|

Getting your Trinity Audio player ready...

|

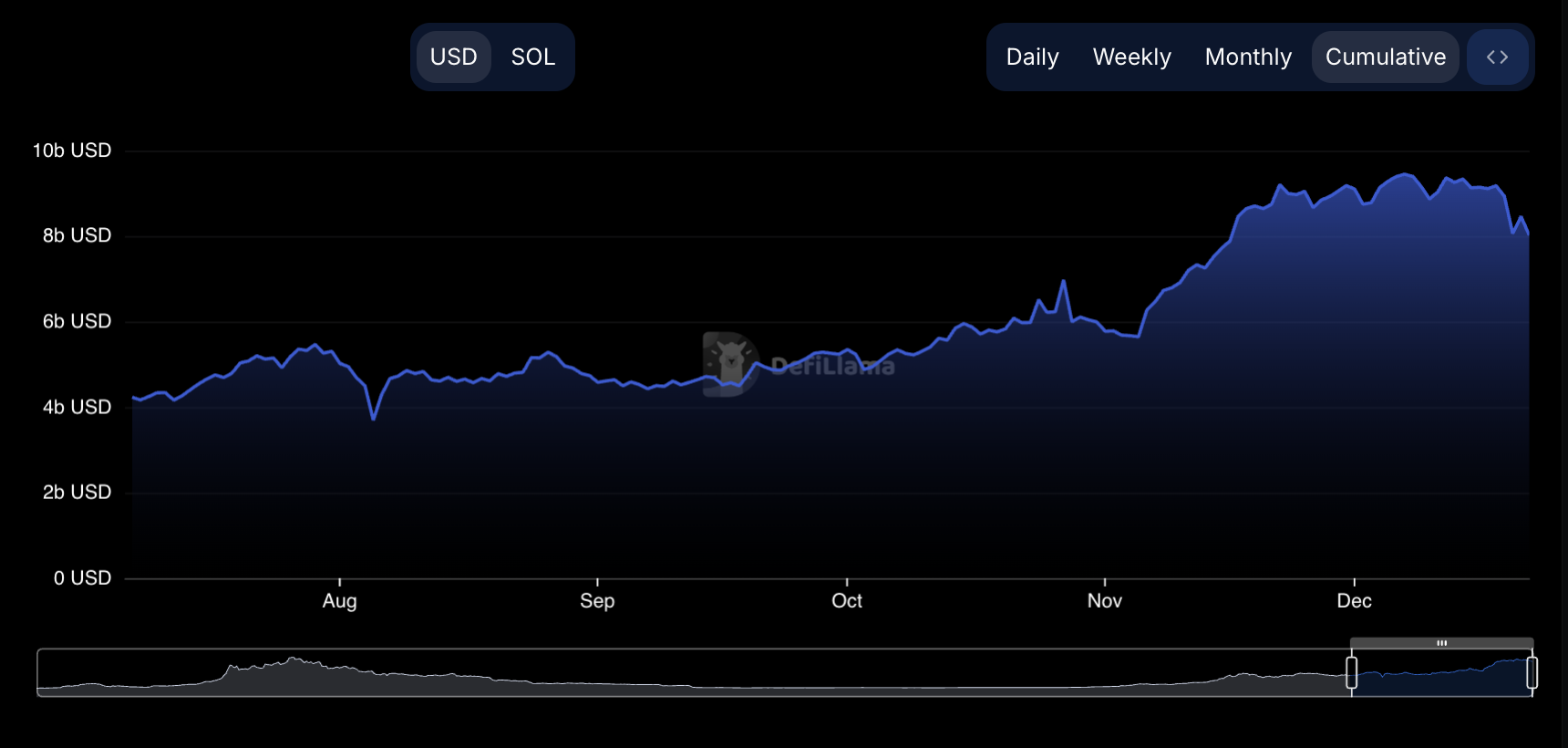

Solana’s Total Value Locked (TVL) has taken a significant hit, plummeting to $8.01 billion, marking a 12% drop since December 1. This decline represents a $1.1 billion exit from the ecosystem, highlighting the broader issues surrounding Solana’s usage and on-chain activity. The downturn is a stark reflection of the decreasing daily active addresses and dwindling user base on the network.

The most impacted protocol within the Solana ecosystem is Jito, which has experienced a severe 28% drop in TVL over the past month. Jito’s current TVL stands at $2.66 billion, further underscoring the slowdown within Solana’s decentralized finance (DeFi) space. According to DeFiLlama, this TVL slump is directly tied to the drop in user engagement, with Artemis reporting a 7% decline in unique active addresses over the past 21 days.

As a result of the decreased network usage, Solana’s revenue has also taken a hit. The blockchain has seen a 24% decrease in network revenue since the beginning of December. The challenges are compounded by Solana’s native token, SOL, which has dropped by 28% over the same period, further diminishing the overall ecosystem’s health.

This slump in activity and revenue has created a bearish sentiment around Solana’s prospects. Analyzing SOL’s price performance, the Chaikin Money Flow (CMF) indicator, which combines price and volume data, shows a negative value of -0.04. This suggests increased market distribution, signaling more selling pressure than buying, contributing to SOL’s downward price trajectory.

Should this selling pressure continue, SOL’s price could fall to around $168.83. However, a shift in market sentiment could potentially reverse this trend. If buying pressure picks up and market sentiment becomes more bullish, SOL’s price might rise above resistance at $187 and even attempt to surge past the $200 mark.

While Solana‘s current market conditions reflect a challenging landscape, the possibility of a reversal hinges on a positive shift in both user activity and broader market sentiment. As of now, the blockchain’s ability to regain momentum remains uncertain, with much depending on the broader cryptocurrency market’s outlook in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Solana (SOL) Price Surge 9% After Whale Activity, Is This the Start of a Bullish Breakout?

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.