|

Getting your Trinity Audio player ready...

|

On-chain analytics firm CryptoQuant has revealed that apparent demand for Bitcoin (BTC) has significantly slowed since early April, even dipping into negative territory this month. This weakening sentiment for the largest cryptocurrency has contributed to its sideways price action in recent weeks.

CryptoQuant’s demand indicator, which tracks the difference between daily block rewards and changes in long-term holdings, suggests a decline in demand. The firm noted that while miners typically sell their rewards to cover operations, an increase in selling from large holders indicates a waning appetite for the asset.

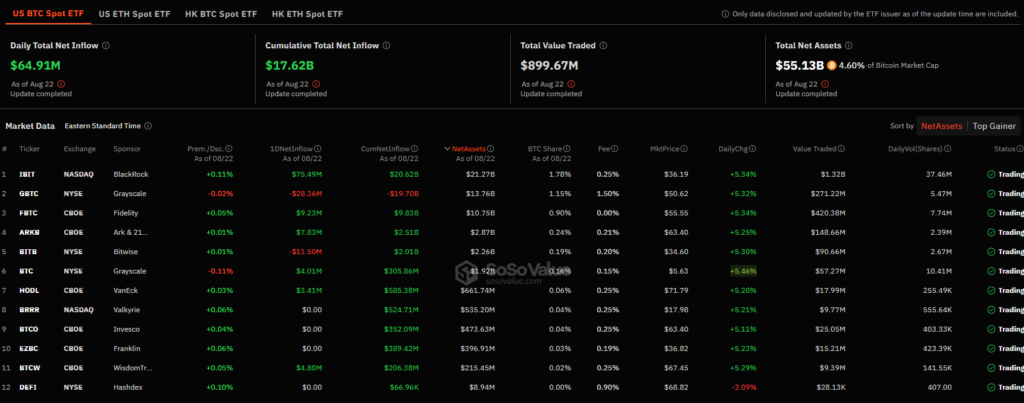

The launch of several spot Bitcoin ETFs in January and the Bitcoin halving event in May had initially fueled optimism, with some analysts predicting a surge to $80,000 by June. However, the price has since fallen by 20% from its May highs. While ETFs have attracted $17.5 billion in net inflows, skeptics argue that much of this flow could be driven by carry trades rather than outright bullish bets.

CryptoQuant also observed a slowdown in purchases from spot ETFs, declining from an average of 12.5K Bitcoin in March to 1.3K Bitcoin last week. Despite these bearish indicators, there have been some positive signs. Long-term holders have continued accumulating Bitcoin at a record-high rate, reaching 391,000 BTC earlier this week. Additionally, the total market capitalization of stablecoins has surged to a new high of $165 billion, a historically bullish sign that indicates increasing liquidity in the crypto market.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OGK3H2HSINE5HJWRNAP73BHP2E.png)

Overall, the weakening demand for Bitcoin, coupled with the slowing ETF inflows and the decline in large holder accumulation, suggests a cautious outlook for the cryptocurrency. However, the continued accumulation by long-term holders and the strong stablecoin market could provide some support for prices in the future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.