|

Getting your Trinity Audio player ready...

|

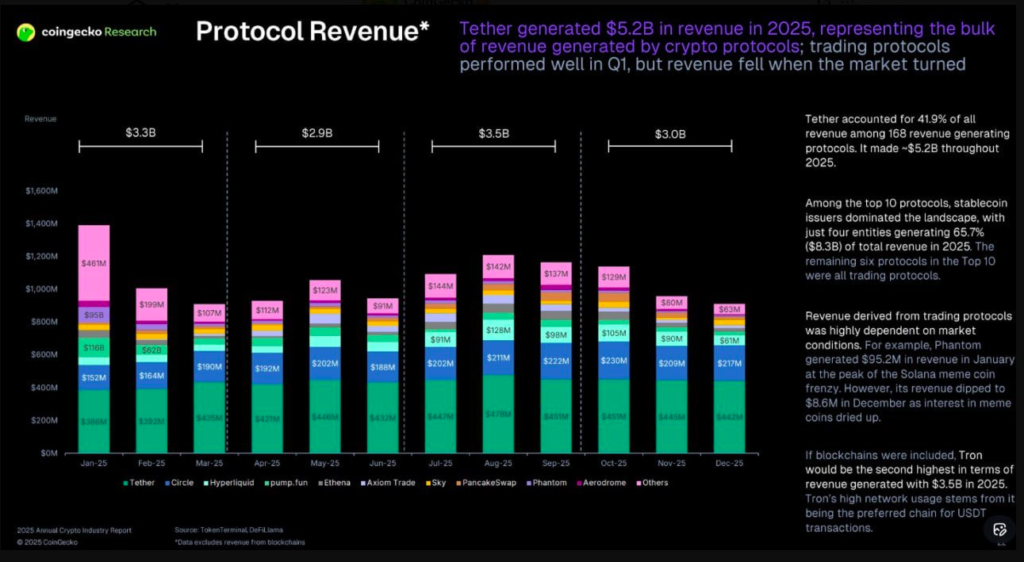

- Tether generated $5.2 billion in revenue during 2025, representing 41.9% of total revenue across 168 analyzed cryptocurrency protocols.

- Stablecoin issuers controlled 71.6% of total protocol revenue, though non-Tether stablecoin issuers collectively declined by $8.38 billion.

- Tron ranked second with $3.5 billion in revenue, driven primarily by its role as a network for USDT transactions.

Tether has emerged as the leading cryptocurrency protocol by revenue generation in 2025, capturing a substantial portion of the market according to research from CoinGecko.

Revenue Leadership

The stablecoin issuer generated approximately $5.2 billion in revenue during 2025, representing 41.9% of total revenue across 168 tracked protocols. This figure positions Tether significantly ahead of competitors in the cryptocurrency ecosystem.

Stablecoin issuers collectively dominated the revenue landscape, accounting for 71.6% of total protocol revenues. However, within this category, performance varied dramatically. While Tether led the sector, other stablecoin issuers reported a combined decline of $8.38 billion in revenue.

The remaining protocols in the analysis were primarily trading-focused platforms, though their collective revenue remained substantially lower than the stablecoin sector.

Tron Network Performance

Tron secured the second position in revenue rankings at $3.5 billion. The blockchain network’s revenue generation is attributed to its function as a major infrastructure provider for USDT transactions. The data indicates Tron serves as a primary network for dollar-pegged token transfers within the cryptocurrency market.

Data Scope and Methodology

The CoinGecko analysis examined 168 different cryptocurrency protocols throughout 2025. The research focused on protocol-level revenue rather than trading volume or market capitalization metrics. The study’s timeframe covers the full 2025 calendar year, with data published on January 25, 2026.

Also Read: Is HBAR About to Lose $0.10? Volatility Says a Big Move Is Coming

The sharp contrast between Tether’s revenue growth and the collective decline among other stablecoin issuers suggests significant market concentration within the stablecoin sector, though the specific factors driving this disparity are not detailed in the available data.

The research reveals a highly concentrated revenue structure within cryptocurrency protocols, with stablecoin issuers and particularly Tether capturing the majority of economic value. The data demonstrates the continued dominance of payment and settlement infrastructure over other protocol categories in terms of revenue generation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!