategy was not to be constrained by outdated financial paradigms and that the rating agency’s criticism was a sign of fear from an industry resistant to change.

The Future of Tether’s USDT: Transparency and Regulation

While Tether has long operated outside of U.S. stablecoin regulations, there are growing calls for greater transparency. Critics like analyst Novacula Occami argue that the issue isn’t necessarily the value of USDT, but rather the lack of clear auditing and oversight from Tether itself. Tether’s USDT is not bound by U.S. regulatory requirements for stablecoins, which mandate 1:1 backing with government bonds or cash equivalents.

Also Read: Tether Invests in Parfin to Drive USDT Adoption in Latin America

To counteract these concerns, Tether has made strides in expanding its reserve portfolio, including becoming the largest independent gold buyer in recent months. The company is also expanding into new sectors like AI, infrastructure, and energy, showing a broader investment strategy. However, as stablecoin regulations continue to evolve, it’s clear that Tether’s transparency and risk management practices will be under increasing scrutiny.

Despite the S&P downgrade, Tether’s growing market share and ambitious expansion plans suggest that the firm is not backing down from its strategy of diversifying its reserves with high-risk assets. Whether Tether’s approach will ultimately prove successful or lead to further regulatory pressure remains to be seen. One thing is certain: Tether is at the center of an ongoing debate about the future of digital currencies and their role in challenging traditional financial systems.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!