|

Getting your Trinity Audio player ready...

|

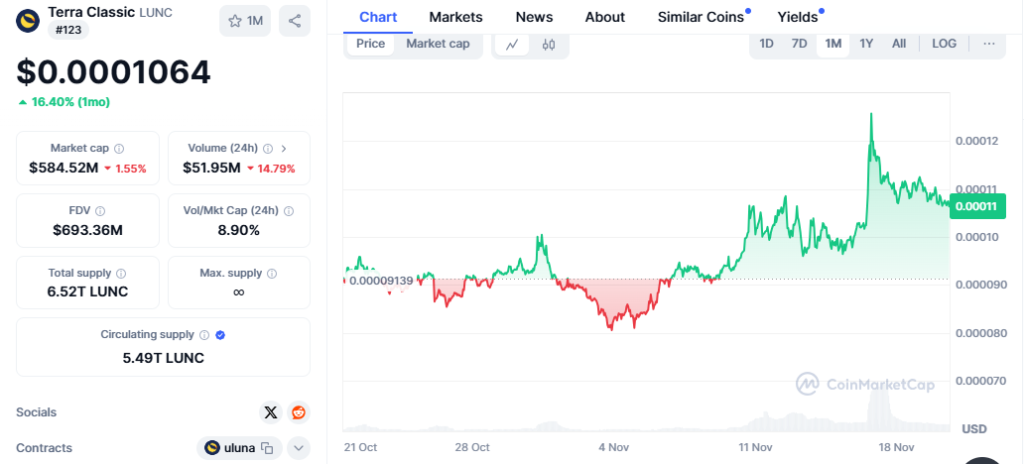

Terra Classic (LUNC) has ignited a spark of optimism among investors as its price surges in line with the broader November crypto market rally. The recent burn of 1 billion LUNC tokens by Binance has further intensified interest, propelling the token’s trading volume on the exchange.

The Power Of Burning

The Terra Classic Foundation’s strategic move to allocate 50% of trading fees to buy back and burn LUNC tokens has injected fresh momentum into the market. By reducing the circulating supply, this mechanism aims to increase scarcity and drive potential price appreciation.

Over the past seven days, a staggering 393 million LUNC tokens have been burned, bringing the total burn count to 389.25 billion since May 13, 2022. While this is a significant achievement, the current circulating supply remains substantial at 6.51 trillion tokens.

A Bullish Outlook

The LUNC price has soared over 30% in the past month, signaling a resurgence in market activity. Currently trading at $0.0001092, the token’s value has shown resilience despite minor fluctuations.

As the broader crypto market experiences a slight uptick, with Bitcoin hovering above $91,000 and Ethereum stabilizing above $3,100, a shift in market sentiment could propel Terra Classic beyond its current resistance level of $0.00019. A successful break through this barrier could pave the way for a potential rally to $0.00025 and even $0.0003, representing a 170% surge from current levels.

Technical Analysis – A Bullish Signal

The Moving Average Convergence Divergence (MACD) indicator has crossed above the signal line, suggesting a bullish trend. This technical signal further reinforces the optimistic outlook for LUNC.

Terra Classic’s recent price surge, fueled by significant token burns and growing investor interest, has positioned the token for potential substantial gains. With bullish technical indicators and a favorable market environment, LUNC could break resistance levels and deliver a 170% rally in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.