|

Getting your Trinity Audio player ready...

|

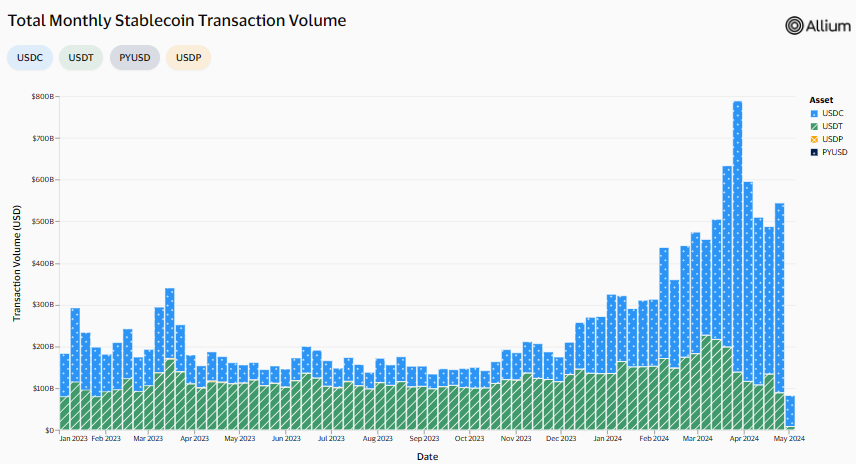

The top three stablecoins – Tether (USDT), USDC, and DAI – have collectively processed a staggering amount of transactions, surpassing Visa’s monthly average for 2023, according to data from on-chain analysis firm Nansen.

Nansen’s data reveals that Tether, the largest stablecoin by market capitalization, processed a whopping $654 billion in the past 30 days. DAI and USDC followed closely behind with $394 billion and $321 billion in transaction volume, respectively.

“The combined total for these three stablecoins is $1.369 trillion, which is significantly higher than Visa’s monthly average of $1.23 trillion in 2023,” stated Nansen. Notably, Tether alone processed nearly as much as Mastercard, the second largest card provider globally, whose monthly average volume sits around $750 billion.

However, Visa claims a different narrative. In an April report, they argued that USDC should be considered the leading stablecoin in terms of transaction volume. Visa’s methodology involved filtering out inorganic activity and focusing solely on the largest stablecoin amount transferred within a single transaction, placing USDC ahead of its competitors.

Also Read: $200 Million Mystery: Lazarus Group Laundered 17% of Stolen Crypto in 2023 – Here’s How They Did It

Stablecoins: A Growing Force in the Financial Landscape

While the exact ranking may be debated, the overall trend is undeniable: stablecoins are experiencing a significant surge in activity. Their ability to provide a bridge between traditional finance and the crypto world, coupled with their price stability pegged to fiat currencies, is attracting increasing interest.

This growth is evident in the combined $1.369 trillion processed by the top three stablecoins, exceeding the established giant Visa. Whether USDC or Tether reigns supreme in terms of individual transactions, the overall rise of stablecoins highlights their growing influence within the global financial landscape.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!