|

Getting your Trinity Audio player ready...

|

Solana (SOL), a high-performance blockchain platform, has been making waves in the cryptocurrency market, particularly in its derivatives market. The recent surge in Open Interest (OI) has ignited a fierce battle between bulls and bears, leaving traders on the edge of their seats.

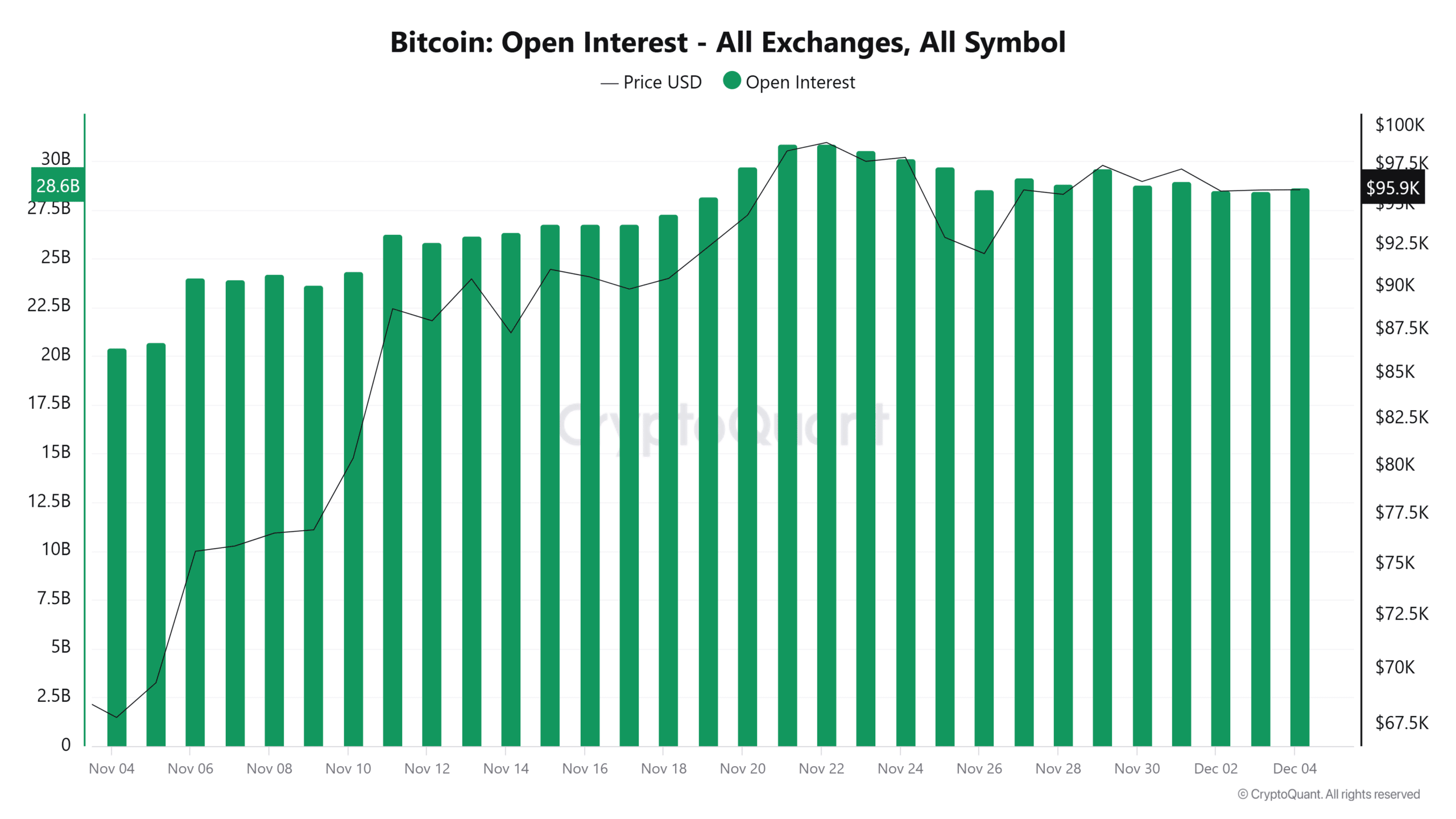

A Surge in Open Interest

November witnessed a significant uptick in Solana’s derivatives market, with OI reaching record-high levels. This surge indicates heightened market activity and suggests that traders are increasingly confident in Solana’s future price movements. As a result, the stage is set for potentially dramatic price swings.

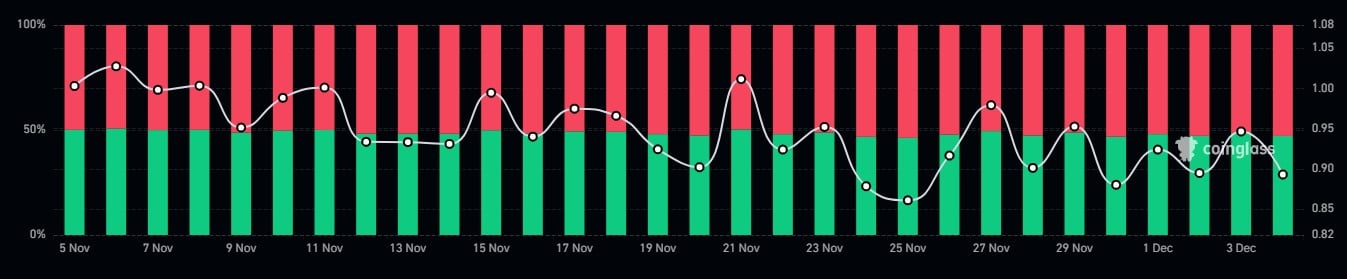

Funding Rates: A Mixed Bag

While the rise in OI paints a bullish picture, funding rates offer a more nuanced perspective. These rates, which reflect the cost of borrowing or lending a cryptocurrency, have fluctuated between positive and negative territory, signaling ongoing uncertainty in the market.

Currently, bearish funding rates slightly outweigh bullish ones, suggesting that a significant portion of the market remains skeptical about Solana’s short-term prospects. However, it’s important to note that funding rates can be highly volatile and subject to rapid shifts.

Short Sellers vs. Long-Term Bulls

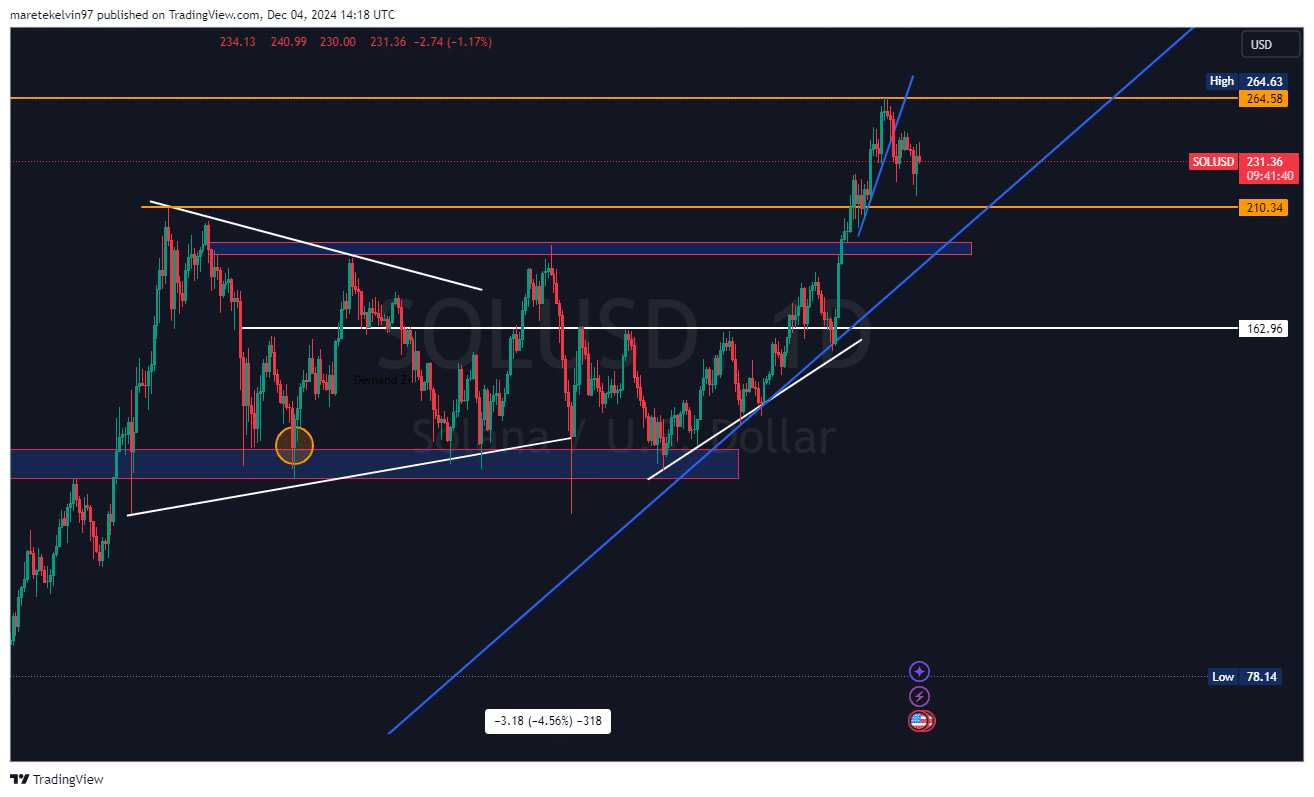

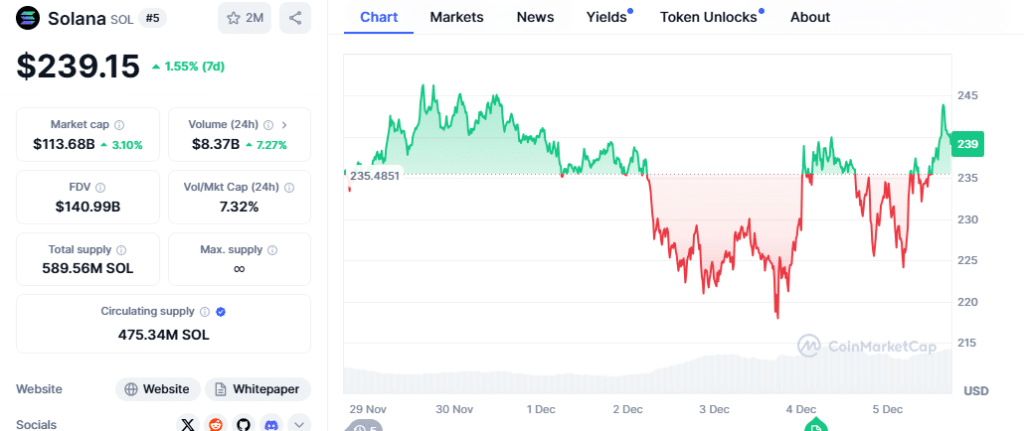

The Long/Short Ratio for SOL currently stands at 0.89, indicating a dominance of short positions. This suggests that a significant number of traders are betting on a price decline. However, Solana’s recent 10% rally in less than 48 hours has challenged this bearish sentiment, demonstrating the resilience of the cryptocurrency.

A Potential Bullish Scenario

Solana’s strong recovery from a crucial support level has ignited hopes among bulls. If buying pressure continues to intensify, and short sellers begin to cover their positions, a rally towards the $264 resistance level could be on the horizon.

The combination of high OI and a significant number of short positions creates a volatile market environment. As the battle between bulls and bears rages on, traders will need to closely monitor market dynamics, funding rates, and technical indicators to make informed decisions.

While Solana’s recent price action has been impressive, it’s crucial to approach the market with caution and manage risk effectively. As always, conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!