|

Getting your Trinity Audio player ready...

|

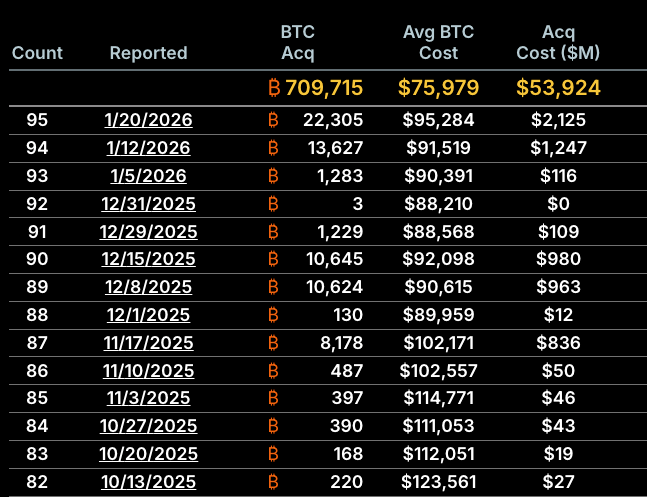

- Strategy bought 22,305 BTC at an average price of $95,284

- Total holdings now stand at 709,715 Bitcoin

- The purchase marks Strategy’s largest buy since February 2025

Michael Saylor’s Strategy has reinforced its position as the world’s largest public holder of Bitcoin, crossing a major milestone after adding more than 22,000 BTC in a single week. The latest purchase lifts the company’s total Bitcoin holdings above 700,000 coins, underscoring its long-term conviction in the asset despite market volatility.

According to a filing with the U.S. Securities and Exchange Commission, Strategy acquired 22,305 Bitcoin for roughly $2.13 billion, paying an average price of about $95,284 per coin. The move comes as Bitcoin trades near multi-month highs, briefly pushing above $97,000 during the week.

A Milestone Buy for Strategy

The latest acquisition brings Strategy’s total Bitcoin holdings to 709,715 BTC. In aggregate, the company has spent approximately $53.9 billion to build its position, with an average purchase price of $75,979 per Bitcoin. The scale of the holdings further cements Strategy’s role as a proxy for institutional Bitcoin exposure in public markets.

This purchase also marks a notable shift in momentum. For much of 2025, Strategy’s buying pace had slowed compared to earlier years. The new transaction represents its largest Bitcoin purchase since February 2025, when it acquired just over 20,000 BTC in a deal worth around $2 billion.

Accelerating After a Strong Start to the Year

Strategy had already signaled renewed buying interest earlier this year. In mid-January, the company disclosed a 13,627 BTC purchase valued at roughly $1.3 billion, which at the time stood as its biggest acquisition since July of the previous year.

The timing of the latest buy coincided with a strong move in both Bitcoin and Strategy’s stock. Shares of Strategy (MSTR) climbed above $185 during the week, aligning with Bitcoin’s rally toward recent highs. Market watchers also point to broader equity index developments as a tailwind.

Index Inclusion and Market Sentiment

Investor sentiment around Strategy has been supported by a decision from MSCI earlier this month not to exclude digital-asset treasury companies from its market indexes. That move reduced concerns that firms heavily exposed to Bitcoin could face forced selling or reduced institutional visibility.

Strategy’s latest $2.13 billion Bitcoin purchase signals renewed aggression after a relatively quieter stretch and highlights continued confidence in Bitcoin at elevated price levels. By pushing its holdings past 700,000 BTC, the company is doubling down on its role as a long-term Bitcoin accumulator—one that increasingly shapes both crypto and equity market narratives.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!