|

Getting your Trinity Audio player ready...

|

In a bold move reaffirming its position as the largest corporate Bitcoin holder, MicroStrategy—now rebranded as Strategy—has announced yet another major Bitcoin purchase. Between April 14 and April 20, the firm acquired 6,556 BTC at an average price of $84,785, totaling $555.8 million.

This acquisition boosts Strategy’s total holdings to a staggering 538,200 BTC, valued at approximately $36.47 billion. The company’s year-to-date (YTD) yield stands at 12.1%, underscoring the effectiveness of its Bitcoin-centric treasury strategy. Notably, this marks the second consecutive week of BTC accumulation, following the purchase of 3,459 BTC for $285 million just earlier this month.

Despite Bitcoin’s sideways price action in recent months, Strategy remains unwavering in its accumulation plan. The company has signaled intentions to continue buying Bitcoin through stock sales, with over $20 billion reportedly earmarked for further acquisitions in 2025.

Michael Saylor’s Bitcoin bet is increasingly mirrored by other institutions. Japanese firm Metaplanet recently acquired 330 BTC for $28.2 million, raising its total stash to 4,855 BTC. Meanwhile, fashion retailer ANAP entered the crypto space with a $70 million Bitcoin investment.

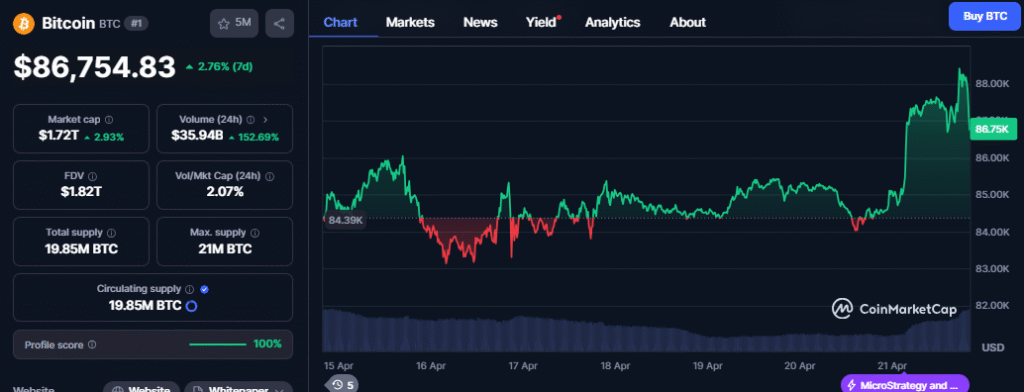

The market responded favorably to Strategy’s announcement. MSTR stock climbed nearly 3%, reaching $325 in pre-market trading—up from Friday’s $317 close. This price surge coincides with Bitcoin’s own mini rally, which saw the cryptocurrency touch $87,500 over the Easter weekend.

Also Read: Michael Saylor’s Strategy Buys 3,459 Bitcoin, Boosts Holdings to 531K BTC Amid Market Dip

Analysts remain cautious. Crypto trader Kevin Capital warns that BTC must breach the $89,000 resistance to confirm a sustained bull trend. Until then, investors are advised to tread carefully.

Still, Strategy’s BTC accumulation strategy continues to yield results. Since adopting a Bitcoin-first approach, the firm has consistently outperformed traditional asset classes—a fact Saylor has emphasized as validation of his long-term vision.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.