|

Getting your Trinity Audio player ready...

|

The Terra Luna Classic (LUNC) ecosystem continues its aggressive token burn initiative, with 19,674,564 tokens burned on December 22, 2024. This figure includes 7,265,976 tokens burned by individual wallets and an additional 12,408,588 tokens through on-chain mechanisms, as reported by LUNC Burn Tracker.

To date, over 394 billion LUNC tokens have been burned, reducing the supply from a massive 5.5 trillion tokens. This burn strategy plays a pivotal role in the ecosystem’s recovery plan, aiming to stabilize prices and drive future growth.

LUNC Price Holds Steady Amid Market Volatility

In the last 24 hours, LUNC’s price rose by 1.82%, reaching $0.0001123 with a trading volume of $37.21 million. Despite this short-term uptick, the token has faced challenges, declining by 12.31% over the past week.

Currently, LUNC’s market cap is approximately $618.43 million. Over the past day, its price fluctuated between $0.0001054 and $0.0001135, while the broader 7-day range spanned $0.00009174 to $0.0001344. The token is attempting to stabilize near the $0.0001100 support level, with immediate resistance at $0.0001200.

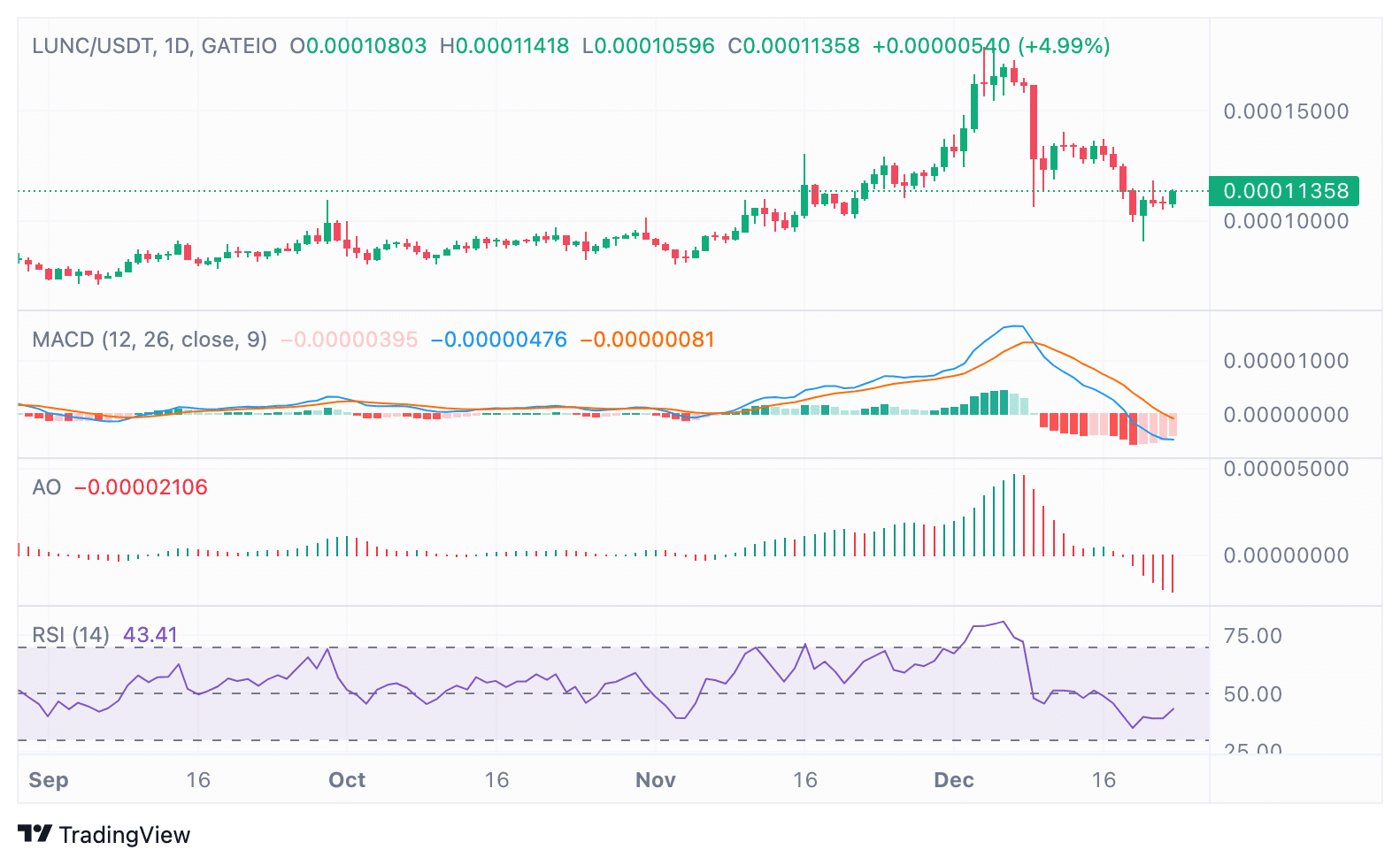

Technical Indicators Signal Mixed Momentum

LUNC’s daily chart reveals mixed momentum signals. The Moving Average Convergence Divergence (MACD) shows a bearish crossover, but fading red histogram bars indicate weakening bearish pressure. Similarly, the Awesome Oscillator (AO) reflects diminishing selling activity, hinting at a potential reversal.

The Relative Strength Index (RSI) stands at 43.41, recovering from oversold territory. A move above the 50-level could signal bullish momentum. Key levels to watch are $0.0001000 on the downside and $0.0001200–$0.0001250 for upside confirmation.

Derivatives Data Reflects Cautious Sentiment

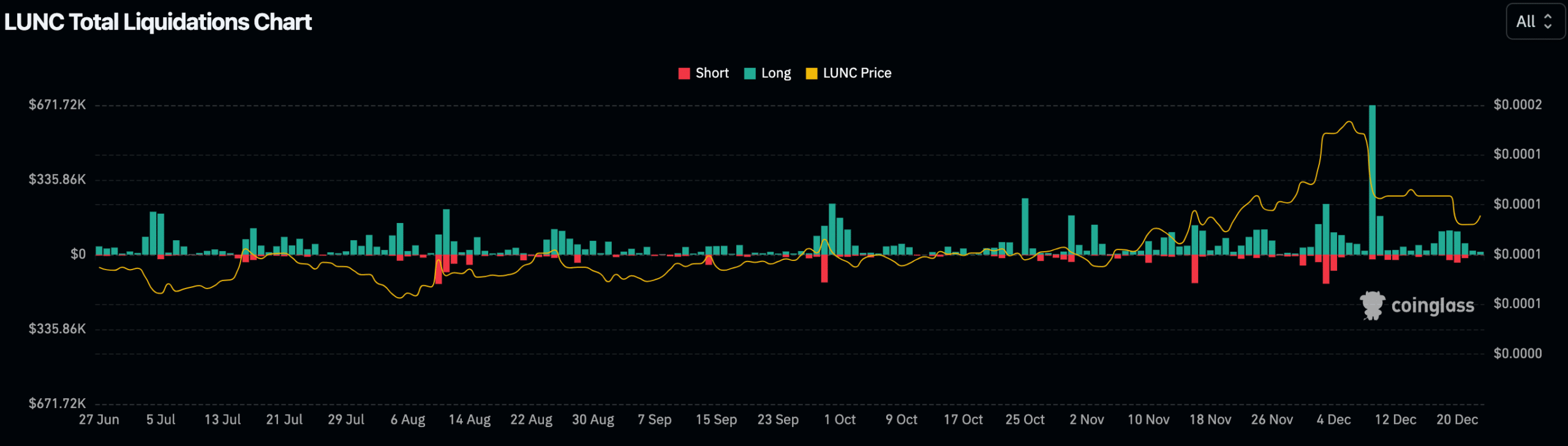

In derivatives markets, LUNC trading volume decreased by 15.35%, and open interest dropped by 4.57%. Despite this, the 24-hour long/short ratio of 1.0255 slightly favors bullish positions.

Notably, OKX traders showed stronger optimism, with a long/short ratio of 1.26. However, liquidation data reveals $12.63K in long positions were liquidated compared to $1.27K in short positions, reflecting higher bullish leverage amid ongoing price volatility.

LUNC’s token burn strategy and cautious market sentiment underline the token’s efforts to navigate a challenging landscape while laying the groundwork for future growth.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!